- XRP bulls battled against the mid-range resistance zone.

- The futures market clues pointed to bearish sentiment and a consolidation phase under $0.6.

Ripple [XRP] has formed a bullish triangle pattern over the past 18 months and investors would be hoping a tremendous breakout can ensue sometime during the bull run. In the shorter timeframes, a range formation was anticipated.

XRP was already trading within a range that stretched back almost a year, and at press time was just below the mid-range resistance at $0.585. AMBCrypto’s analysis showed a smaller range could materialize.

Bearish sentiment evident in the futures markets

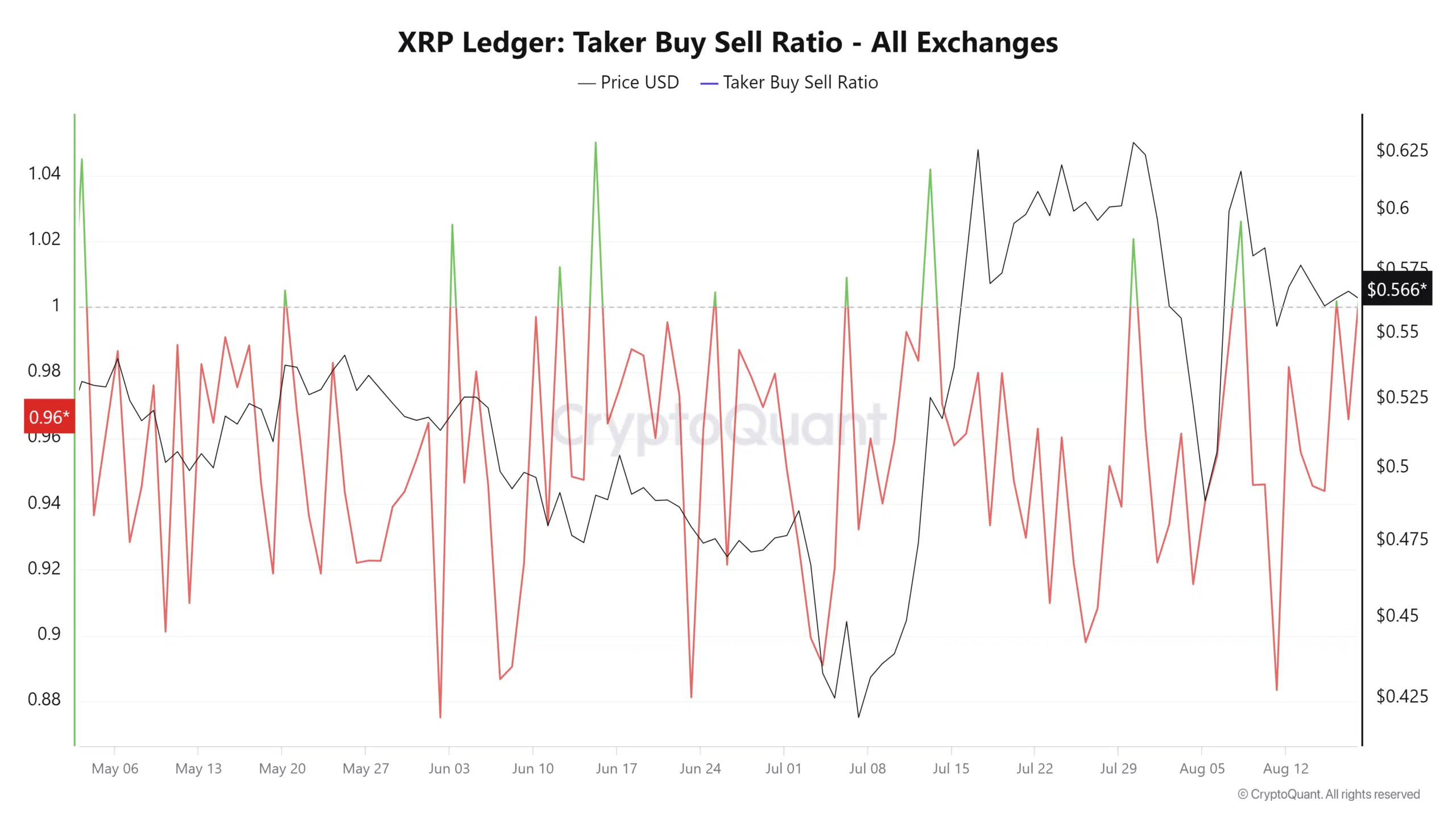

Source: CryptoQuant

The taker buy-sell ratio measures the volume of buy to sell market orders in the perpetuals market. A ratio of under one shows more taker sell volume, implying greater bearish sentiment.

