Acquire the knowledge needed for maintaining trading consistency. Grab your “How to Trade Gold” guide for invaluable ideas and tips!

Recommended by Diego Colman

How to Trade Gold

GOLD PRICE FORECAST – MARKET SENTIMENT

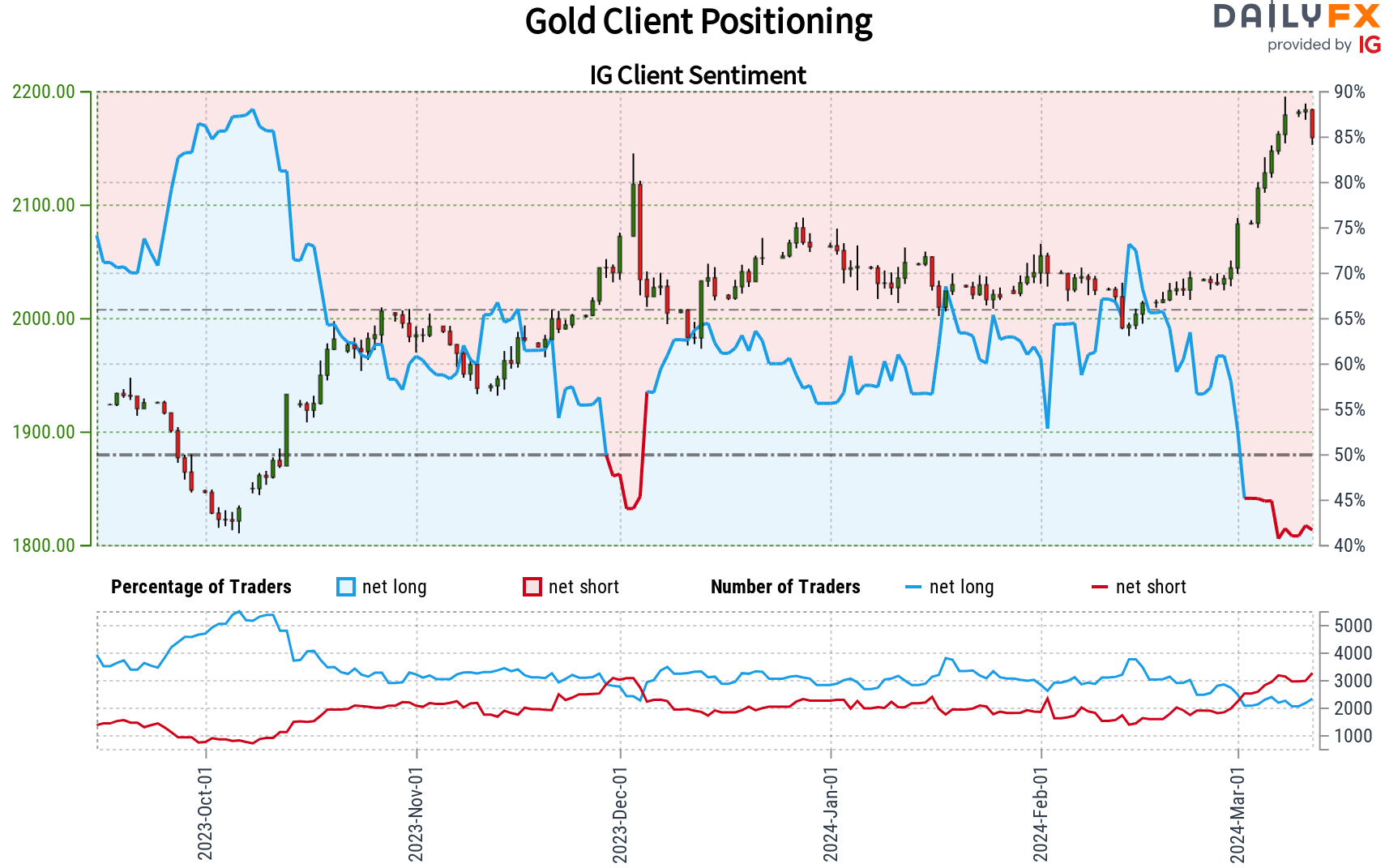

Retail trading activity reveals a net-short bias towards gold, with the ratio of bearish to bullish positions currently sitting at 1.47 to 1 as of late afternoon on Tuesday.

