Most Read: Gold Prices on the Rise, Confluence Resistance in Sight. What Now for XAU/USD?

The U.S. dollar fell modestly on Tuesday on the back of subdued U.S. yields in a session lacking significant drivers. Volatility in the FX space, however, may accelerate later in the week, courtesy of a high-impact event on the U.S. calendar on Wednesday: the release of the FOMC minutes.

The minutes will surely provide a greater degree of clarity regarding the central bank’s assessment of the inflation outlook and the possible timing of the first rate cut, so traders should parse and analyze the document closely.

Based on recent comments from several Fed officials, the readout of the last meeting may signal limited interest for immediate rate cuts in response to stagnating progress on disinflation. This scenario should boost U.S. Treasury yields, bolstering the U.S. dollar in the process.

Seeking actionable trading ideas? Download our comprehensive trading opportunities guide, filled with insightful strategies tailored for the first quarter!

Recommended by Diego Colman

Get Your Free Top Trading Opportunities Forecast

In the unlikely event that the minutes demonstrate a greater inclination among policymakers to initiate the easing cycle sooner rather than later, the opposite response could materialize, i.e., a pullback in yields and the greenback. Regardless of the outcome, we could see larger FX market swings in the coming days.

Fundamentals aside, the remainder of this article will center on the technical outlook for major U.S. dollar pairs such as EUR/USD, GBP/USD and USD/JPY. Here we’ll assess the crucial price thresholds that currency traders should be aware of in the upcoming sessions.

Gain access to an extensive analysis of the euro’s fundamental and technical outlook in our complimentary Q1 trading forecast. Download the guide now for valuable insights!

Recommended by Diego Colman

Get Your Free EUR Forecast

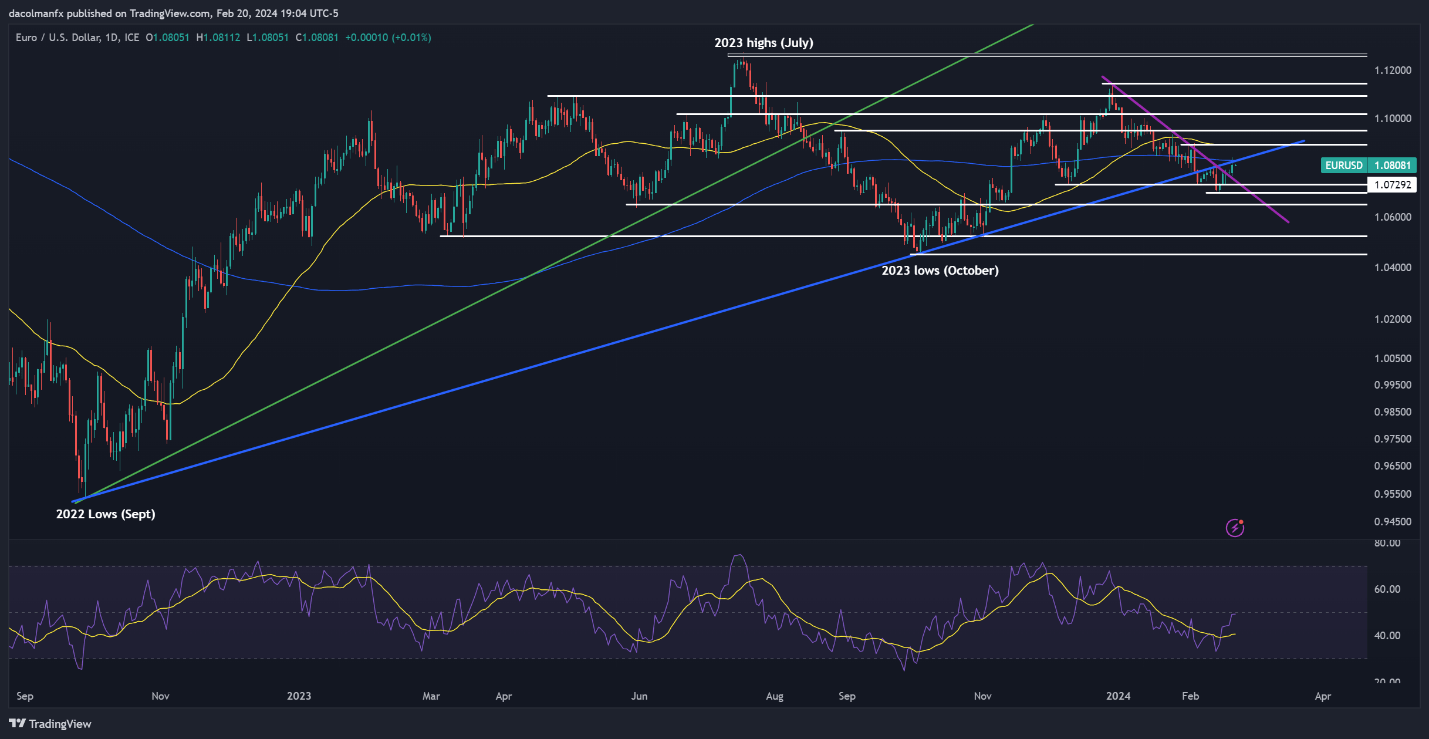

EUR/USD FORECAST – TECHNICAL ANALYSIS

EUR/USD continued its recovery on Tuesday after rebounding from support near 1.0700 last week. If gains persist in the upcoming days, resistance is anticipated around the 200-day simple moving average at 1.0820. Beyond this threshold, all eyes will be on 1.0890, followed by 1.0950.

