Oil (Brent Crude, WTI) News and Analysis

- OPEC+ extends supply cuts for Q2, Russia forced into further cuts

- Brent crude oil starts the week on the back foot despite extra Russian cuts

- WTI oil signals bullish fatigue as prices pullback towards key level

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Recommended by Richard Snow

How to Trade Oil

OPEC+ Extends Supply Cuts for Q2, Russia Forced into Further Cuts

The Organization of the Petroleum Exporting Countries and its allies, otherwise known as OPEC+, decided to extend supply cuts into the second quarter of this year, as expected. Therefore, the market reaction was rather muted at the start of the week despite the one surprising detail of the decision which was the additional Russian cuts of 471,000 barrels per day (bpd) – a result of lower refinery runs due to Ukrainian drone strikes.

Oil importers and consumers have benefitted from lower oil prices and a general decline in the US dollar since their respective highs in September/October. The global growth slowdown has materialized via the reality of technical recessions in major economies like the UK and Japan, with the European Union close on their heels. China, which makes up the majority of oil demand growth each year, has also struggled to revitalise its economy, keeping oil prices capped. This week, Chinese officials meet to decide on growth targets for the year and other strategic measures but to date, accommodative measures have proven to provide limited relief. The growth target is expected to be set at the same level as 2023, “around 5%”.

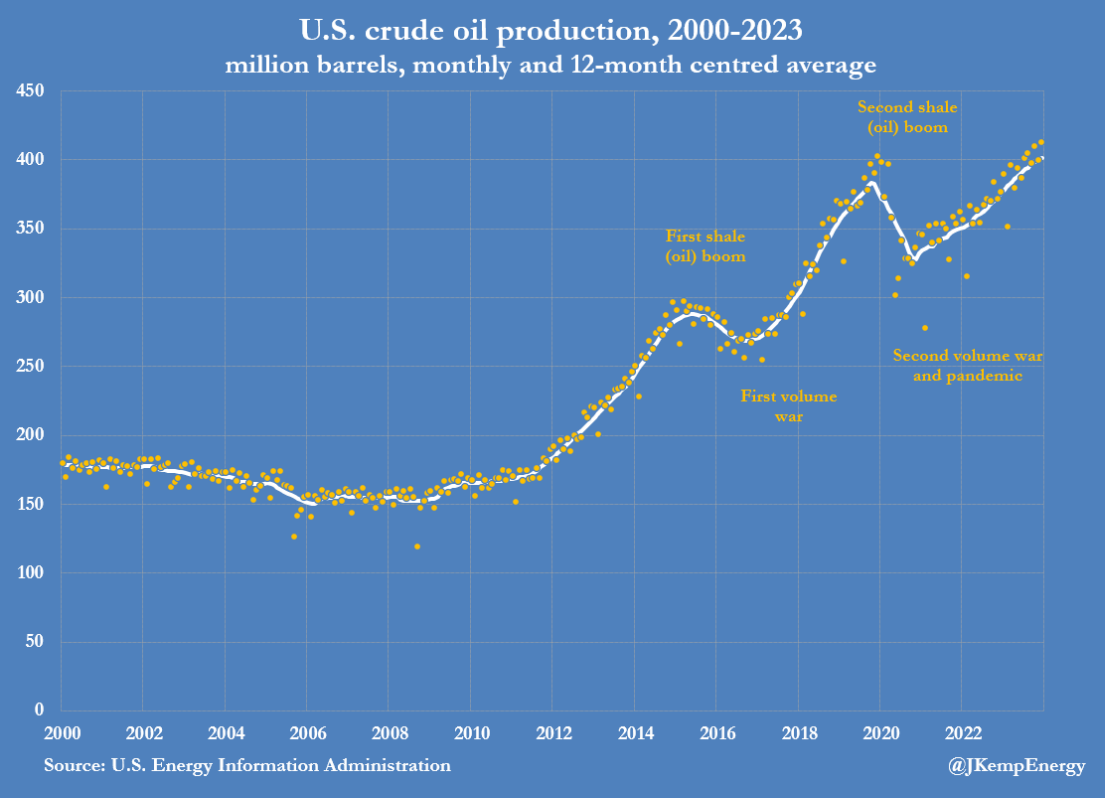

Another factor weighing on oil upside is the record levels of non-OPEC supply entering the market, with the US the main contributor. The graph below shows the longer-term uptrend in US oil production.