In aggregate, bullish bets on the precious metal are 9.67% lower than yesterday and 12.80% below prevailing levels one week ago. Meanwhile, bearish wagers are 0.31% down compared to the previous session and 13.15% higher from last week.

Our analysis often adopts a contrarian stance on crowd sentiment. With that in mind, the current net-short positioning suggests continued upward potential for gold prices in the near term.

Wondering how retail positioning can shape silver prices? Our sentiment guide provides the answers you seek—don’t miss out, download it now!

| Change in | Longs | Shorts | OI |

| Daily | -7% | 4% | -5% |

| Weekly | -11% | 25% | -6% |

SILVER FORECAST – MARKET SENTIMENT

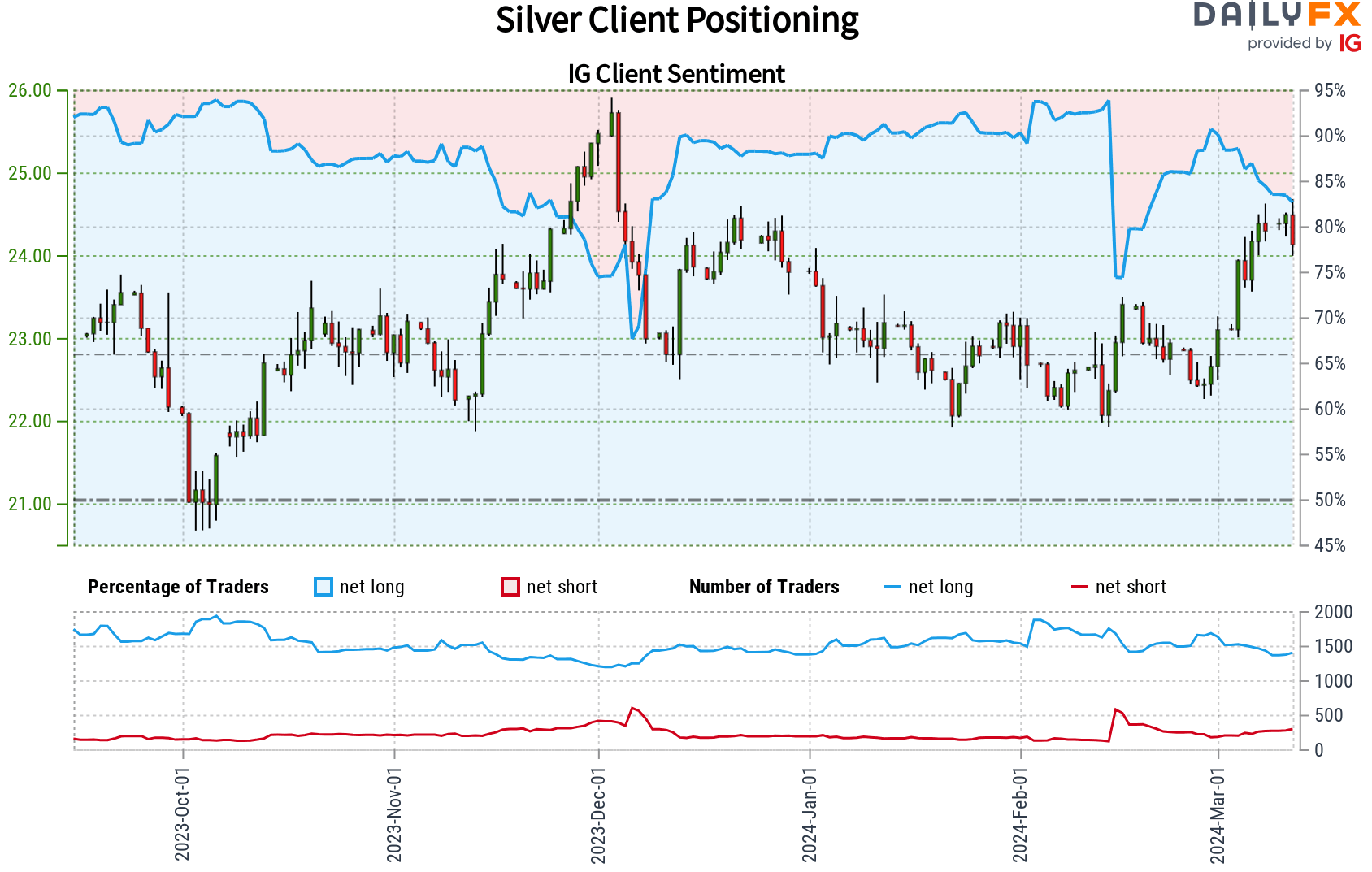

Retail trader data shows 81.60% of traders are net-long silver, with the ratio of long to short at 4.44 to 1.

The number of traders net-long is 7.08% lower than yesterday and 12.23% lower than last week, while the number of traders net-short is 6.86% higher than yesterday and 21.81% higher than last week.

From a contrarian perspective to crowd sentiment, silver’s overwhelmingly bullish positioning among retail investors raises the possibility that prices will soon begin a downward trajectory.

Eager to gain a better understanding of where the oil market is headed? Download our quarterly forecast for enlightening insights!

