Most Read: Gold, Silver Price Update: XAU/USD Rises on a Softer Dollar, Silver Withers

In the world of trading, it’s easy to get swept up in the herd mentality, buying when everyone else is buying and selling in a frenzy of fear. But savvy traders understand the potential of contrarian thinking. Indicators like IG client sentiment offer a unique window into market psychology, revealing when excessive optimism or pessimism may create ripe opportunities to go against the prevailing trend.

Of course, contrarian indicators aren’t a magical crystal ball. They’re best used as a valuable tool within a well-rounded trading strategy. By blending contrarian insights with robust technical and fundamental analysis, traders gain a richer understanding of market dynamics that may be overlooked by the crowd. Let’s explore this concept further by examining how IG client sentiment can shed light on the Japanese yen‘s potential.

Want to learn how retail positioning can offer clues about EUR/JPY’s directional bias? Our sentiment guide contains valuable insights into market psychology as a trend indicator. Download it now!

| Change in | Longs | Shorts | OI |

| Daily | 4% | 5% | 5% |

| Weekly | 78% | -7% | 8% |

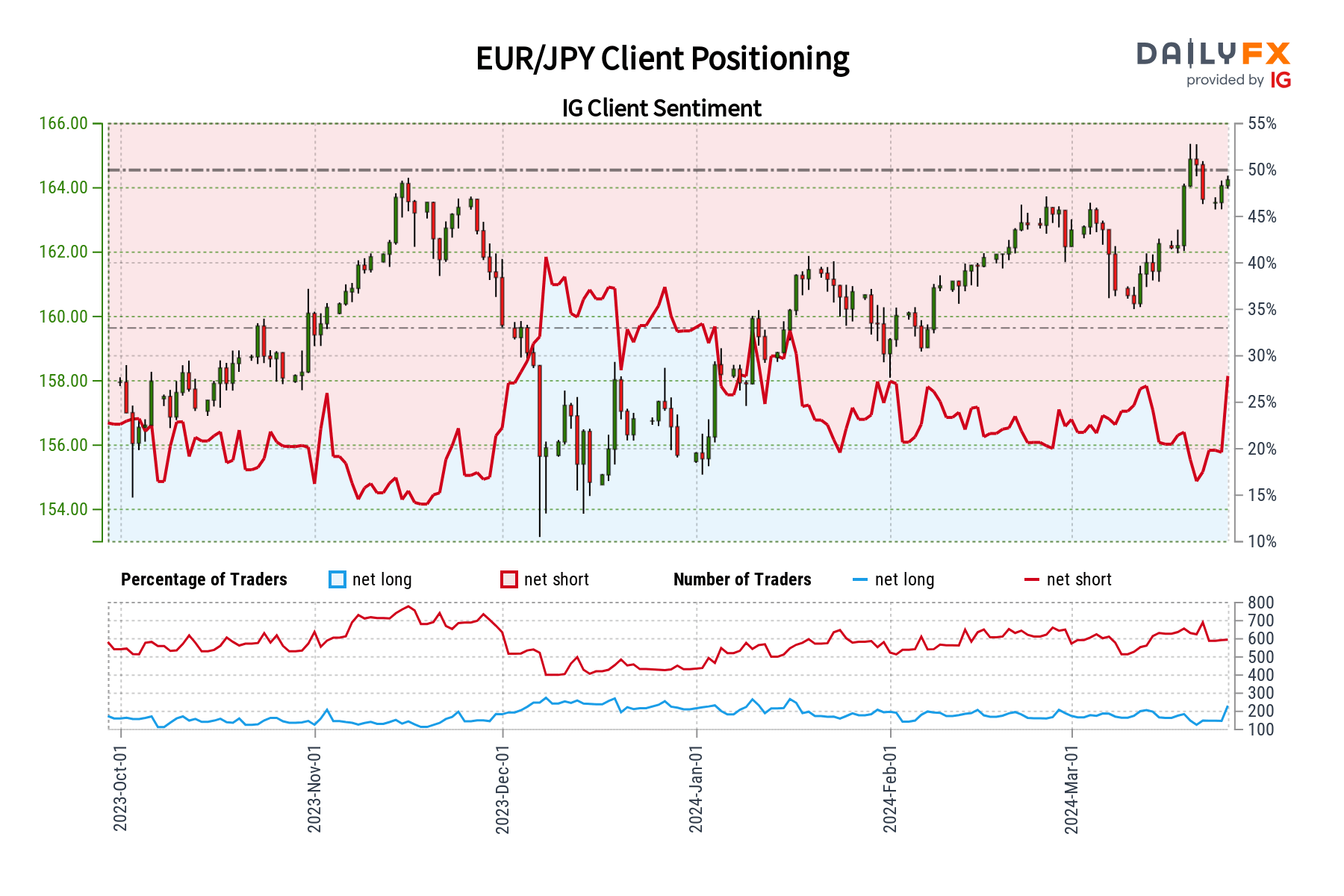

EUR/JPY FORECAST – MARKET SENTIMENT

IG client data highlights the retail crowd is overwhelmingly bearish on EUR/JPY, with 71.61% of traders holding net-short positions. This translates to a short-to-long ratio of 2.52 to 1. While this net-short positioning aligns with our typical contrarian approach (suggesting potential for a price rise), recent shifts in sentiment create a more nuanced picture.

Compared to yesterday, traders are slightly less bearish, with the number of net-long positions up 3.88%. Yet, looking back to last week, the number of net-long positions has surged by 60.67%, indicating a substantial increase in bets in favor of the euro over that timeframe.

This combination of factors—current net-short positioning alongside a recent easing of bearish sentiment— brings ambiguity to our contrarian analysis of EUR/JPY, leading to a mixed outlook. That said, the market may still have room to push higher, but traders should exercise caution.