Source: Refinitiv, @JKempEnergy, EIA, prepared by Richard Snow

Brent Crude Oil Starts the Week on the Back Foot

Brent crude oil accelerated at the end of last week, rising on the back of a weaker dollar. The dollar eased in response to some potentially concerning manufacturing data in the US as a forward-looking indicator, ‘new orders’ turned lower. Naturally, markets will be more focused on US services figures tomorrow to confirm if a similar uptick has emerged in the sector responsible for the majority of US GDP.

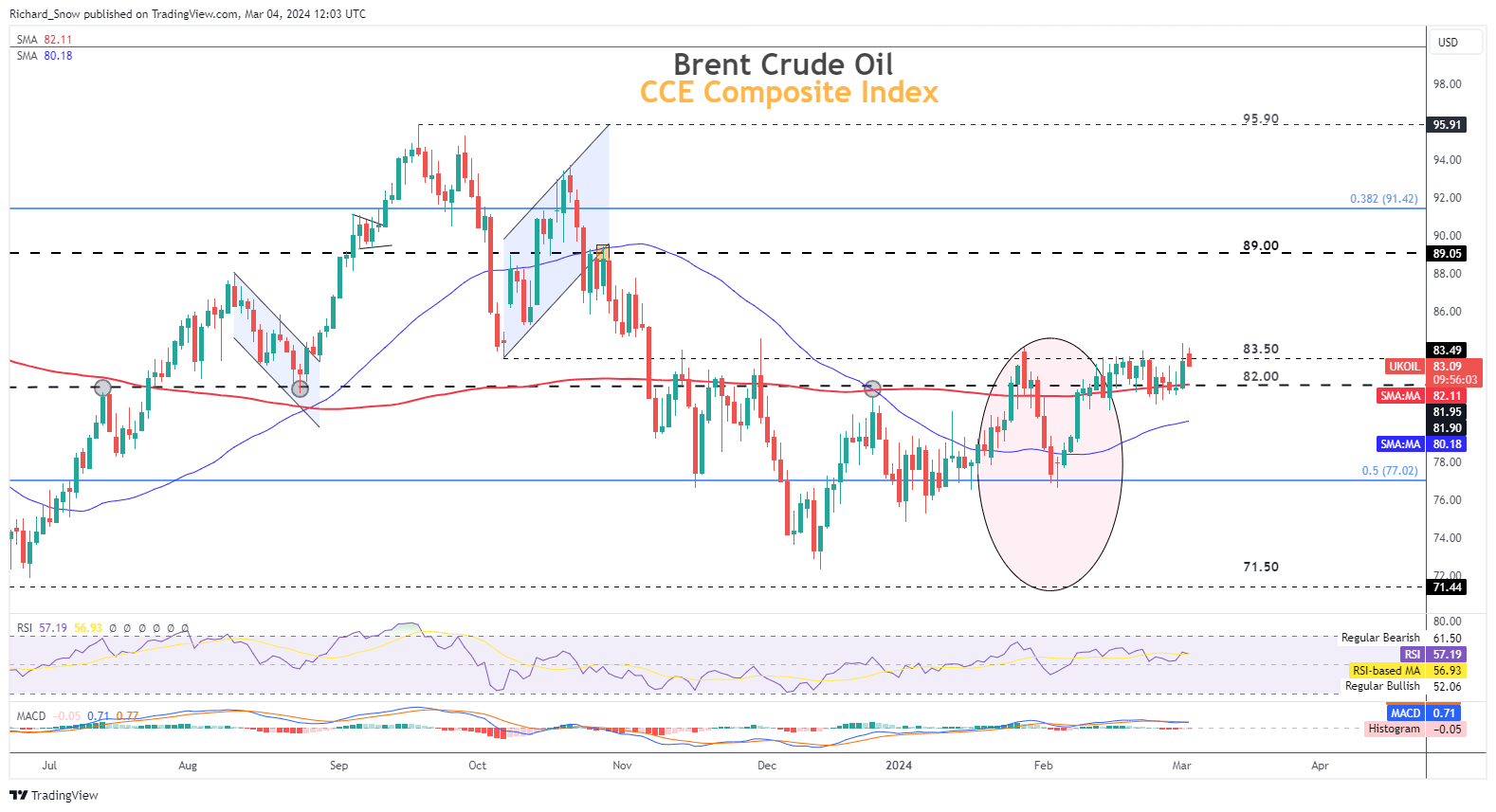

At the start of this week, Brent crude is rather flat but trades above the prior level of resistance around $83.50. The next levels of resistance appear at $87 and $89 with price above both the 200 and 50-day simple moving averages (SMA). In the event bulls fail to build momentum from here, $82 appears as support which coincides with the 200 SMA and $77 remains the next level of significance to the downside.

