Alphabet’s Earnings – What to Expect

Source: Refinitiv

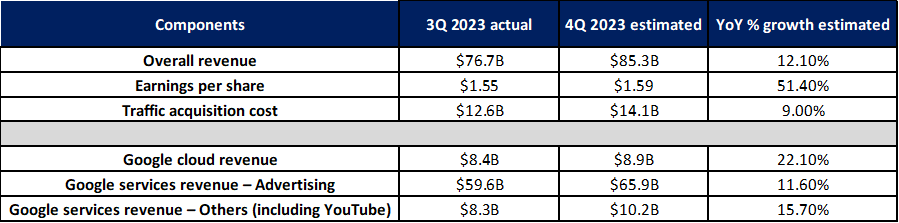

For Alphabet’s upcoming results, expectations are for a broad recovery on all fronts. Double-digit growth in both its key segments (Google Cloud and Google Services) is expected to power a 12.1% year-on-year (YoY) growth in overall revenue to US$85.3 billion.

Likewise, its 4Q 2023 earnings per share (EPS) is expected to improve to US$1.59 from the previous quarter’s US$1.55, which will extend its streak of positive YoY EPS growth to the third straight quarter.

Recommended by Jun Rong Yeap

Traits of Successful Traders

Rebound in advertising activities to continue in 4Q 2023

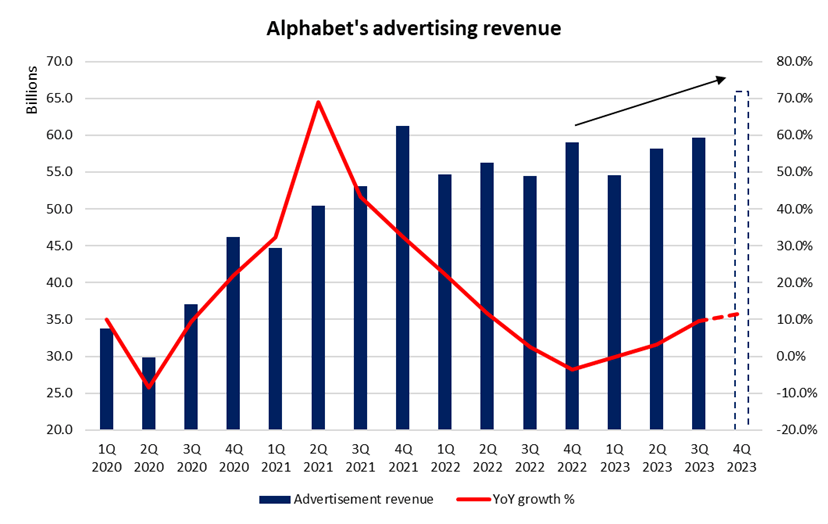

Advertisement revenue accounts for 78% of Alphabet’s top-line. Having reverted to positive YoY growth over the past two quarters, the recovery momentum for the segment is expected to continue with a stronger 11.6% growth in 4Q 2023, up from 9.5% in 3Q 2023.

Increasing views of a US soft landing and further clarity of a peak in the Federal Reserve (Fed)’s hiking cycle in 4Q 2023 may see business confidence return, which could further accelerate ad spending ahead. Back in 3Q 2023, Alphabet’s management guided that there has been some ‘stabilisation’ in advertising spend, which seems to set the tone for better times ahead.

Source: Refinitiv

Ongoing race to unlock synergies of generative AI on product offerings

With the ongoing traction towards generative artificial intelligence (AI), Alphabet has previously incorporated AI-powered solutions like Search and Performance Max to help customers increase their ad’s return on investment (ROI), which may allow Alphabet to defend its edge over the broader advertising industry.

Further integration of Bard with Google apps and services will also be on the lookout, but no doubt it will be a race against time against Microsoft, which has been a first-mover with its ChatGPT. Microsoft’s Copilot feature to integrate AI into its office applications will also serve as a threat to Alphabet’s cloud-based products, including Google Sheets and Google Docs, while further developments of Microsoft’s search engine Bing could continue to compete for Google’s market share.

