US Dollar (USD) Weekly Forecast: Bullish

- Concerning forward-looking data sends the dollar lower ahead of the new week

- US Dollar (USD) finds support, the Fed continues its cautions approach to rate cuts

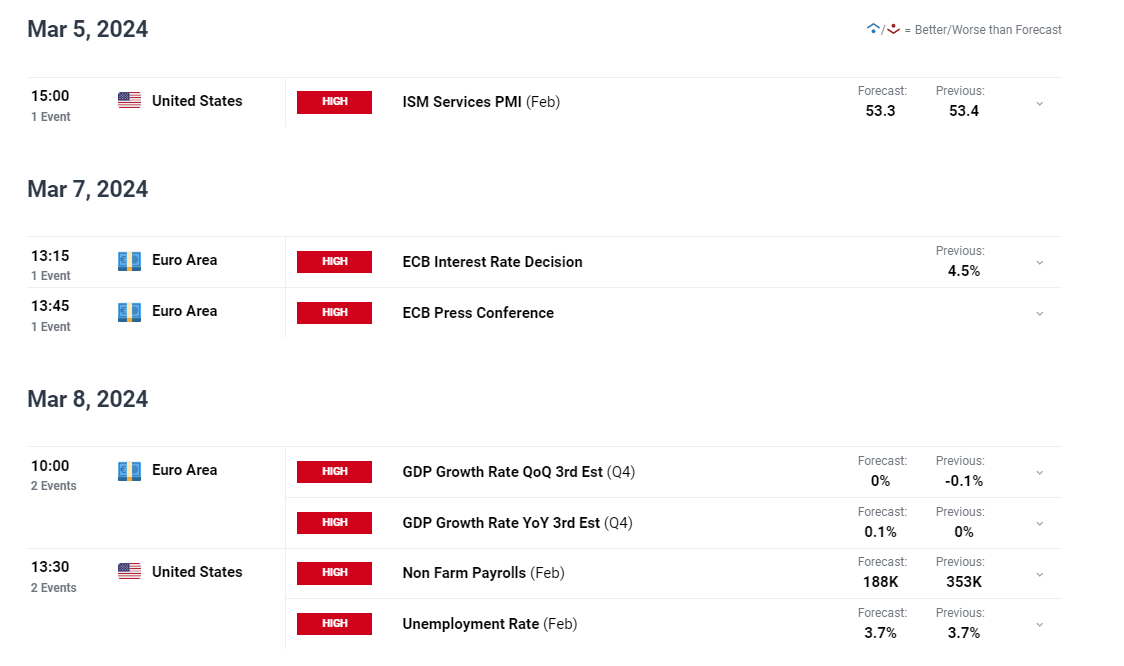

- US Dollar event risk for the week ahead: Services PMI and NFP

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Concerning Forward-Looking Data to Translate into a Lower Start Next Week?

The dollar limped into the end of the trading week after US manufacturing data posted some slightly concerning results, as the overall sector continued to contract for the 16th straight month.

