Most Read: British Pound Technical Analysis & Trade Setups: GBP/USD, EUR/GBP, GBP/JPY

The U.S. dollar edged higher today, but displayed measured strength amid subdued U.S. Treasury yields. A sense of caution permeated markets as traders anxiously awaited the looming release of the core PCE deflator, the Federal Reserve’s preferred inflation gauge. This economic report can greatly influence the central bank’s monetary policy outlook so it could bring volatility in the days ahead.

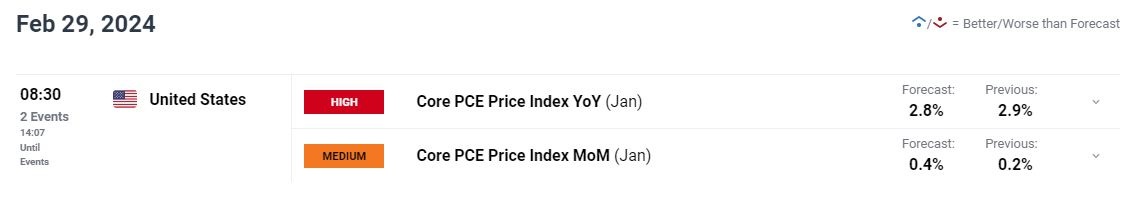

Forecasts suggest that January’s core CPI rose 0.4% m-o-m, resulting in a slight deceleration in the yearly print from 2.9% to 2.8%, a baby step in the right direction. In any case, the substantially higher-than-anticipated CPI and PPI readings for the same period underscore a key point: investors may be underestimating inflation risks, leaving them vulnerable to an upside surprise in tomorrow’s data.

Source: DailyFX Economic Calendar

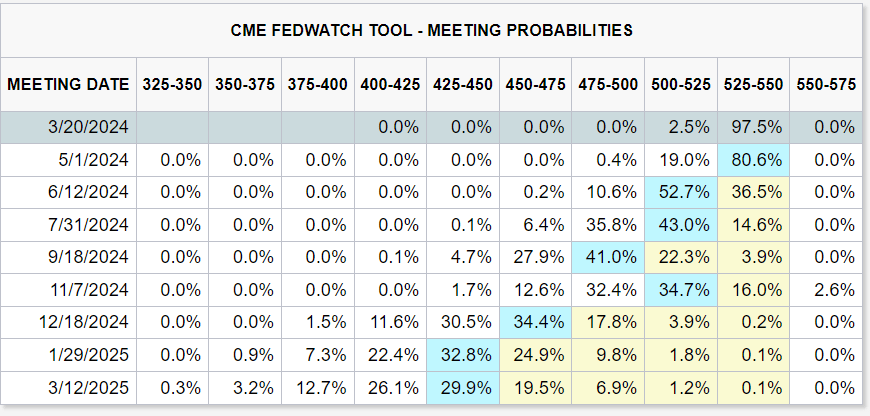

A hot PCE report indicating minimal progress on disinflation may prompt Wall Street to scale back bets on the number of rate cuts envisioned for 2024, while increasing the odds of the FOMC delaying its easing cycle to the second half of the year. A hawkish repricing of interest rate expectations should exert upward pressure on U.S. Treasury yields, boosting the U.S. dollar but weighing on gold prices.

The following table shows FOMC meeting probabilities as of February 28.

Source: CME Group

You May Also Like: Euro Price Action Setups – EUR/USD, EUR/GBP and EUR/JPY

Transitioning from fundamental analysis, the remainder of this article will focus on assessing the technical outlook for EUR/USD, USD/JPY, GBP/USD and gold prices. Here, we’ll scrutinize recent price behavior and dissect essential levels where historically there has been strong buying or selling pressure and which could be used for risk management when establishing positions.

Want to know where the euro is headed over the coming months? Explore all the insights available in our quarterly forecast. Request your complimentary guide today!

