Japanese Yen Prices, Charts, and Analysis

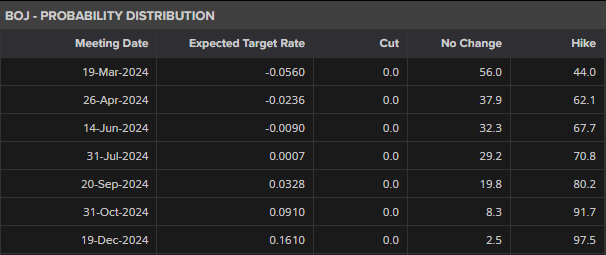

- Current market pricing shows a 44% chance of a 10 basis point rate hike tomorrow.

- Recent wage negotiations may well give the BoJ confidence to move.

Recommended by Nick Cawley

How to Trade USD/JPY

Tuesday’s BoJ policy meeting may see the Japanese Bank Rate lifted out of negative territory for the first time in over eight years after Japan’s largest trade union agreed to the largest wage increase in over three decades. The central bank has been pushing for higher wages to help domestic inflation stay at target and help boost the economy.

Japanese Wages Rise to 30-Year High Fuelling BoJ Rate Speculation

Financial markets are currently showing a 44% probability of a 10bp interest rate hike tomorrow and a 62% chance at the April meeting. The Quarterly Economic Outlook is released in April and the Bank of Japan may wait for this before pulling the trigger and raising interest rates for the first time in 17 years. Markets also predict that the BoJ will end their yield curve control, allowing bond rates to rise.

The US dollar is currently driving USD/JPY price action. The greenback picked up a bid over the past few days as stronger-than-expected CPI and PPI data questioned market expectations of a rate cut at the June FOMC. The Fed will announce their latest policy decision on Wednesday and it will be Chair Jerome Powell’s post-decision commentary that will be the next driver of the US dollar direction.

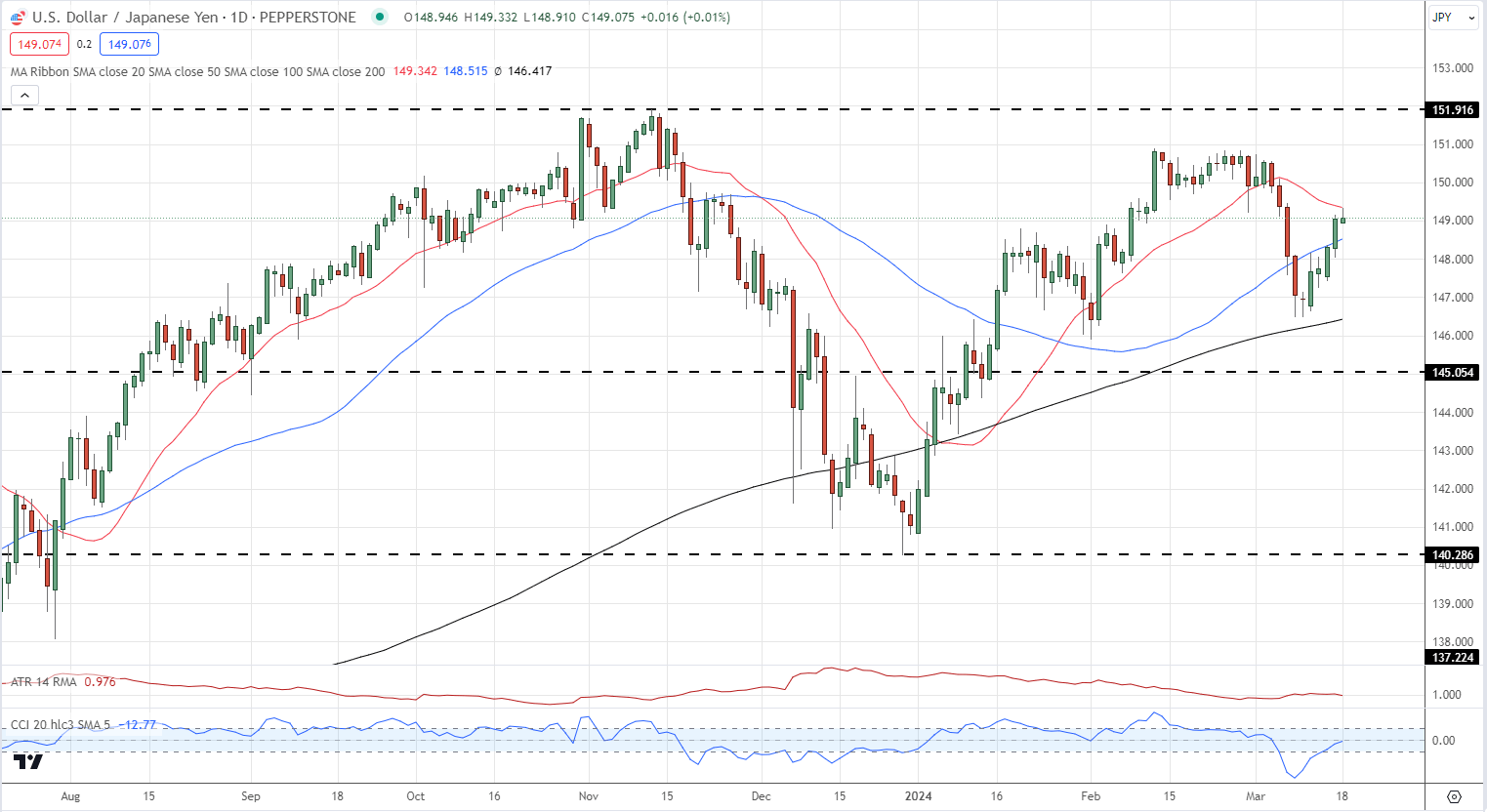

This US dollar strength has pushed USD/JPY back above 149.00 ahead of the BoJ’s decision. There is a solid block of recent resistance between 150 and 151 on the chart that is very unlikely to be broken, while the 50- and 200-day smas and the recent double-low at 146.50 guard a move lower to 145.

USD/JPY Daily Price Chart

Retail trader data shows 24.11% of traders are net-long with the ratio of traders short to long at 3.15 to 1.The number of traders net-long is 14.58% higher than yesterday and 13.50% lower from last week, while the number of traders net-short is 4.95% higher than yesterday and 15.39% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USD/JPY prices may continue to rise.

Download the Latest IG Sentiment Report to see how daily/weekly sentiment changes can affect USD/JPY price outlook

| Change in | Longs | Shorts | OI |

| Daily | 16% | 7% | 9% |

| Weekly | -13% | 17% | 8% |

What is your view on the Japanese Yen – bullish or bearish?? You can let us know via the form at the end of this piece or contact the author via Twitter @nickcawley1.