Japanese Yen (USD/JPY) Analysis, Prices, and Charts

- USD/JPY is especially weak, even as the Dollar gets a broad bashing

- Reports suggest the Bank of Japan is moving closer to abandoning ultra-loose monetary policy

- It’s important to remember that these hopes have been dashed before

Learn how to trade USD/JPY with our free guide

Recommended by David Cottle

How to Trade USD/JPY

The Japanese Yen could be set for its biggest day of gains against the United States Dollar this year as investors seem increasingly to believe that the Bank of Japan will soon start to retreat from its venerable, ultra-loose monetary policy.

BoJ board member Junko Nakagawa said on Thursday that Japan’s economy was moving toward sustainably achieving a 2% inflation target, while a local news agency reportedly said that at least one board member is likely to favor the removal of negative interest rates at the March policy meeting which will release its decision on the 19th. If this sort of commentary stream keeps up, that looks like a serious date for the foreign exchange community’s diaries. The Japanese central bank has long been an outlier among developed-market authorities in actively attempting to generate some inflation while others have been forced to fight it. The prospect of a BoJ more in line with those others has understandably seen the Yen gain.

It’s worth noting, however, that markets have looked for change from the BoJ before, only to see those expectations shattered by a central bank for whom the time was never quite ripe. Given rising prices and wage pressures there would seem to be more to the story this time around, however, and the March BoJ meeting will be fascinating.

USD/JPY dropped by more than 1.5 Yen Thursday, appearing to stabilize in the European morning session. While the BoJ has been on investors’ minds, some broad Dollar weakness in the wake of Federal Reserve Chair Jerome Powell’s Congressional testimony in the previous session is also playing its part. He didn’t add much to what the markets already knew, however, reiterating that interest-rate cuts will likely be appropriate this year assuming data permit, but hearing this again was enough to send the Dollar lower.

USD/JPY Technical Analysis

| Change in | Longs | Shorts | OI |

| Daily | 12% | -11% | -5% |

| Weekly | 28% | -11% | -2% |

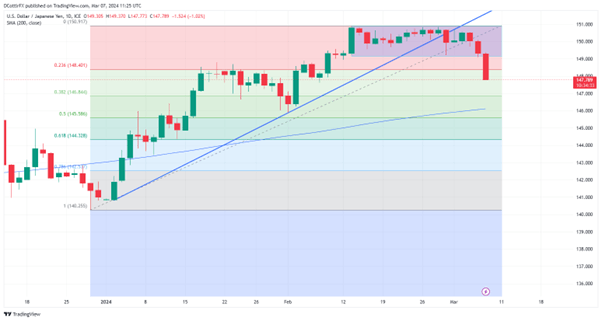

USD/JPY Daily Chart Compiled Using TradingView

USD has retreated back to levels not seen since early February, although it’s notable that the previously dominant uptrend from the lows of January had already been broken in the course of the range-trade seen between February 13 and 29.

USD/JPY has fallen below the first Fibonacci retracement of its climb from those January lows to February 13’s significant four-month peak. That retracement comes in at 148.401 and it could be instructive to see whether the pair ends this week below that level. Should it do so there’s likely support in the 147.78 region ahead of the second retracement point at 146.84.

Despite three sessions of falls USD/JPY remains significantly above its 200-day moving average. That now offers support at 146.095 and might be a tempting target for Dollar bears.

–By David Cottle for DailyFX