Recommended by Diego Colman

Get Your Free EUR Forecast

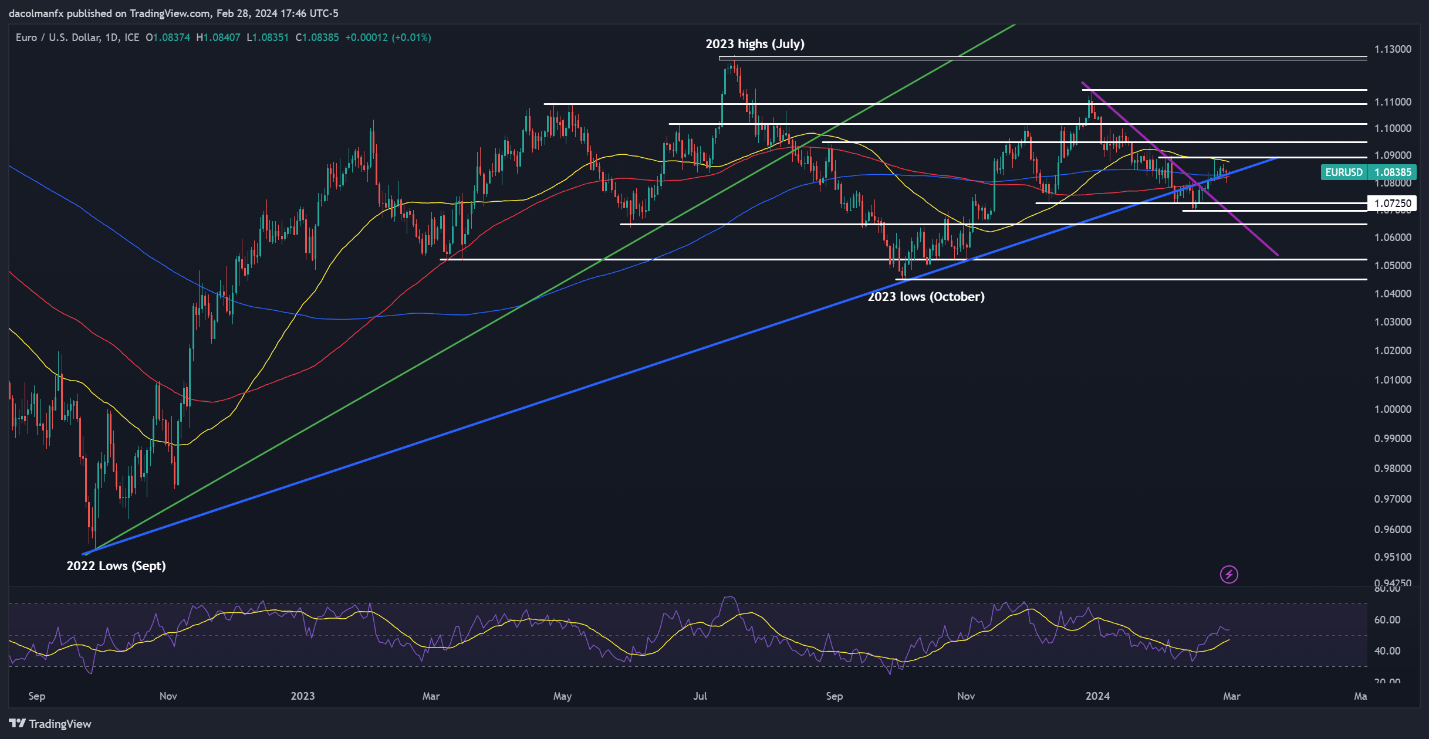

EUR/USD FORECAST – TECHNICAL ANALYSIS

EUR/USD experienced a minor downtick on Wednesday, yet managed to find support above the 1.0835 area, where trendline support converges with the 200-day moving average. Bulls must vigorously defend this pivotal zone; any failure to do so could prompt a downward reversal towards 1.0725. If weakness persists, market attention will likely shift towards the 1.0700 handle.

Conversely, if buyers regain control and drive prices higher in the upcoming sessions, resistance is anticipated near 1.0890, aligned with the 50-day simple moving average. A sustained advance beyond this threshold could strengthen upward impetus, paving the way for an ascent towards 1.0950.

EUR/USD PRICE ACTION CHART

EUR/USD Chart Created Using TradingView

Curious about what lies ahead for the Japanese yen? Find comprehensive answers in our quarterly trading forecast. Claim your free copy now!