In the past few months, this ratio has been predominantly bearish. This helped explain why XRP has retraced both the rallies to $0.7 that occurred in the past year.

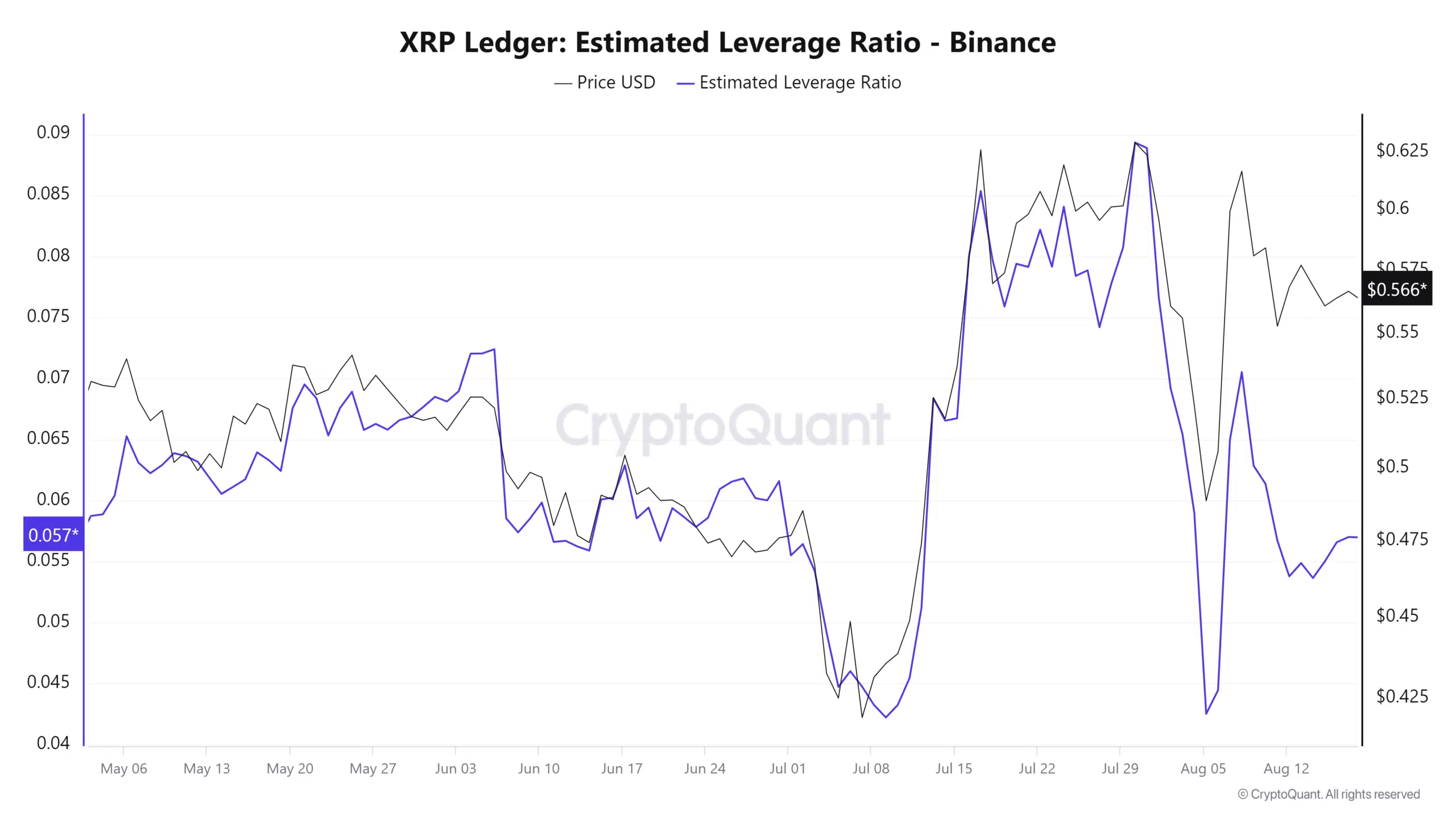

Source: CryptoQuant

Since late July the estimated leverage ratio has fallen dramatically. This meant that participants taking more risk and greater leverage was reduced, potentially due to the price volatility.