In the event of a market reversal, initial support can be identified near 1.0725 and 1.0700 subsequently. Bulls will need to vigorously protect this technical floor; failure to do so could result in a pullback towards 1.0650. On further weakness, attention will be squarely on 1.0520.

EUR/USD TECHNICAL CHART

EUR/USD Chart Created Using TradingView

Eager to discover what the future holds for the Japanese yen? Delve into our Q1 trading forecast for expert insights. Get your free copy now!

Recommended by Diego Colman

Get Your Free JPY Forecast

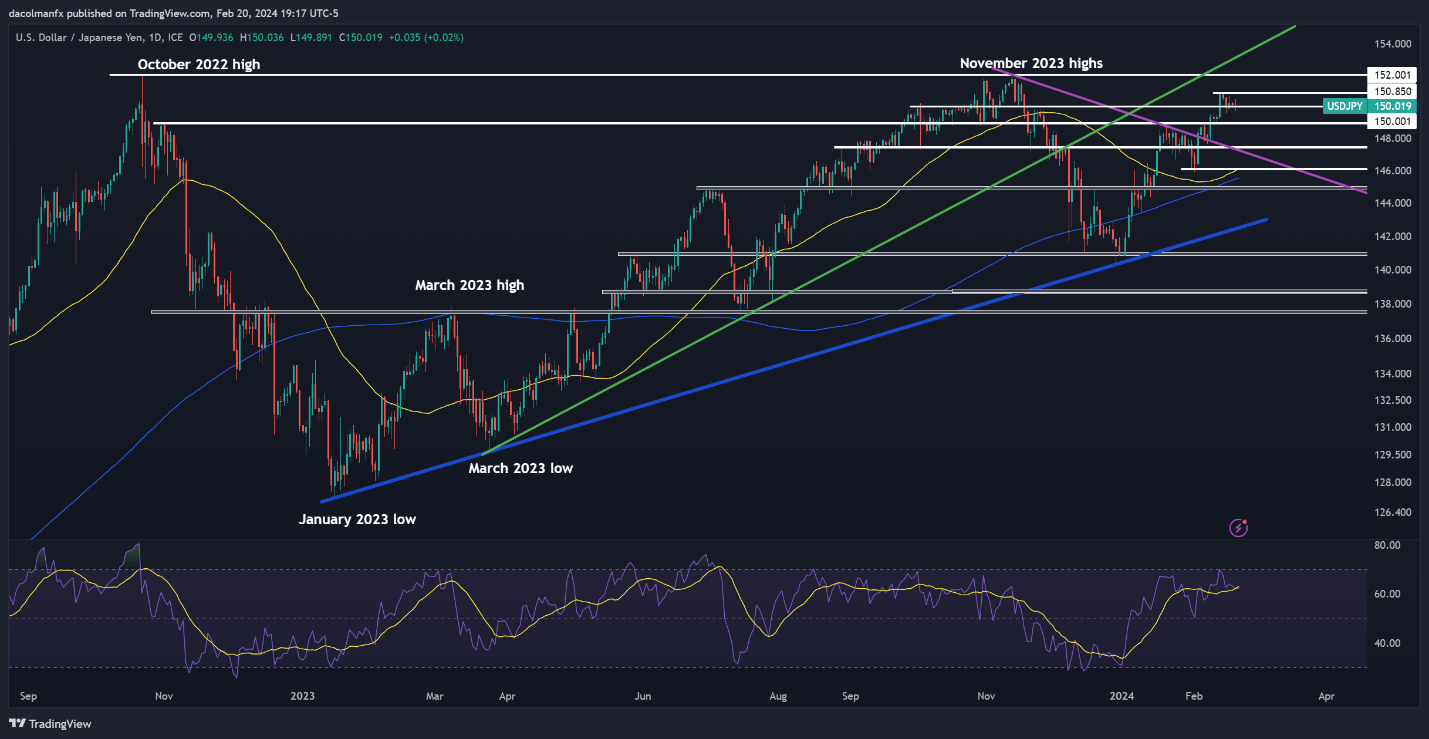

USD/JPY FORECAST – TECHNICAL ANALYSIS

USD/JPY ticked down and fell below the 150.00 handle on Tuesday. Should weakness persist throughout the week, support emerges at 148.90, followed by 147.40. Further losses from this point onward may bring the 50-day simple moving average near 146.00 into focus.

