British Pound Forecast: Neutral

- GBP/USD remains stuck in a broad range

- This isn’t likely to change durably on the coming week’s ‘known knowns.’

- Such heavyweight numbers as there are come from the USD side.

Download our complimentary Q1 British Pound Technical and Fundamental Report

Recommended by David Cottle

Get Your Free GBP Forecast

The British Pound didn’t move very far against the United States Dollar in the past week, despite news of a surprise uptick in British inflation and an even more shocking slide in domestic retail sales.

Sterling’s torpor can be explained by two factors which are likely to endure into the coming session. One is that expectations of what the Bank of England might do to borrowing costs haven’t materially changed. The market still thinks interest rates are as high as they’re going to go. It’s also largely content to view current inflation pressures as temporary increases in a gradual downward trend.

Investors still think rate cuts are coming this year, with some economists reportedly suggesting that they could come as soon as May.

On the other side of the GBP/USD pair, the Dollar has seen some support as the market wonders how soon the Federal Reserve might cut its base rates. Inflation remains above target in the US, and the economy has proven surprisingly robust in the face of tighter credit after rate-rises already made.

The coming week doesn’t offer a huge number of UK data cues but there are some big numbers due from the US. The British January Purchasing Managers Index is coming up on Wednesday. It’s likely to show manufacturing well in the doldrums (again) but the big question for investors will be the extent to which services are shouldering the growth burden.

US durable goods order numbers are coming up on Thursday. They’re almost sure to see the Dollar move, if not, perhaps very sustainably. Personal Consumption and Expenditure price data will round out the week.

The central bank cycle starts again, but the Bank of Japan and European Central Bank will kick it off. Sterling investors must wait until February 1 to hear how the Bank of England views 2024 so far.

With that in mind, it seems likely that Sterling will be stuck to current ranges this week.

Recommended by David Cottle

Recommended by David Cottle

Master The Three Market Conditions

GBP/USD Technical Analysis

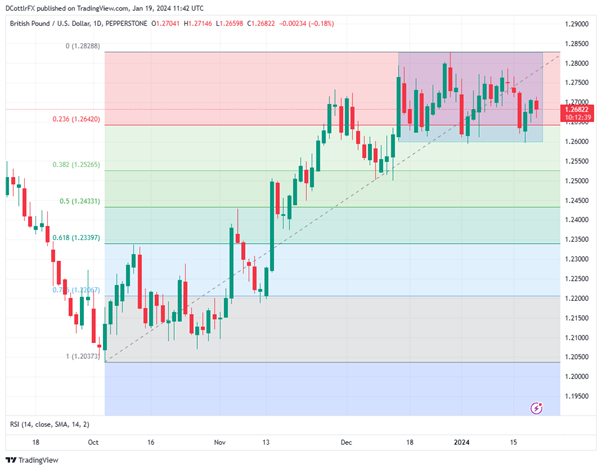

GBP/USD Daily Chart Compiled Using TradingView

The pair remains trapped in a broad range bounded by December 28’s four-month peak of 1.28288 and the intraday lows of January 3 and 17, at 1.26007.

Clearly the 1.2600 psychological support zone is key for sterling bulls now and they’ll need to defend it if they’re going to avoid deeper falls. They have done so successfully since mid-December 2023.

Above that, 1.26420 could also be significant. That’s the first Fibonacci retracement of the rise to that December peak from the lows of October 4.

To the upside, bulls will have January 11’s closing high of 1.27600 in their sights as near-term resistance. They can take some comfort from the fact that the Pound doesn’t look at all overbought against the Dollar according to its Relative Strength Index. That sits around the fifty mark as of January 19, well shy of the 70 level which would warn of overbuying.

Still, as both the Dollar and the Pound are struggling for momentum, the call remains neutral for Sterling into another trading week.

–By David Cottle for DailyFX