Recommended by Diego Colman

Get Your Free Oil Forecast

US CRUDE OIL FORECAST – MARKET SENTIMENT

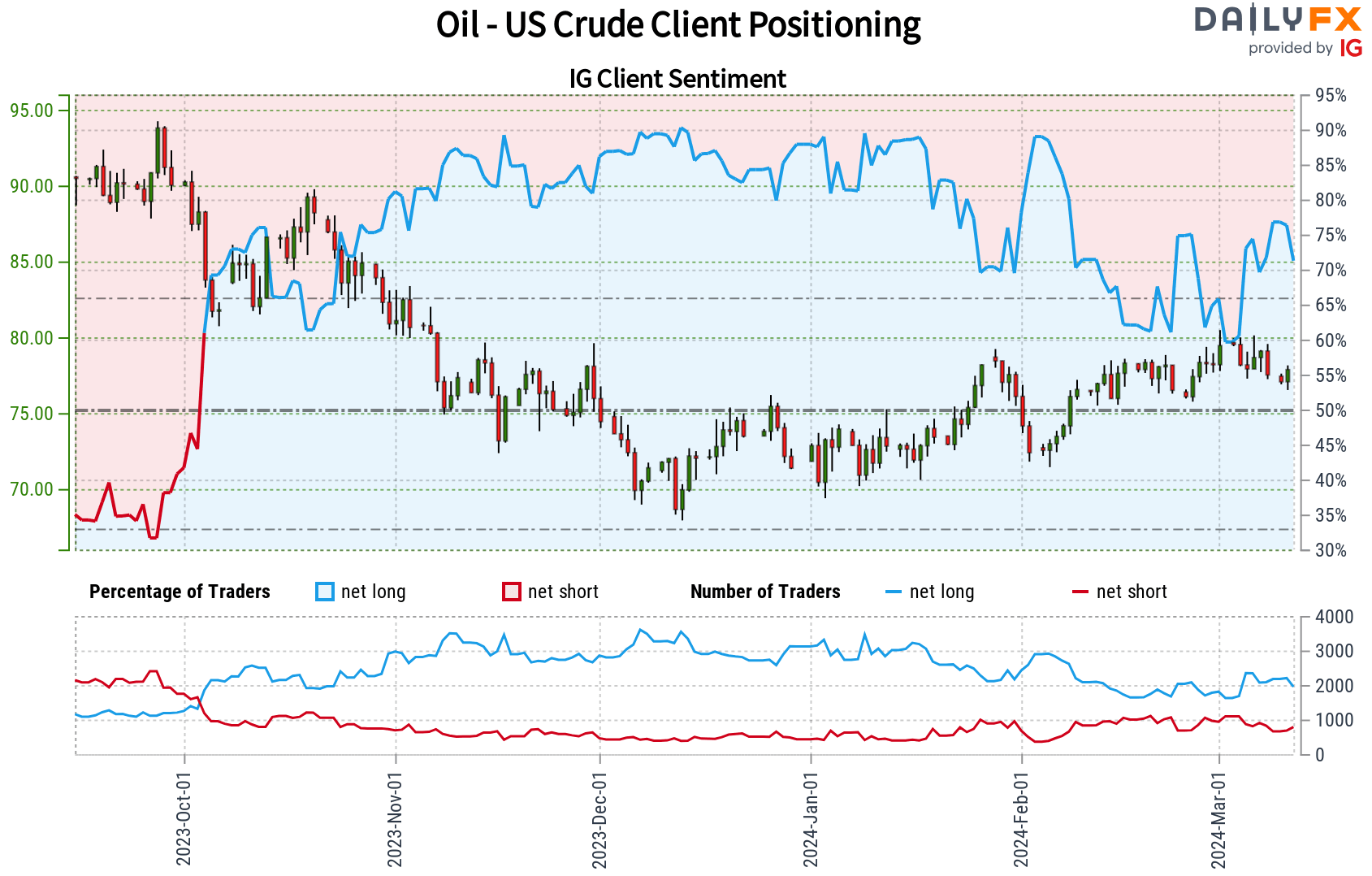

IG proprietary client data from today shows that 69.87% of retail investors are net-long US crude oil, with the ratio of bullish to bearish positions currently standing at 2.32 to 1.

Upon further examination, the number of traders net-long has decreased by 8.58% compared to yesterday and 17.45% relative to last week. Meanwhile, net-short positions have increased by 17.58% from the previous session, though they have fallen slightly by 0.48% from last week’s levels.

We often adopt a contrarian stance towards crowd sentiment, and the prevailing net-long position among traders hints at a possible decline in oil prices in the near future. This observation underscores the importance of leveraging market insights to navigate potential market movements effectively.

If you are looking for a more comprehensive view of U.S. equity indices, our quarterly stock market trading guide packed with great insights. Grab your free copy now!