The race to unlock synergies of generative AI on product offerings will remain tight, with any progress of new features on close watch at the upcoming earnings call.

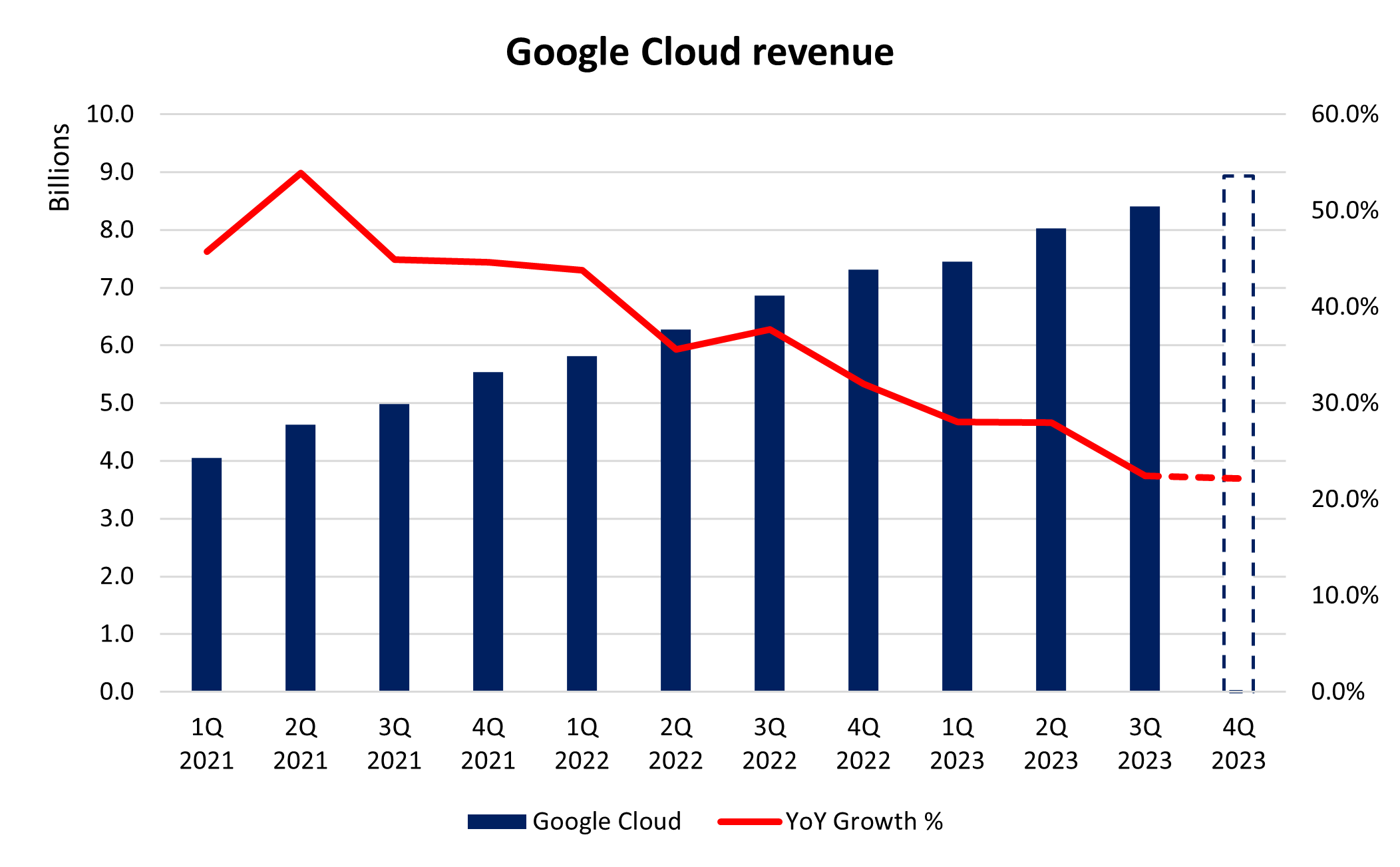

Cloud business performance will remain high on market participants’ radar

In the 3Q 2023 results, Alphabet topped both revenue and EPS estimates, but its share price plunged as much as 10% in a single day due to a miss in its cloud revenue. This highlights the importance that market participants are placing on this segment as Alphabet’s key growth driver, amid the rising trend of generative AI which should translate to growing demand for public cloud services.

