Crude Oil (WTI) Main Talking Points:

- US Crude still doesn’t look comfortable above $80/barrel

- Its overall uptrend remains in place, however

- This week will bring its share of event risk

Recommended by David Cottle

How to Trade Oil

Crude Oil prices fell initially on Tuesday, with investors apparently less-than reassured by China’s latest economic-revival plans, but they have pared losses through the European morning.

Worries about Chinese energy demand have been a problem for oil bulls for some time as the world’s number two economy struggles to regain anything like its pre-pandemic vigor. Beijing has announced its intentions to ‘transform’ its development mode, and address endemic overcapacity, but its 2024 growth target of 5% perhaps only served to remind investors that China remains in the slow lane by its own recent standards.

The Organization of Petroleum Exporting Countries and its allies (the so-called ‘OPEC Plus’ group) has extended production cuts into this year’s second quarter, but that move was widely expected and didn’t affect prices much. More broadly the market remains caught between the prospect of plentiful supply from non-OPEC producers, and uncertain demand chances as the industrialized economies struggle with meager growth or, in some cases, outright recession.

Some economists think supply could tighten into next year, however, as production booms seen last year in the likes of the United Stats and Guyana won’t necessarily be repeated in 2024. Conflicts in the Middle East and Ukraine also put upward pressure on prices, and its notable that, despite investor wariness, the overall uptrend for US crude prices remains in place.

This week will bring plentiful economic news out of the US, culminating in Friday’s release of the official non-farm payrolls data which sent the Dollar soaring last month. Signs that the US economy continues to motor should probably be good news for the oil market but, probably only in so far as rate cuts remain on the table this year. Closer to the market, the Energy Information Administration’s snapshot of oil inventories for last week will be released on Wednesday.

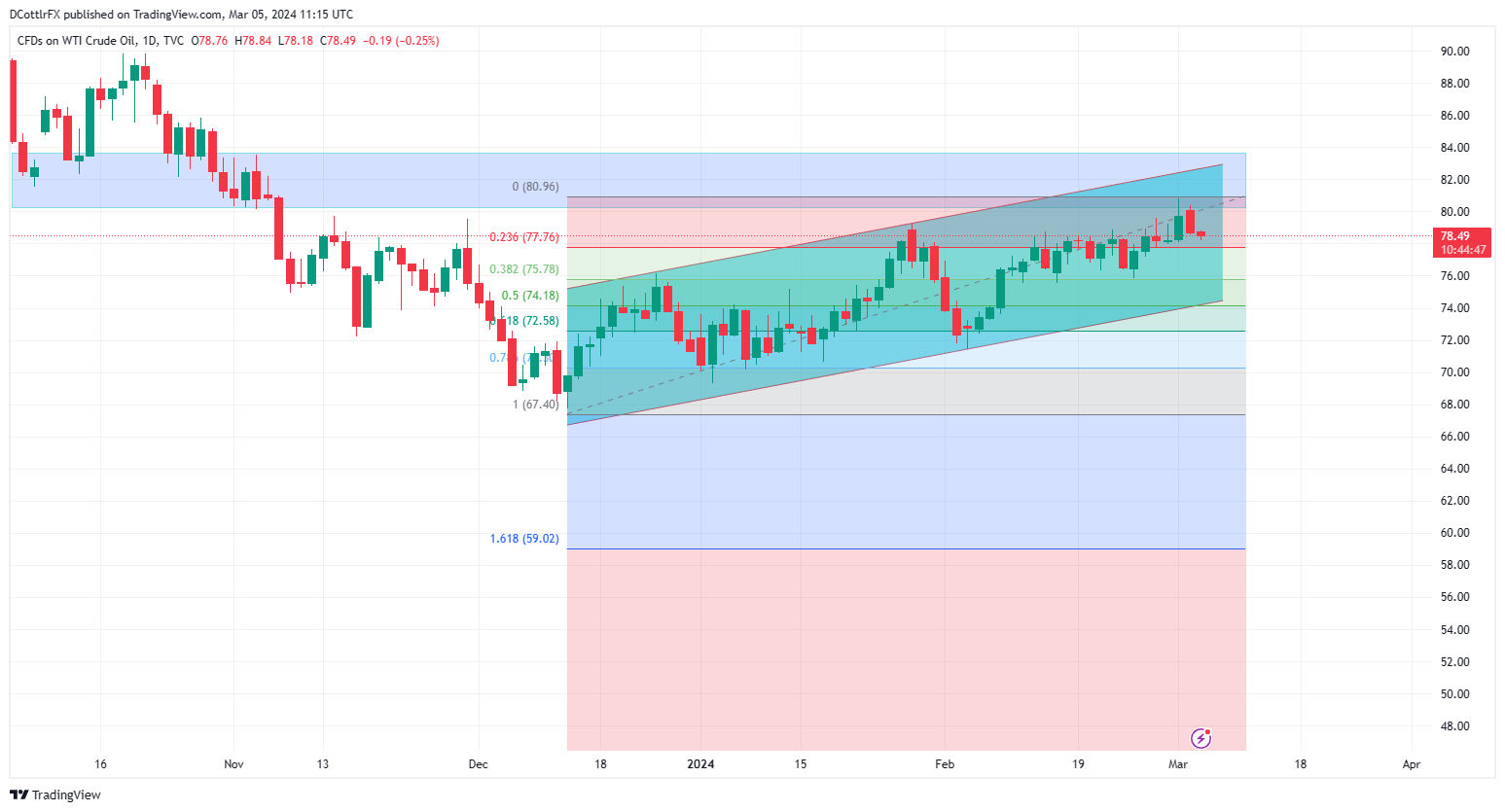

US Crude Oil Technical Analysis

Daily Chart Compiled Using TradingView

The oil market is highly dependent on fundamental forces of supply and demand, geopolitics and global growth. Find out why in our ‘Core Fundamental of Oil Trading’ guide below:

Recommended by David Cottle

Understanding the Core Fundamentals of Oil Trading

The US West Texas Intermediate Benchmark is inching up towards a trading band last seen in late October and early November 2023 which bars the way back to that year’s highs.

The base of that band currently offers resistance at $80.21. Prices are hovering toward the middle of a broad uptrend band which suggests reasonable support at $74.23 and resistance at $82.69. Price moves have been smaller in recent days, however, and there are signs that the uptrend band could be narrowing, a process which might be explained by this week’s significant economic event risk.

Retracemment support comes in at $77.76, and the market will probably retain its overall bullish bias above that point,

IG’s own sentiment data finds traders extremely bullish at current levels, with fully 74% long. This is the sort of rather extreme positing which might argue for a contrarian bullish play, even if only a short-term one.

Stay up to date with the latest market news and themes driving markets by signing up to our weekly newsletter:

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

–By David Cottle for DailyFX