Recommended by Diego Colman

Get Your Free Equities Forecast

S&P 500 FORECAST – MARKET SENTIMENT

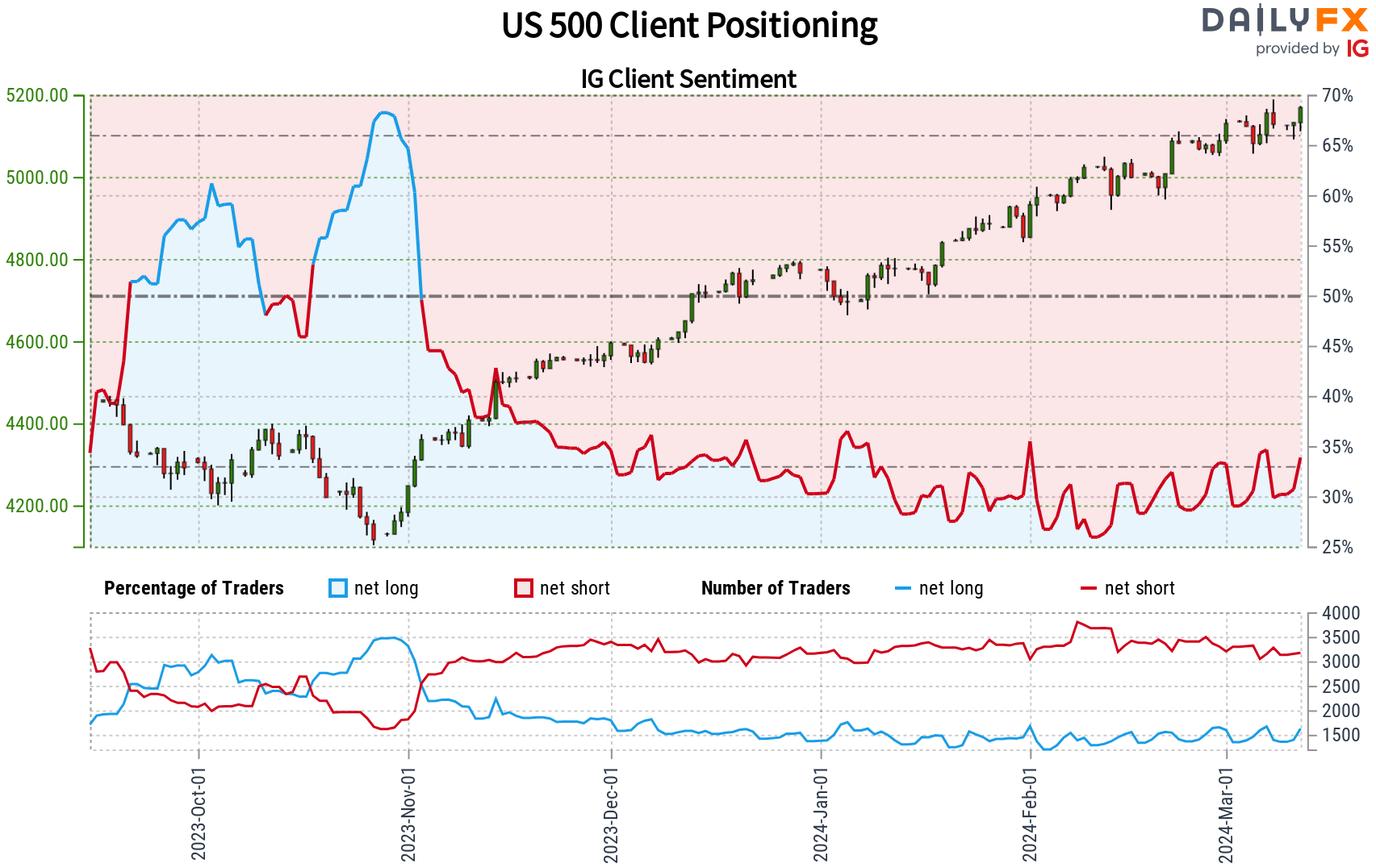

Retail trader data shows 33.09% of traders are net-short, resulting in a bearish to bullish ratio of 2.02 to 1. Comparatively, the number of traders holding net-short positions has increased by 4.42% since yesterday but has slightly decreased by 0.03% from last week.

On the other side of the coin, the number of traders holding net-long positions has risen by 2.89% since yesterday and by 4.76% compared to last week.

Taking a contrarian approach to prevailing sentiment, the current net-short stance of among the retail crowd implies that there might be room for S&P 500 to continue their upward trajectory.

Polish the skills that form the bedrock of consistent trading performance. Obtain a copy of the “How to Trade EUR/USD” guide, teeming with priceless insights and tips to improve your strategies.