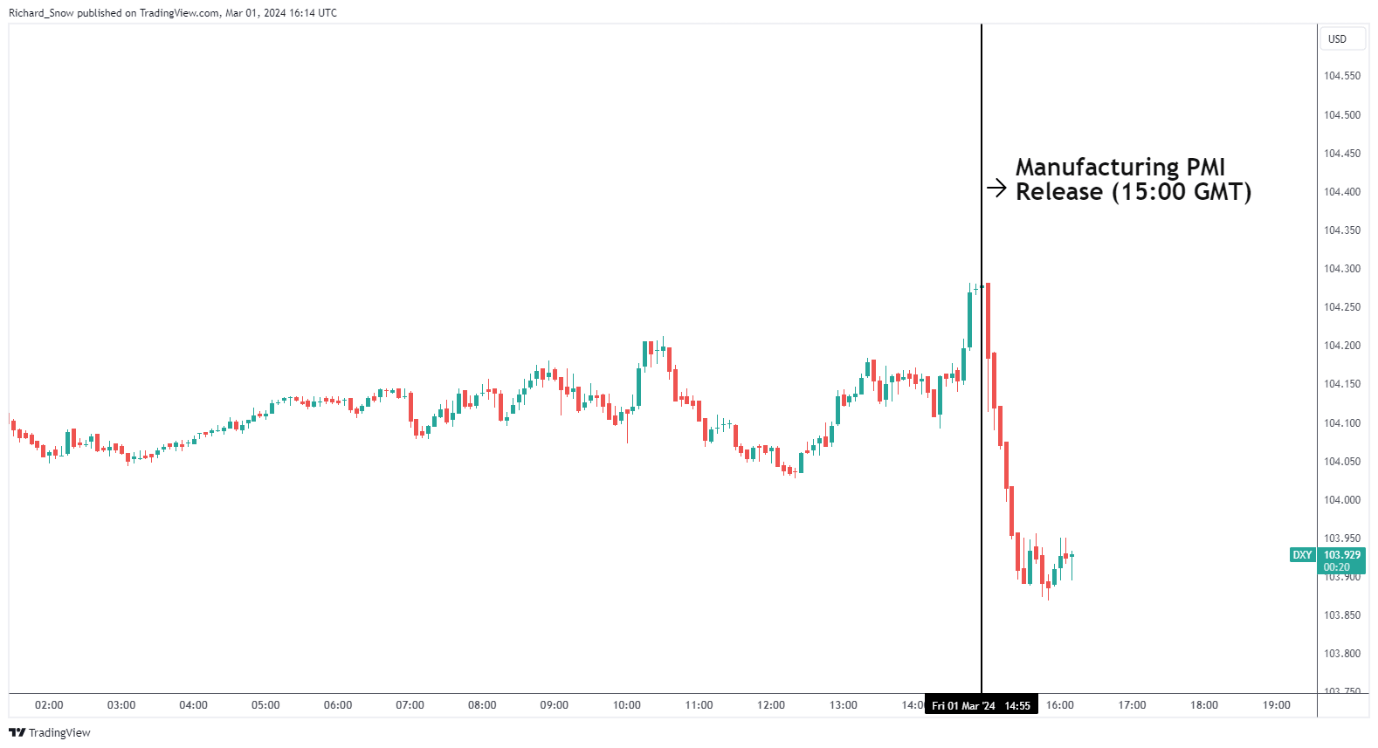

Notable standouts in the report surfaced via sub-indices, ‘employment’, ‘production’ and the forward-looking metric ‘new orders’ as they all declined compared to January. While the surveyed results provide ‘soft data’, it is something the market has viewed as noteworthy – judging by the reaction. The chart below depicts the immediate reaction to the data from the dollar basket’s (DXY) perspective.

US Dollar Benchmark (DXY) 5-Minute Chart

Source: TradingView, prepared by Richard Snow

Learn how to set up for and prepare for high importance market moving data and events via our downloadable guide below:

Recommended by Richard Snow

Trading Forex News: The Strategy

Next week’s US services PMI carries greater importance as the services sector makes up the majority of US GDP