Recommended by Diego Colman

Get Your Free JPY Forecast

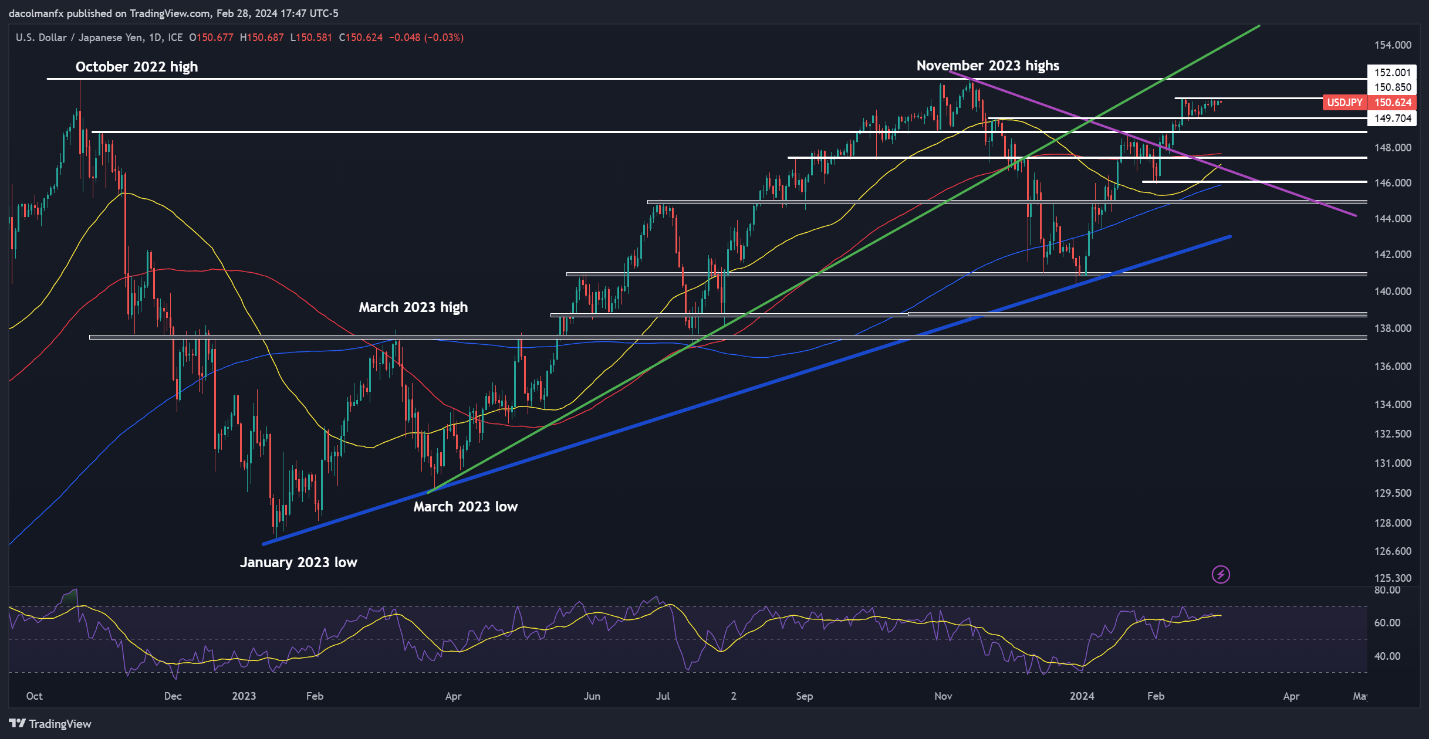

USD/JPY FORECAST – TECHNICAL ANALYSIS

USD/JPY made modest gains on Wednesday, flirting with overhead resistance at 150.85. Traders should closely monitor this technical ceiling throughout the week, as a bullish breakout could ignite buying pressure and potentially lead to a retest of the 152.00 mark.

On the contrary, if sellers unexpectedly seize control and drive the pair lower, support levels are identified at 149.70 and 148.90. A sustained decline below these key thresholds may trigger a retreat towards the 100-day simple moving average, situated slightly above 147.50.

USD/JPY TECHNICAL CHART

USD/JPY Chart Created Using TradingView

Interested in learning how retail positioning can offer clues about GBP/USD’s directional bias? Our sentiment guide contains valuable insights into market psychology as a trend indicator. Request a free copy now!