Recommended by Diego Colman

Get Your Free EUR Forecast

EUR/USD FORECAST – MARKET SENTIMENT

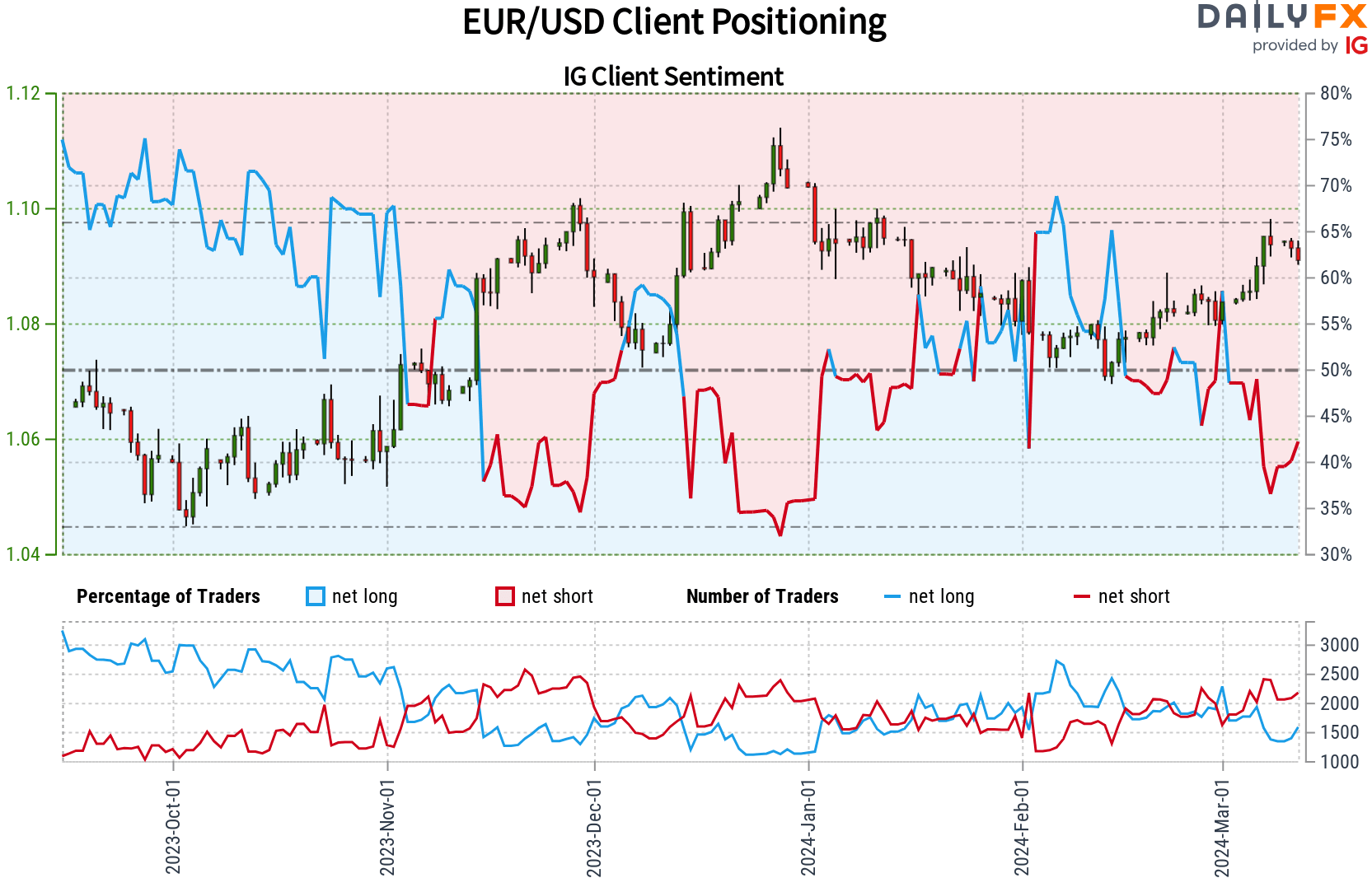

IG retail client data from today shows 43.27% of traders are net-short, with the present ratio of bullish to bearish bets standing at 1.31 to 1.

Taken together, bullish positioning is down 0.73% versus the previous session and 19.44% lower than levels registered last week. Meanwhile, the number of traders net-short is 2.10% lower than yesterday and 0.28% higher than last week.

Our strategy often diverges from prevailing sentiment, and the current net-short positioning of traders indicates that EUR/USD may encounter minimal resistance on the upside.