Japanese Yen Prices, Charts, and Analysis

- Rising inflation and wage pressures seen.

- USD/JPY upside is limited.

Learn How to Trade USD/JPY with our Complimentary Guide

Recommended by Nick Cawley

How to Trade USD/JPY

In an interview with Reuters earlier today, Japan’s Deputy Chief Cabinet Secretary Hideki Murai said that early signs of rising inflation and wages were becoming evident in the economy, boosting market hopes that an end to Japan’s multi-decade era of ultra-loose monetary policy may soon be coming to an end.

“We need to revitalise the economy by shifting away from one that prioritizes cost cuts to one where a positive cycle of higher growth and wages kicks in,” Murai said. “We’re gradually seeing such a positive cycle fall into place.”

This positive outlook follows on from recent commentary by Bank of Japan board member Hajime Takata who said that the central bank’s goal of sustainable 2% inflation is ‘finally in sight’.

Japanese Yen Grabs a Bid, Emboldened by Bank of Japan Talk

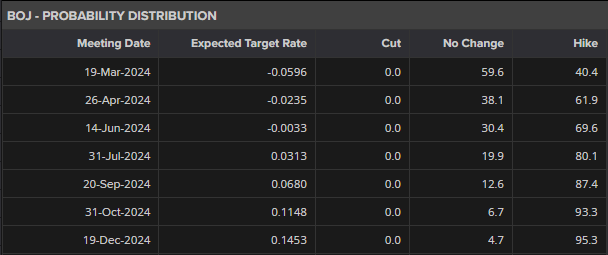

Today’s commentary shifted interest rate hike hikes marginally but not enough to noticeably strengthen the Japanese Yen. According to market probabilities, there is now a 40% chance that the BoJ will hike rates at this month’s meeting, although June remains the most likely meeting for the central bank to take interest rates out of negative territory.

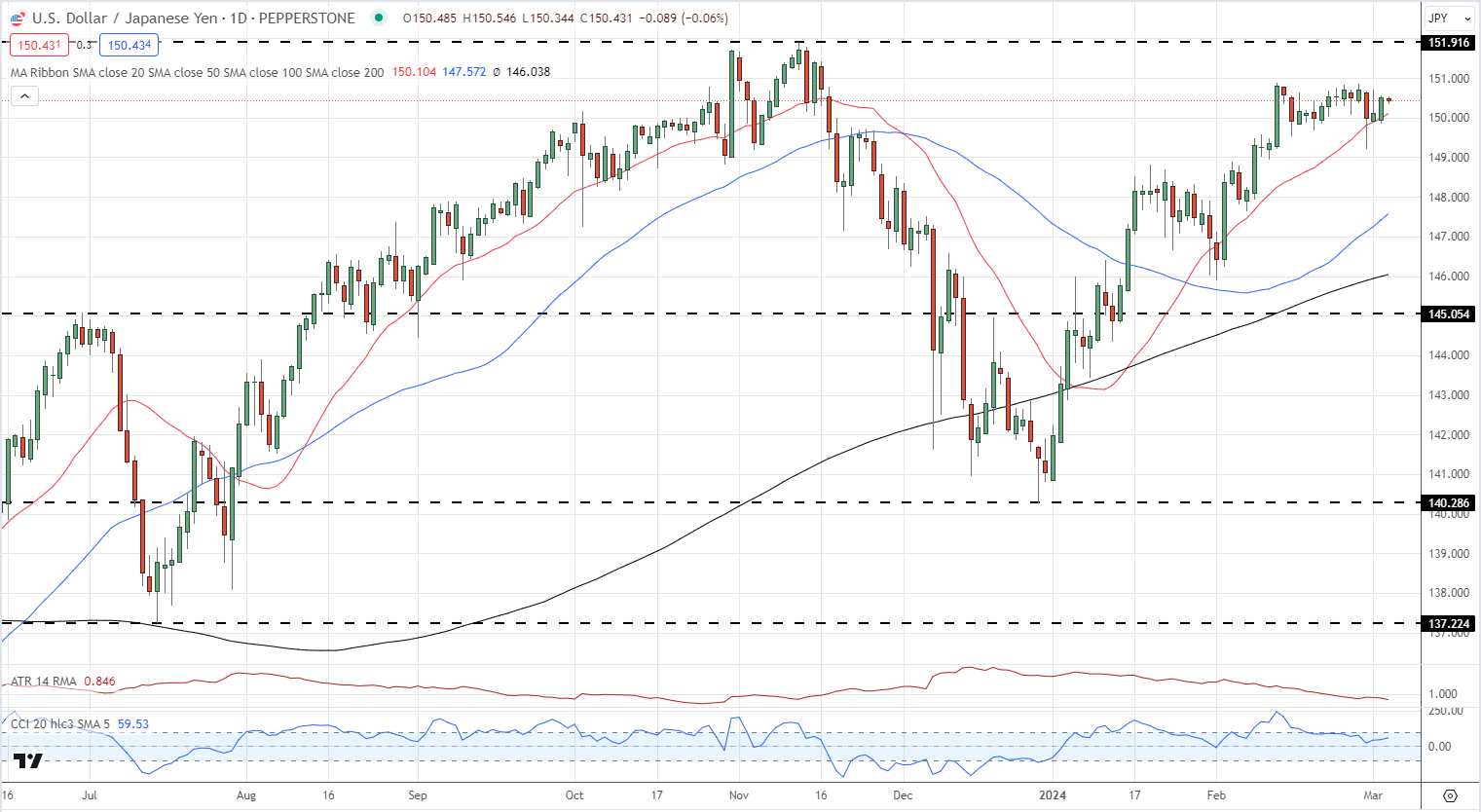

USD/JPY continues to trade just above the 150 level although the pair are finding it difficult to move higher. Further upside is limited with the 151.90 multi-decade high a formidable level of resistance to take out, especially after the recent official commentary. The downside looks the path of least resistance with a few levels of support of prior swing lows and all three simple moving averages before the 145 area comes into view.

USD/JPY Daily Price Chart

Retail trader data 21.93% of traders are net-long with the ratio of traders short to long at 3.56 to 1.The number of traders net-long is 3.12% higher than yesterday and 13.50% lower than last week, while the number of traders net-short is 6.83% higher than yesterday and 6.43% higher than last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USD/JPY prices may continue to rise.

Download the Latest IG Sentiment Report to see why daily/weekly changes affect USD/JPY price outlook

| Change in | Longs | Shorts | OI |

| Daily | -7% | -7% | -7% |

| Weekly | 24% | -19% | -10% |

What is your view on the Japanese Yen – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.