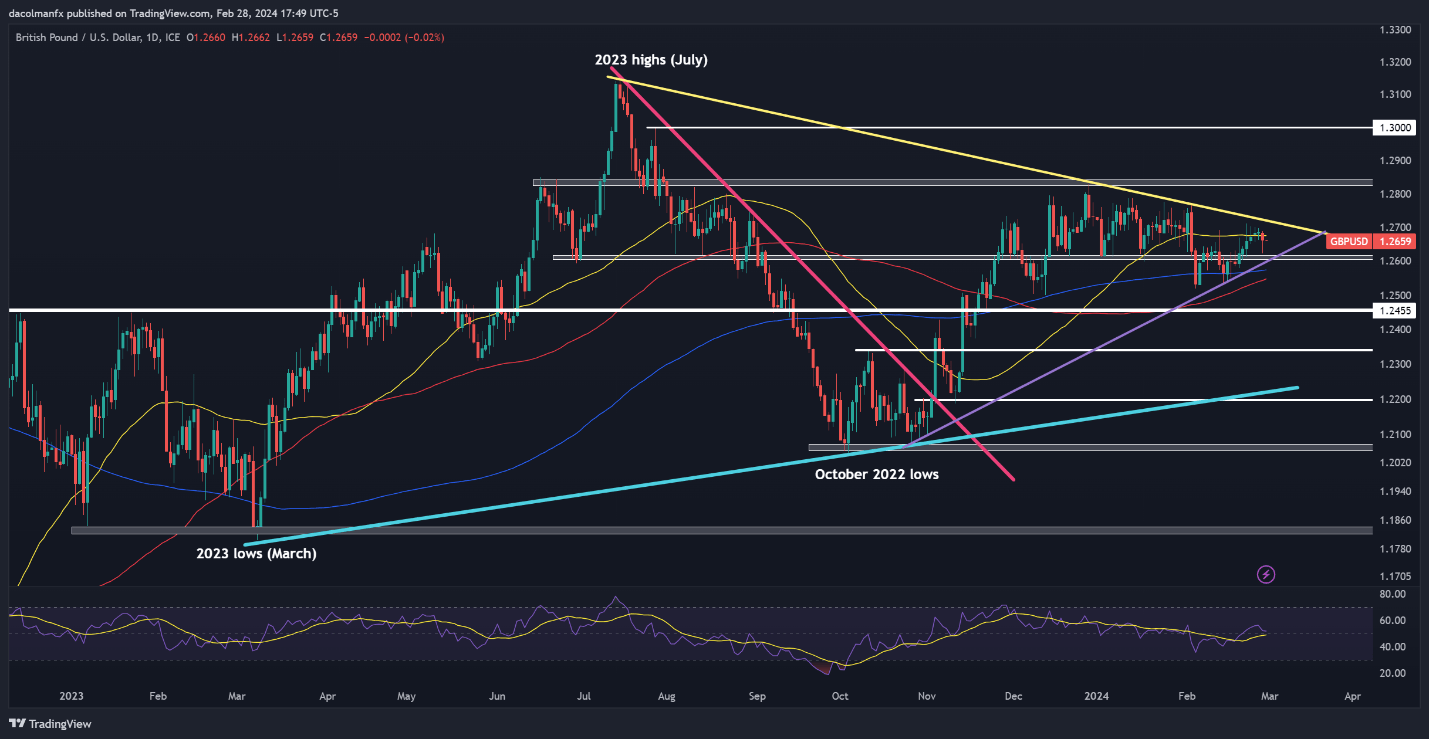

GBP/USD FORECAST – TECHNICAL ANALYSIS

GBP/USD suffered a setback on Wednesday, sliding below its 50-day simple moving average. If the bearish swing is sustained in the coming days, we could soon see prices heading towards the 1.2600 handle. Further losses could attract attention towards the 200-day simple moving average near 1.2570.

On the flip side, if bulls mount a comeback and propel cable upwards, the 50-day SMA will be the first obstacle on the road to recovery. Above this technical ceiling, all eyes will be on trendline resistance located in the vicinity of 1.2720, followed by 1.2830.