This sets up conditions for a healthy spot-driven rally.

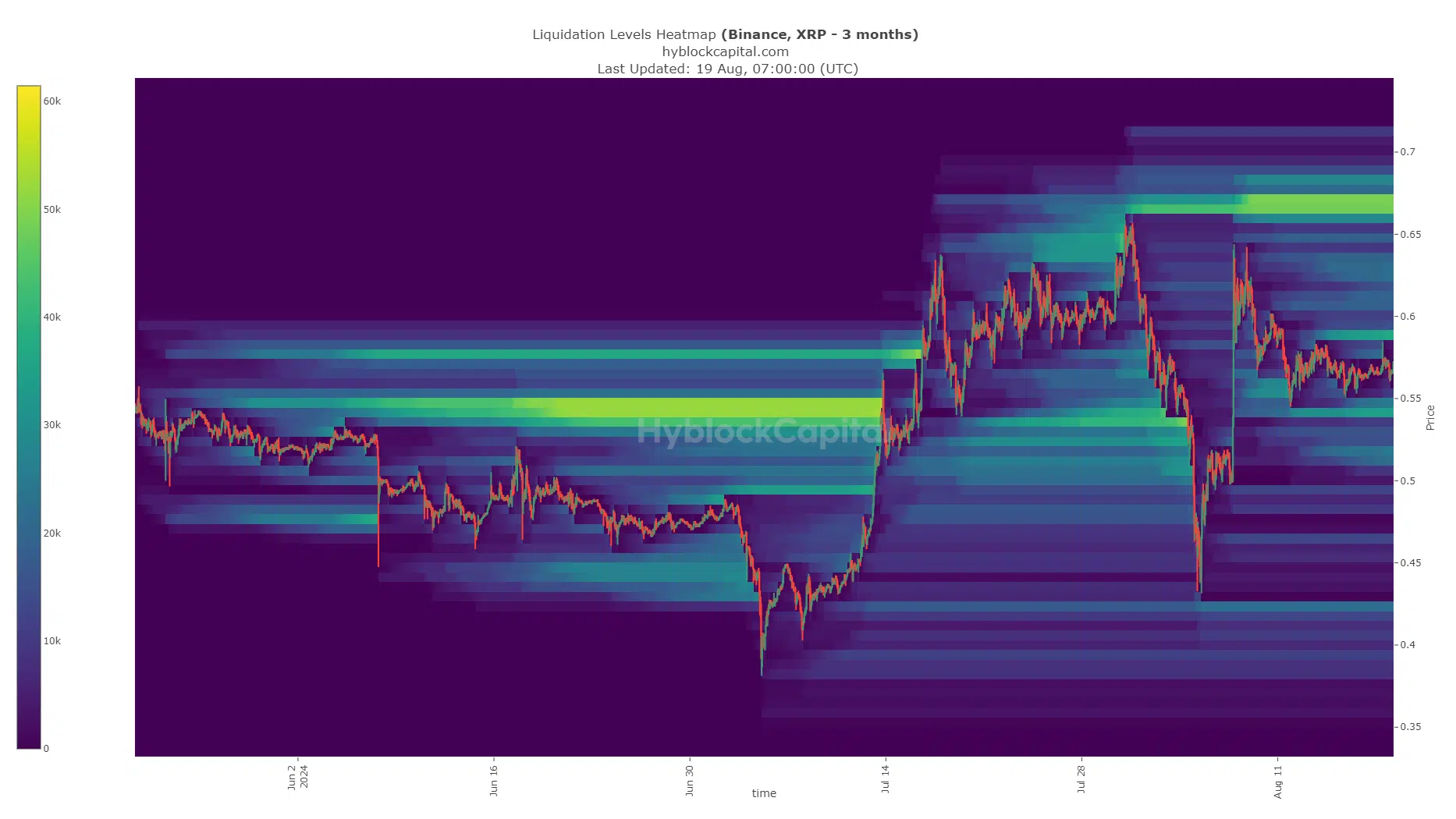

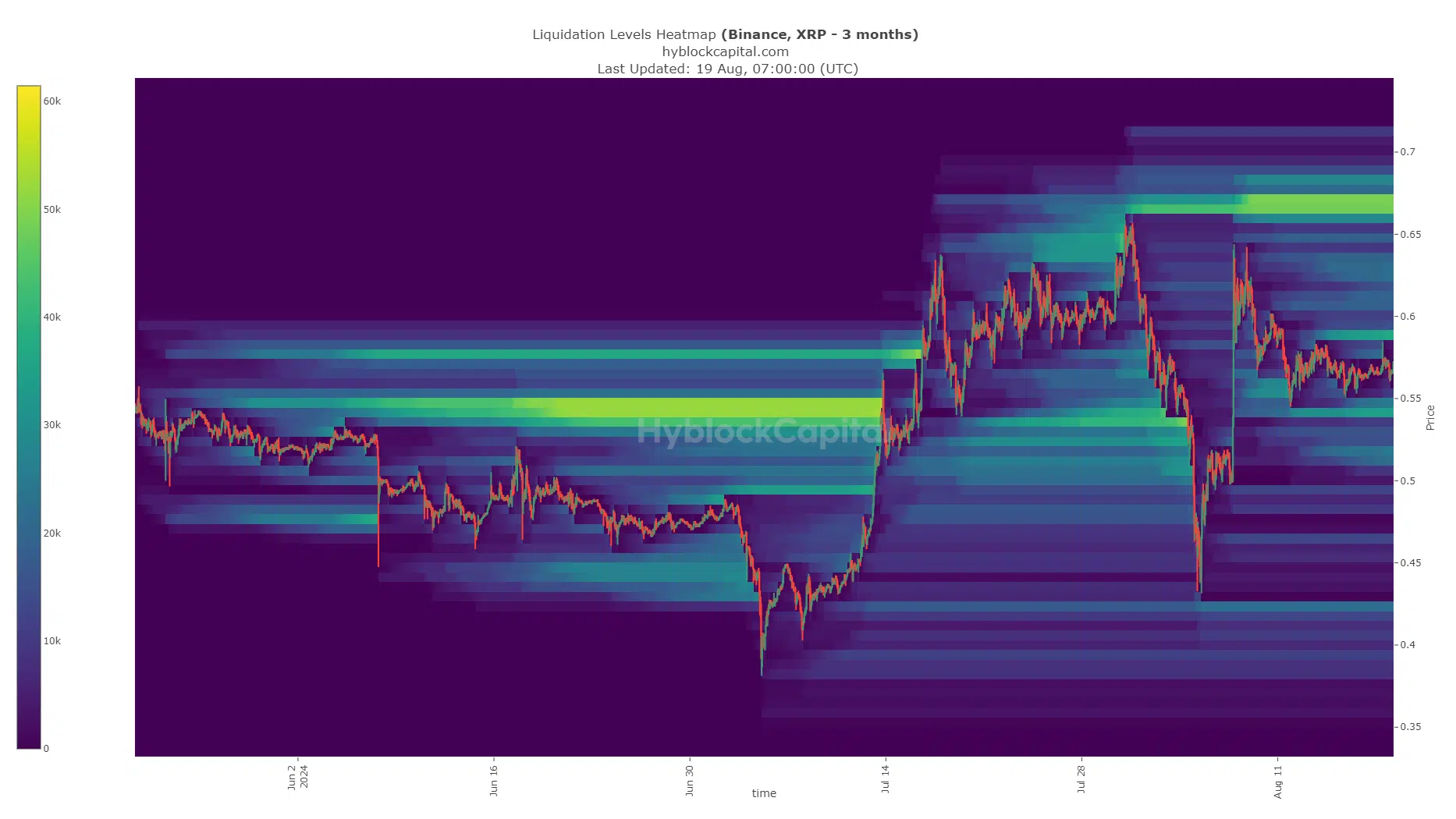

Examining the XRP liquidation heatmap for price trend clues

Source: Hyblock

The largest liquidity pool on the 3-month look-back chart was at $0.67, just below the range highs at $0.7. Meanwhile, two more considerable magnetic zones have developed at $0.589 and $0.541.

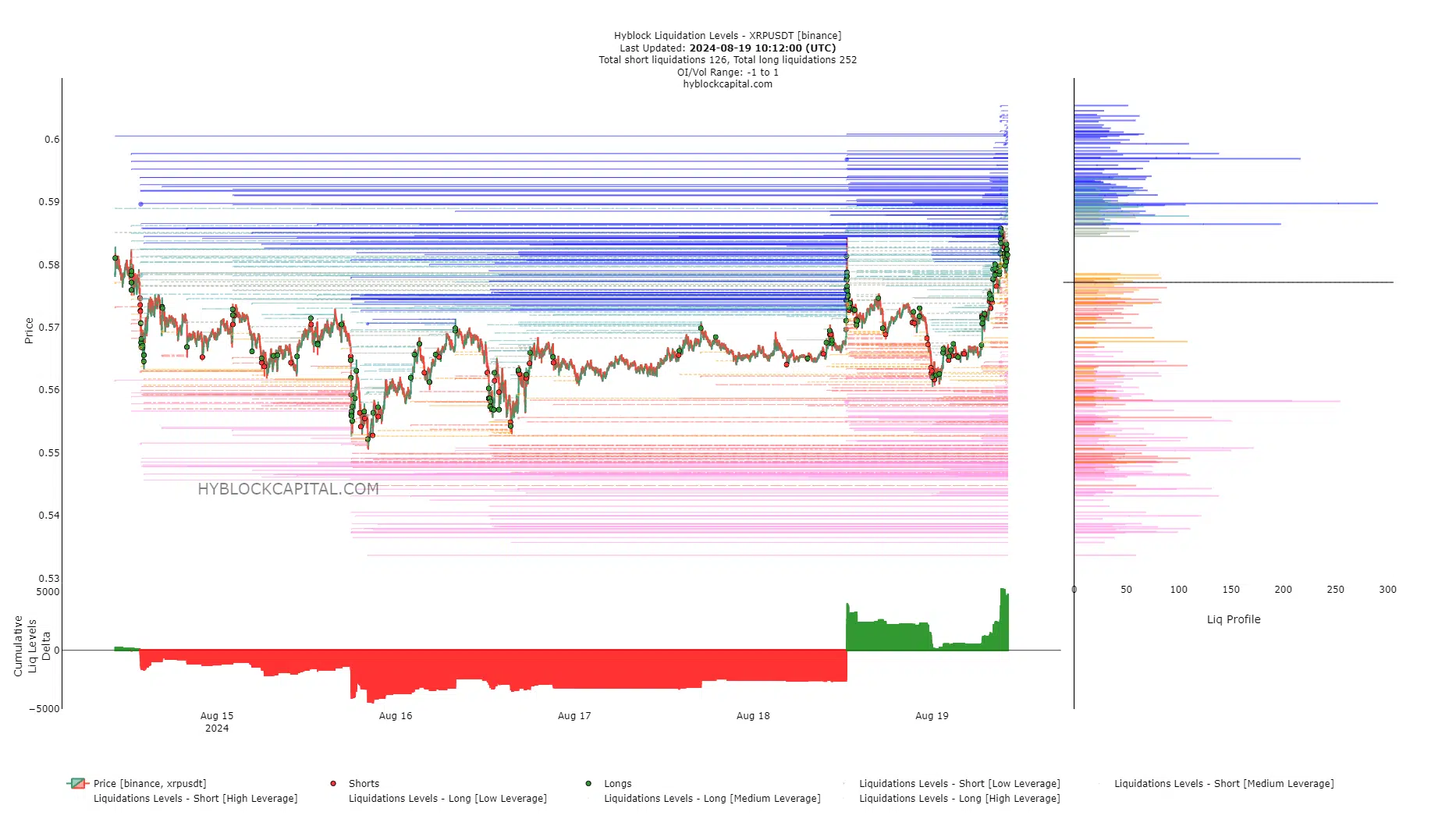

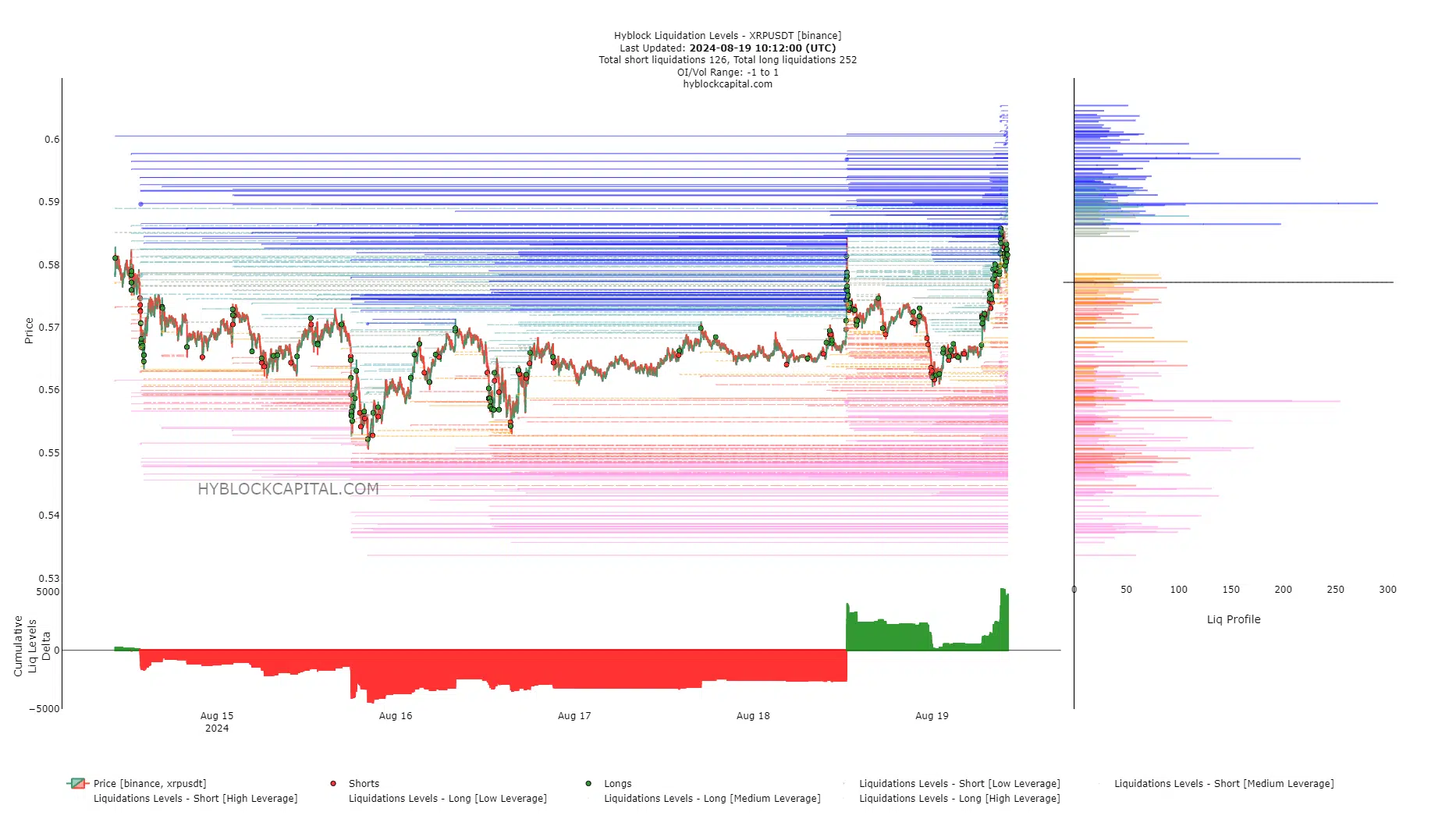

Source: Hyblock

Meanwhile, the short-term liquidation levels data showed that the long levels were beginning to outnumber the shorts.

Read Ripple’s [XRP] Price Prediction 2024-25

The rising positive delta could see a sharp price move down to hunt the overeager bulls.

The cumulative liq levels delta was not yet high enough to warrant expectations of such a reversal. If XRP reaches the $0.59-$0.6 resistance zone, this situation could change.