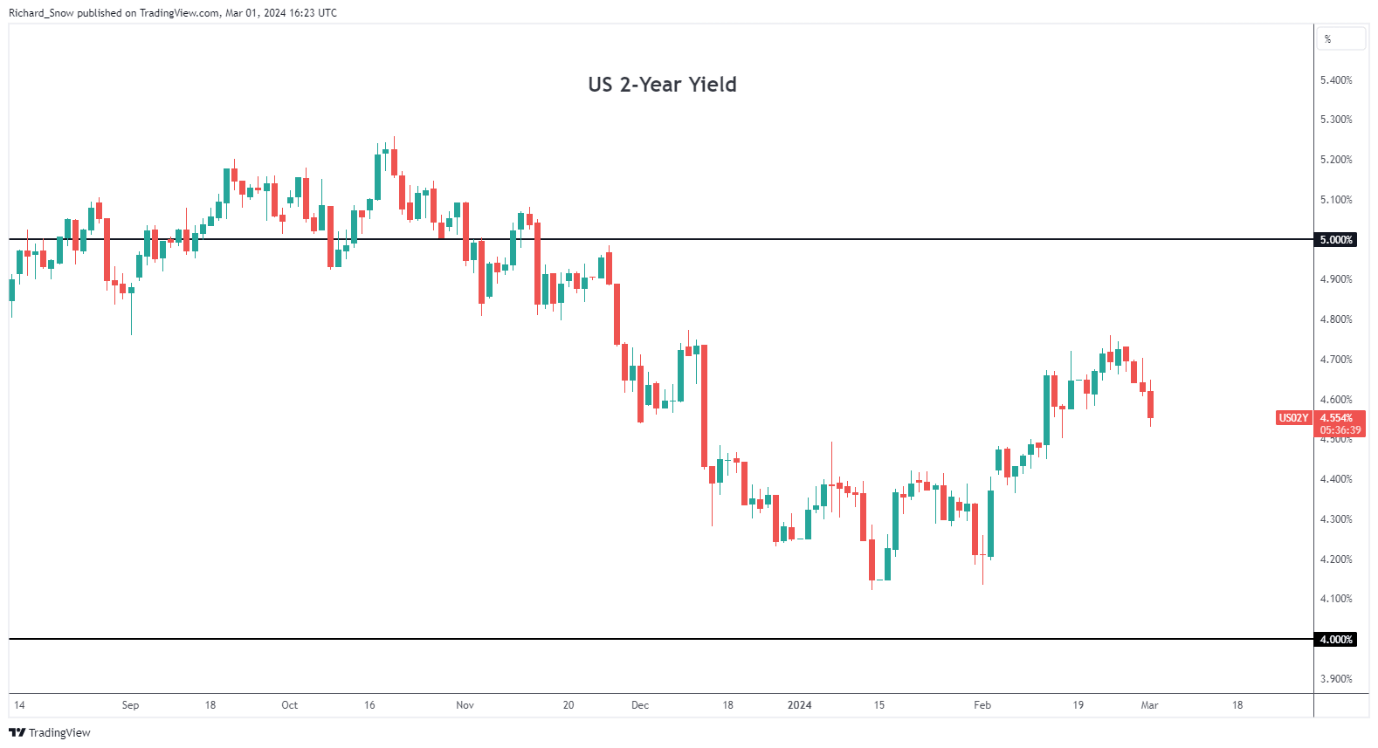

The move also had US Treasury yields moving lower, extending the weekly slide. The 2-year treasury yield is known to be sensitive to fluctuation in Fed funds bets, and the recent move lower suggests a renewed focus on inevitable rate cuts which could arrive in June or July this year.