Brent Crude Oil (UK Oil) Daily Chart

Source: TradingView, prepared by Richard Snow

The oil market is heavily dependent on the forces of demand and supply, geopolitics and global economic growth. Find out all of the fundamental considerations all oil traders should be aware of:

Recommended by Richard Snow

Understanding the Core Fundamentals of Oil Trading

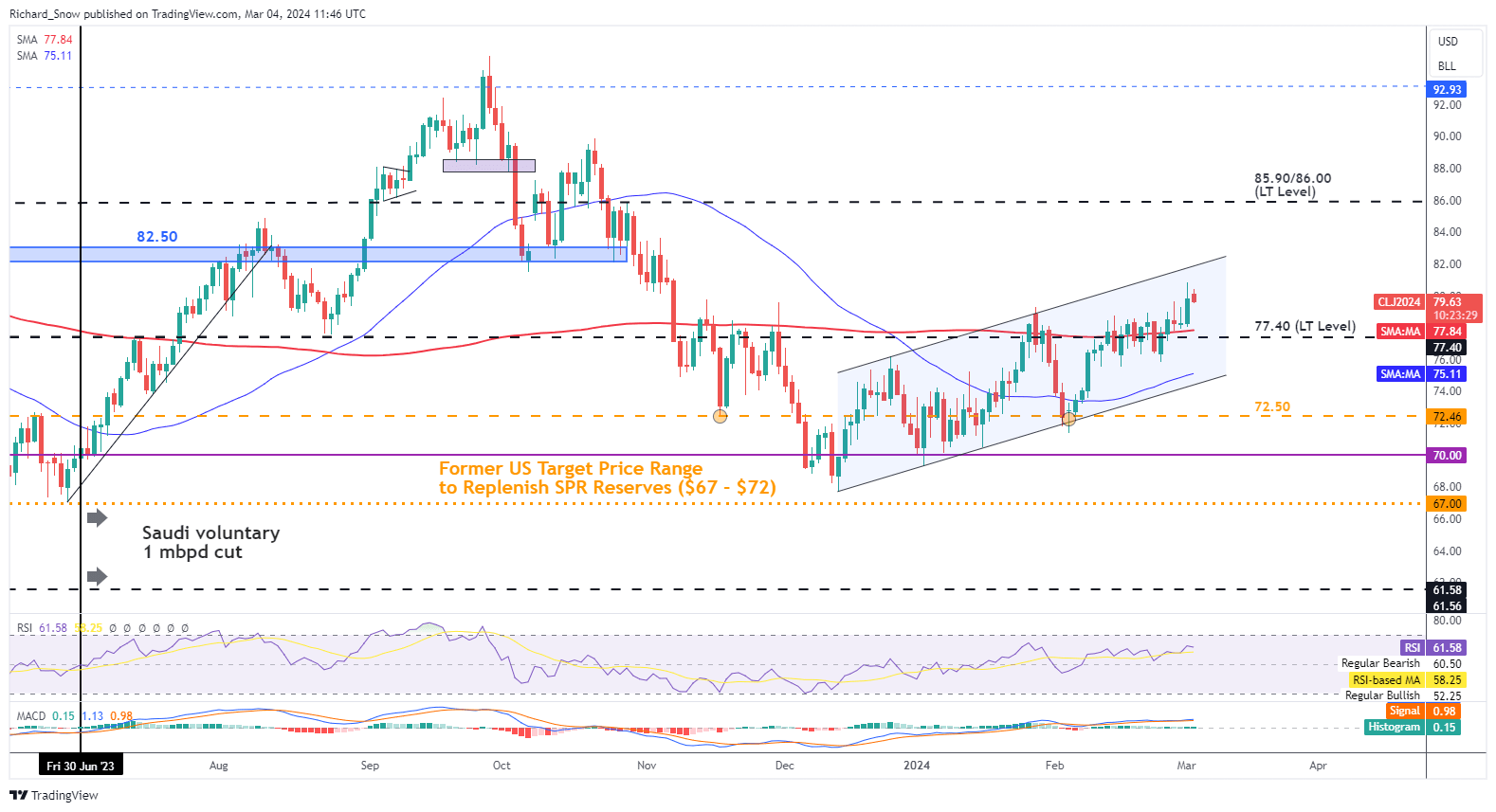

WTI Oil Signals Bullish Fatigue as Prices Pullback Towards Key Level

The WTI chart presents the broader uptrend in oil, but signs of fatigue appear ahead of channel resistance. Friday’s upper wick and today’s slightly slower start, hint at a shorter-term pullback towards $77.40 and the 200 SMA.

Economic data from the US this week (services ISM, NFP) and important meetings in China, could direct oil prices towards the end of the week.

Source: TradingView, prepared by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX