British Pound Forecast: Bearish

- UK rate-cut expectations have come forward as US ones have been pushed back

- This undermines a key source of support for GBP

- Without it, the overall downtrend looks set to endure

You can download our new Q2 British Pound Technical and Fundamental forecasts below:

Recommended by David Cottle

Get Your Free GBP Forecast

The British Pound heads into a new trading week under pressure against the United States Dollar as once-reliable monetary policy support continues to ebb.

Markets are betting that the Bank of England could cut borrowing costs as soon as June given signs that inflation is coming to heel. That is the same month investors now consider most likely for a first move by the US Federal Reserve, according to the Chicago Mercantile Exchange’s popular ‘FedWatch’ tool.

This is quite a contrast from the situation at the start of this year.

Back then, the Fed was thought likely to cut rates much sooner than its British counterpart, the United Kingdom having had to deal with stubbornly higher inflation than most central banks. That prospect underpinned Sterling’s rise from the lows of last October. But the first quarter of this year has seen expectations of early US reductions toned down, while anemic British growth and decelerating consumer prices have brought forward expectations as to when the BoE might act.

Given that backdrop, it’s hardly surprising that the Pound should be under a bit of pressure. Of course, central banks don’t put anything in stone and the prognosis that rates will fall in either the US or UK remains heavily dependent on economic data supporting it.

US Inflation Numbers On Tap, Not Much Else

There’s not a lot of that in the coming week, and what there is comes mainly from the US. Consumer price inflation figures for March will be released on Wednesday, with factory-gate numbers coming a day later. UK Gross Domestic Product figures for February will round out the week, along with the University of Michigan’s consumer sentiment snapshot.

Any or all of these will likely offer short-term trading opportunities, but they’ll have to spring major surprises to move the dial for GBP/USD. Given that, it’s hard to see the overall downtrend being challenged, even if there might be some volatility within in it. So it’s a bearish call for Sterling this week.

GBP/USD Technical Analysis

Recommended by David Cottle

How to Trade GBP/USD

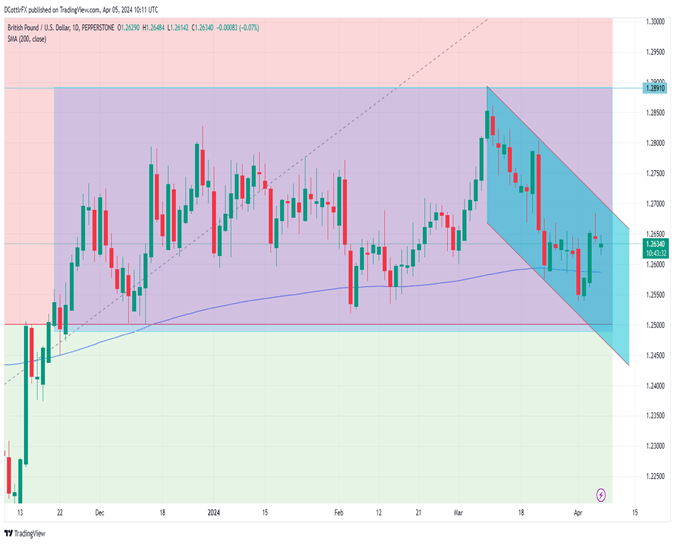

GBP/USD Daily Chart Compiled Using TradingView

The downtrend channel from March 8’s peak continues to overshadow GBP/USD trade, with even sharp spikes upward such as that seen on April 3 unable to break its spell.

The pair seems to be retreating back toward its 200-day moving average, having spent most of the time since last November above that point.

Should the current downtrend endure, GBP/USD is probably only weeks away at best from a test of important retracement support at 1.25010. This has held since the Pound broke above it in the last week of November, with a slide below it likely to herald a further, deeper fall toward the 1.24 handle.

However, the broad trading range of which that retracement support is the base has held for nearly five months now. Breaking it either way may require more clarity on the fundamental interest-rate differential picture between the US and UK than markets currently have.

Bulls would need to consolidate progress above the 1.27 region if they are going to try and snap the current downtrend, and that doesn’t seem likely any time soon.

–By David Cottle for DailyFX