GBP/USD PRICE ACTION CHART

GBP/USD Chart Created Using TradingView

Wondering how retail positioning can shape gold prices in the near term? Our sentiment guide provides the answers you are looking for—don’t miss out, get the guide now!

| Change in | Longs | Shorts | OI |

| Daily | -7% | 10% | 0% |

| Weekly | -8% | 5% | -2% |

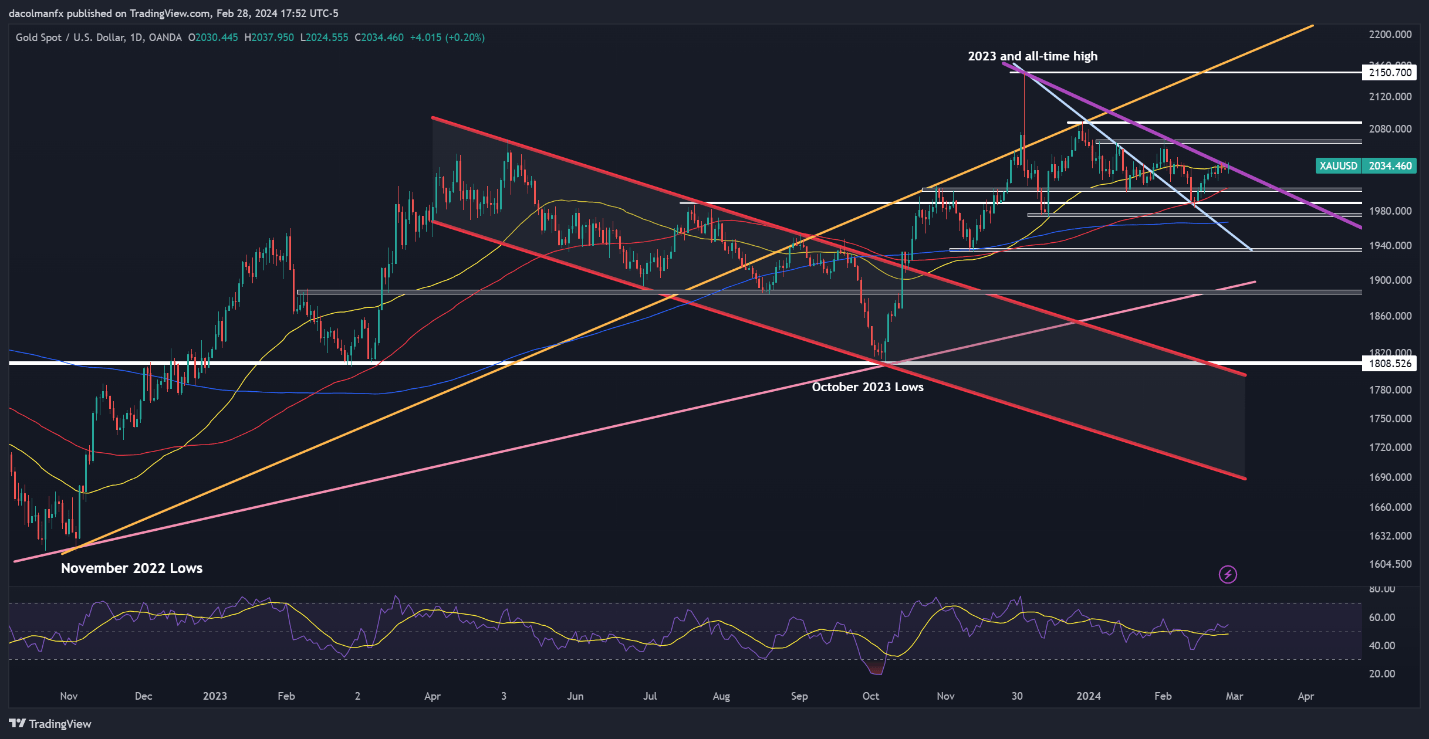

GOLD PRICE TECHNICAL ANALYSIS

Gold rose on Wednesday but encountered resistance around the $2,035 mark, a key technical roadblock where a downtrend line converges with the 50-day simple moving average. Sellers need to firmly protect this ceiling to thwart bullish momentum; any lapse could trigger an upward surge towards $2,065.

Alternatively, if sentiment shifts back in favor of sellers and XAU/USD takes a turn to the downside, the first key floor to watch emerges at $2,005, near the 100-day simple moving average. Should selling pressure continue, traders may eye $1,990, followed by $1,995 as potential support levels.