Japanese Yen (USD/PY) Prices and Analysis

Download our Technical and Fundamental Japanese Yen Guides

Recommended by David Cottle

Get Your Free JPY Forecast

- USD/JPY is holding below last year’s significant highs

- Markets have a lot to think about, from whether Tokyo will intervene to the possibility of a BoJ policy shift

- Steady USD/JPY gains have been replaced by range trade

The Japanese Yen was slightly weaker against the United States Dollar on Wednesday in a market that appears to be getting warier of possible intervention by the authorities in Tokyo to shore it up.

USD/JPY is range-trading nervously just below the peaks of late last year, which were as high as the Dollar had been since the late 1980s. While the Federal Reserve and many other central banks boosted interest rates significantly in an attempt to tame inflation, the Bank of Japan, which has been trying unsuccessfully to generate some domestic pricing power for many years, stuck with the loosest monetary policy in the world, negative interest rates, yield-curve control and all.

Given the huge yield gap in the Dollar’s favor, USD/JPY strength is hardly surprising. However, while the export-oriented sectors of the Japanese economy might not mind a weaker Yen at all, there are signs that the Japanese government is getting a little tired of it. Warnings from that quarter that ‘rapid moves’ in the currency are ‘undesirable’ have been heard.

Reuters reports that speculative short positions against the Yen increased massively in the week of February 20, and amount to a $10 billion leveraged wager on the Japanese currency falling still further.

Given the recent resilience seen in Japanese inflation, there’s plenty of commentary out there suggesting that we could see interest-rate rises this year, and possibly in the first half. While any sign of this would probably give the Yen a lift, the yield differential between it and most other traded currencies will endure for a while yet.

These are certainly interesting times for the currency. Those trying to guess what the BoJ will do next have some clues coming up. Japanese retail sales, industrial production and unemployment figures are all due for release in the next twenty-four hours.

USD/JPY Technical Analysis

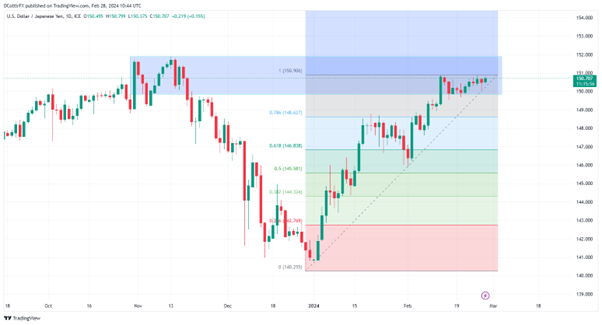

USD/JPY Daily Chart Compiled Using TradingView

Having climbed impressively since late December the market looks wary of topping the intraday high of 150.906 set on February 14 and appears wedded to a trading range between that and 149.809. That latter level was the intraday low of November 2 and, while it has edged below that level in recent days, USD/JPY always trades back above it quite quickly.

Should that level give way there’s likely support around 149.13 ahead of first retracement support at 148.627.

The uptrend from January 2 is currently under test, with the trendline lying quite close to the current market at 150.231. A break of that needn’t be terrible news for Dollar bulls, however as long as the broader range holds.

| Change in | Longs | Shorts | OI |

| Daily | -5% | 6% | 3% |

| Weekly | -10% | 10% | 4% |

–By David Cottle for DailyFX