On the other hand, if bulls return and push prices back above the 150.00 handle, we could soon witness a retest of the 150.85 region. Although overcoming this ceiling might present a challenge for the bulls, a decisive breakout could usher in a rally toward last year’s high in the vicinity of 152.00.

USD/JPY TECHNICAL CHART

USD/JPY Chart Created Using TradingView

Delve into how crowd psychology may influence FX market dynamics. Request our sentiment analysis guide to grasp the role of retail positioning in predicting USD/CAD’s near-term direction.

| Change in | Longs | Shorts | OI |

| Daily | -7% | -18% | -12% |

| Weekly | 19% | -25% | -3% |

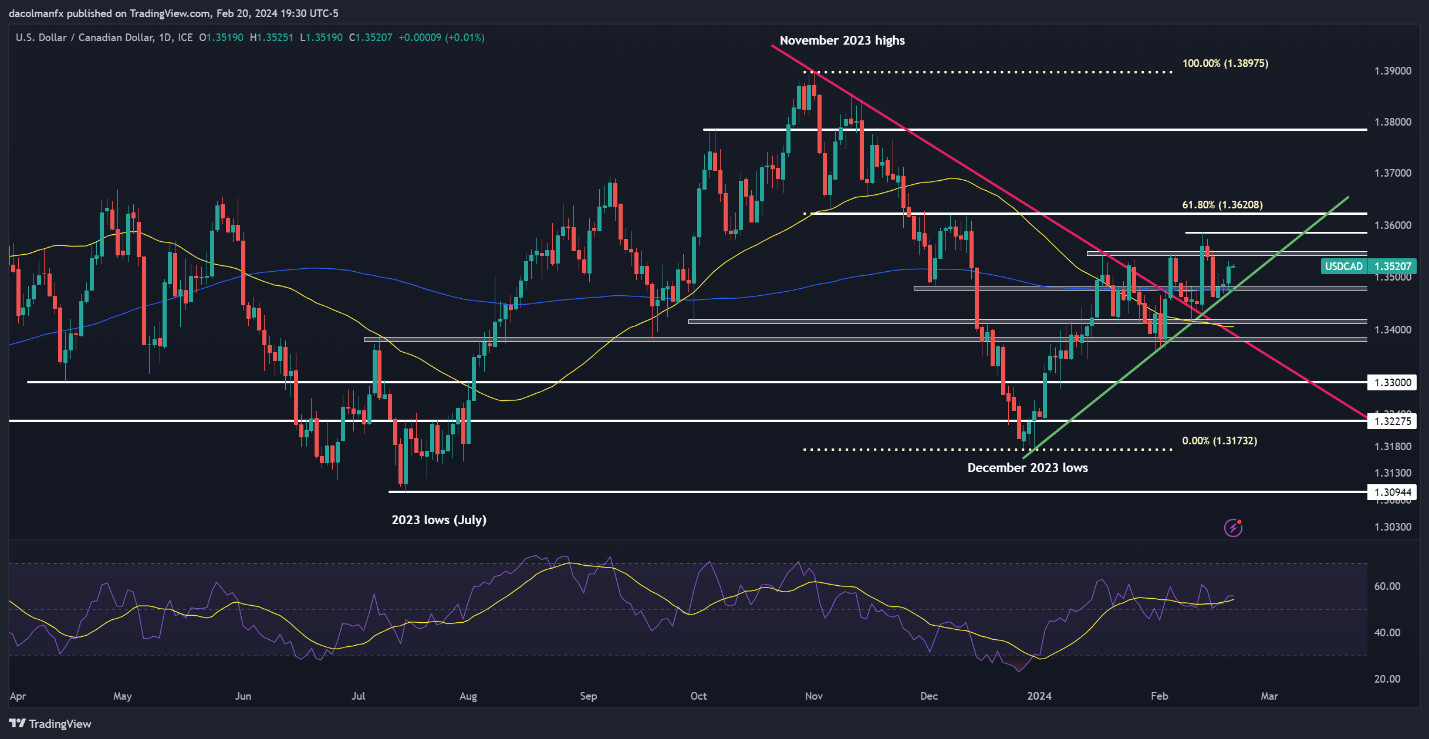

USD/CAD FORECAST – TECHNICAL ANALYSIS

USD/CAD consolidated to the upside on Tuesday, further moving away from its 200-day simple moving average and trendline support near 1.3480. If gains gather momentum over the next few days, overhead resistance looms at 1.3545, followed by 1.3585. Above these levels, the spotlight will be on 1.3620.

Conversely, if prices pivot to the downside and head lower, the first floor to monitor is located at 1.3480. This area might offer stability for the pair during a retracement, but in the event of a breakdown, a rapid decline towards the 50-day simple moving average at 1.3415 could be imminent.