Any lack of growth momentum on that front could mean losing market share to Amazon Web Services (AWS) and Microsoft Azure – the other frontrunners in the highly competitive cloud computing space. With that, a significant miss on this segment could singlehandedly drag the stock price down, given that the company has been investing heavily in its cloud unit and market participants naturally carry high expectations for its growth.

Source: Refinitiv

Can YouTube continue to hold up against its competitors (eg. TikTok)?

YouTube Shorts (Alphabet’s short-form video feature as a reply to competitor TikTok) has been delivering thus far. In the 3Q 2023 results, it is reported to have 70 billion daily views, a significant growth from the 50 billion daily views at the beginning of 2023.

With that, some focus will be on whether the solid momentum in both YouTube’s ads and subscription businesses from 3Q 2023 can be mirrored in the upcoming results as well.

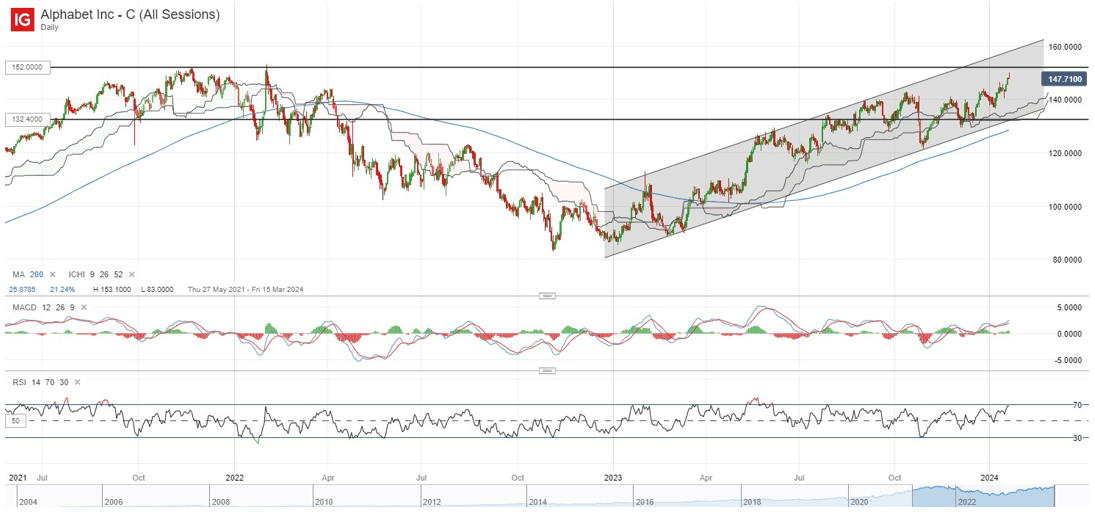

Technical analysis – Alphabet’s share price eyeing for a retest of its all-time high

Alphabet’s share price has been trading on a series of higher highs and higher lows since the start of 2023, with price movement fitting into a broad ascending channel pattern. Trading above its Ichimoku cloud on the daily chart, along with various moving averages (MA) (100-day, 200-day), validates the overall upward trend as well.

On the weekly chart, its weekly relative strength index (RSI) has also been trading above its key 50 level since March 2023, briefly retesting the key level back in October 2023, which managed to see some defending from buyers. Ahead, buyers may eye for a potential retest of its all-time high at the US$152.00 level, with current prices standing just 3% away from the target.

On the downside, immediate support to defend may be at the US$142.50 level. A stronger area of support confluence may be found at the US$132.40 level, where the lower channel trendline coincides with the lower edge of its Ichimoku cloud on the daily chart.

Source: IG charts

Recommended by Jun Rong Yeap

Get Your Free Equities Forecast