US 2-Year Treasury Yield Daily Chart

Source: TradingView, prepared by Richard Snow

US Dollar Finds Support, The Fed Continues its Cautious Approach to Rate Cuts

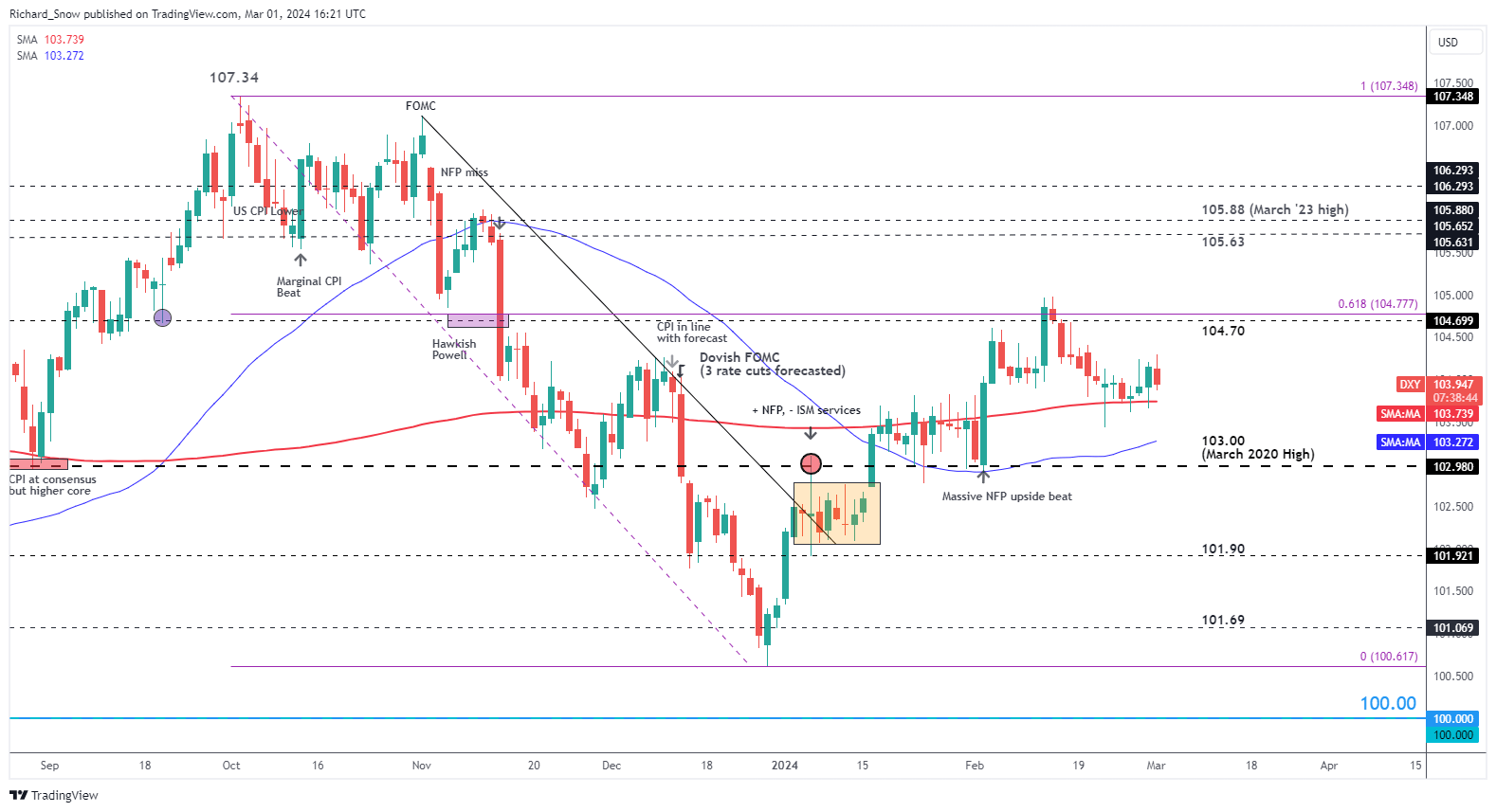

The Fed must be holding back the temptation to say, ‘we told you so’ now that market expectations match those released in the Fed’s December summary of economic projections. Three rate cuts in 2024 is the new expectation, down from six and potentially seven at one stage. As such, the dollar has found its footing in the early weeks of 2024 but has weakened since the February high.

The shorter-term bearish direction appears to have found support at the 200-day simple moving average (SMA) and if not for the weaker manufacturing data, the dollar would have seen reasonable gain.

However, sustained directional moves, outside of yen pairs, have been hard to come by. As we get closer to D-day for the first interest rate cut, markets appear reactive to the incoming data but often lack the necessary follow through to prolong the move. Such market conditions are typically conducive to range trading strategies and setups.

ISM services PMI data next week is forecast slightly lower than in January, meaning a small deviation from expectations or a move higher, may be enough to see the dollar edge higher again. The zone of resistance comprises of the 104.70 level and the 61.8% Fibonacci retracement of the 2023 major decline. This presents the next challenge for USD bulls. Downside levels to watch include the dynamic support provided by the 200 SMA followed by 103.00.

US Dollar Basket (DXY) Daily Chart

Source: TradingView, prepared by Richard Snow

If you’re puzzled by trading losses, why not take a step in the right direction? Download our guide, “Traits of Successful Traders,” and gain valuable insights to steer clear of common pitfalls:

Recommended by Richard Snow

Traits of Successful Traders

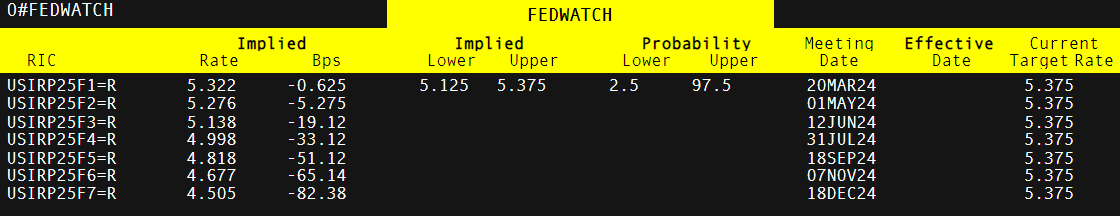

Markets now envision a little over 75 basis points worth of cuts (82) this year, with the March meeting highly unlikely to provide the date of the very first cut.

Implied Rate Cuts Derived from the Fed Funds Futures Market

Source: Refinitiv

US Dollar Event Risk for the Week Ahead: Services PMI, NFP

In the week to come, ISM services PMI data will attract an even greater focus after Friday’s manufacturing print weakened further into contractionary territory, with ‘new orders’ and ‘employment’ sub-indices declining. However, the manufacturing sector makes up roughly 10% of the economy so a strong services print is likely to allay any concerns from Friday.

Then, the ECB is scheduled to kick off the major central bank meetings for March which is likely to filter into the dollar index via its substantial weighting in the EUR/USD pair.

Customize and filter live economic data via our DailyFX economic calendar

Stay up to date with the latest breaking news and events driving the market by signing up to our weekly newsletter:

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX