British Pound Q2 Fundamental Outlook

The Bank of England’s Monetary Policy Committee took a dovish turn at their latest policy meeting, sparking discussion that the UK central bank may bring forward its first interest rate cut from August to June. Both the Federal Reserve and the European Central Bank are seen kick-starting their rate-cutting program in June, and if the BoE joins in, traders may have to re-think their Q2 outlook for all three currencies.

You can download our full British Pound Q2 Forecast including technical analysis on GBP/USD, EUR/GBP, and GBP/JPY by clicking the link below

Recommended by Nick Cawley

Get Your Free GBP Forecast

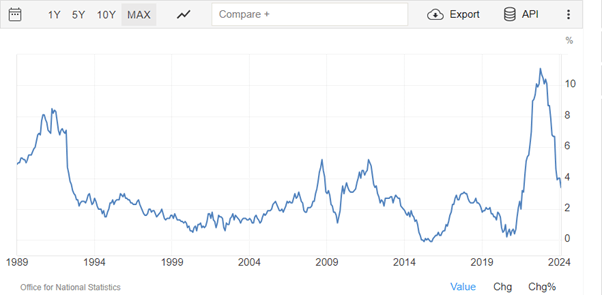

Inflation is Forecast to Meet Target in the Months Ahead

UK inflation continues to move and is likely to hit the central bank’s target in the coming months. According to the BoE, annual headline inflation is ‘projected to fall to slightly below 2% in 2024 Q2’, before moving marginally higher in Q3 and Q4. UK inflation has fallen sharply after hitting a multi-decade high of 11.1% in October 2022 and is now back at levels – 3.4% – last seen in September 2021. The BoE has remained steadfast during this period, signaling that UK price pressures must be tamped down sustainably.

UK Inflation

Chart via Trading Economics

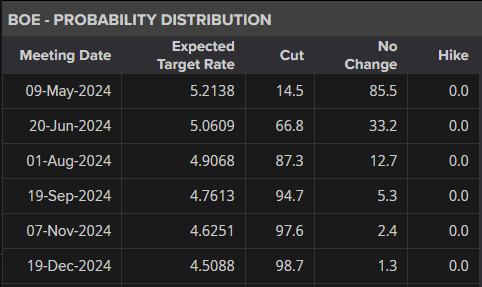

Recent comments from Governor Andrew Bailey suggest that the BoE now sees the economy ‘moving in the right direction’ and that he is ’comfortable’ with market rate cut forecasts. The market expectation of the first UK rate cut has now been pushed forward to the June 20th BoE meeting, bringing it in line with Fed and ECB rate cut forecasts. The markets are also fully pricing in three quarter-point rate cuts this year.

UK Interest Rate Probabilities

Probabilities via Refinitiv

UK Growth Remains Tepid, Jobs Market Remains Tight

The UK economy remains weak and rate cuts will be welcomed across a range of sectors. The latest ONS data showed that the UK economy entered a technical recession in Q4 2023. The British economy contracted by 0.3% in the final quarter of last year, following a 0.1% contraction in Q3. Looking at 2023 as a whole, the economy grew by a miserly 0.1%. The recent Spring Budget is forecast to boost GDP by around a quarter of one percentage point, welcome but domestic growth needs further drivers.

UK wage growth remains firm although wages are growing at a slightly slower rate. Average earnings (ex-bonus) rose by 6.1% in January, sharply higher than the recent UK inflation figure of 3.4%. leaving the UK consumer with more in their pockets. The jobs market remains robust with unemployment at 3.9%, while economic activity (aged 16 to 64) is picking up and remains above pre-pandemic levels.

With a healthy economic backdrop of rapidly falling inflation, a stagnant to marginally weaker jobs market, and an economy that needs a boost, the Bank of England is right to set forward a set of rate cuts this year, starting at the June 20th meeting.