Key takeaway: Even reliable tools like contrarian indicators can sometimes produce conflicting signals. In these situations, it’s essential to prioritize a holistic approach, utilizing technical analysis and fundamental factors alongside sentiment data to gain a clearer understanding of potential price movements.

Disheartened by trading losses? Empower yourself and refine your strategy with our guide, “Traits of Successful Traders.” Gain access to crucial tips to help you avoid common pitfalls and costly errors.

Recommended by Diego Colman

Traits of Successful Traders

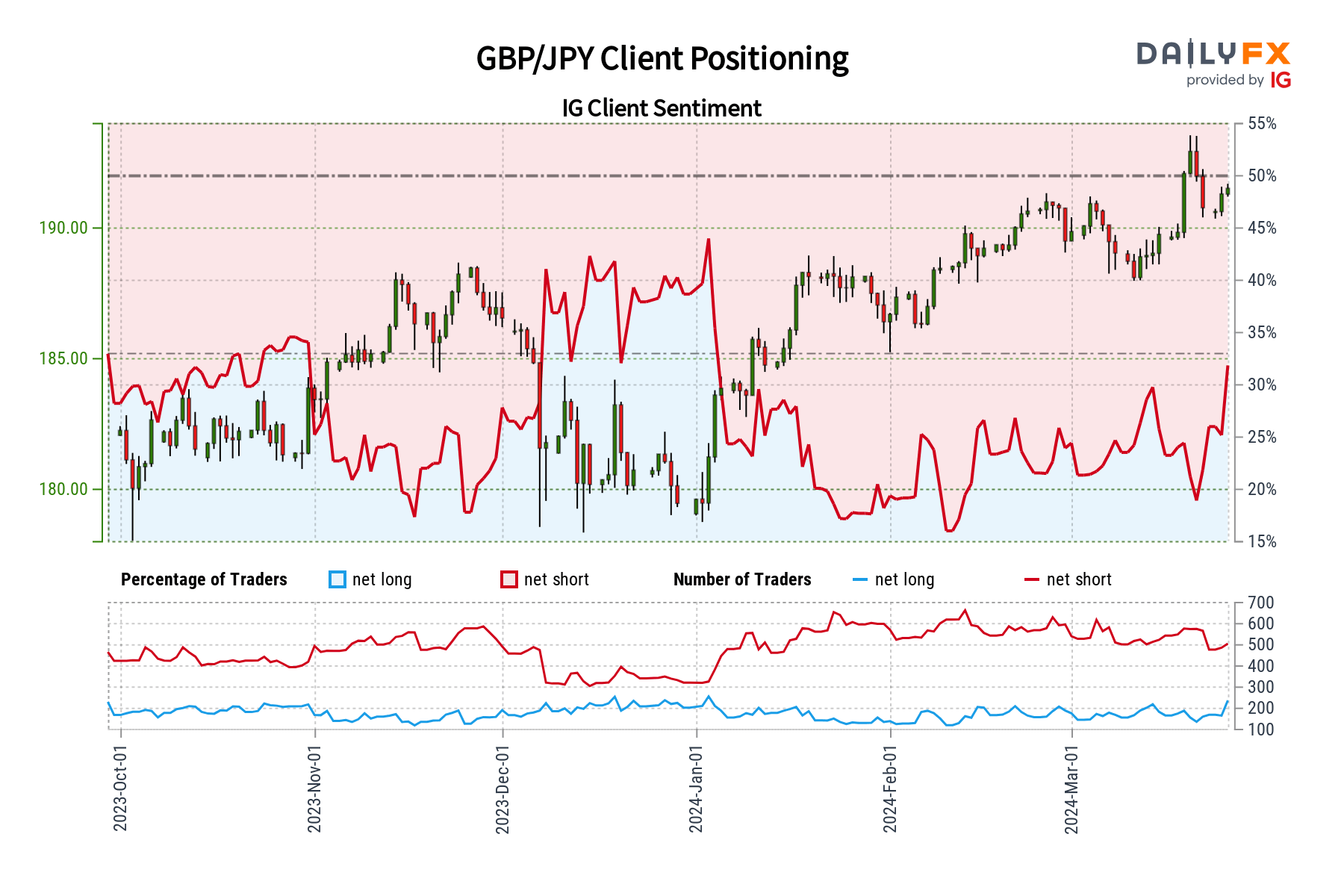

GBP/JPY FORECAST – MARKET SENTIMENT

IG client sentiment data reveals a net-short bias towards the GBP/JPY, with 64.9% of retail traders holding bearish positions. This translates into a short-to-long ratio of 1.85 to 1. In our contrarian framework, this typically implies there may be room for GBP/JPY to climb further. However, recent sentiment shifts complicate this outlook.

The number of net-long positions has increased significantly compared to yesterday (15.22%) and even more dramatically compared to last week (68.79%). This suggests growing bullishness among retail traders, despite the overall net-short positioning.

This weakening of the bearish sentiment introduces uncertainty. While the GBP/JPY may continue its upward trek, the shift could foreshadow a potential reversal. The market might be losing its conviction, making the contrarian signal less reliable.

Key Takeaway: Contrarian indicators are most powerful when market sentiment is strongly skewed in one direction. The recent changes in GBP/JPY sentiment cloud the picture, suggesting increased caution. It’s advisable to incorporate thorough technical analysis and monitor key fundamental drivers impacting price action before relying solely on the contrarian signal.

Eager to discover what the future may have in store for the Japanese yen? Find comprehensive answers in our quarterly forecast! Get it today!

Recommended by Diego Colman

Get Your Free JPY Forecast

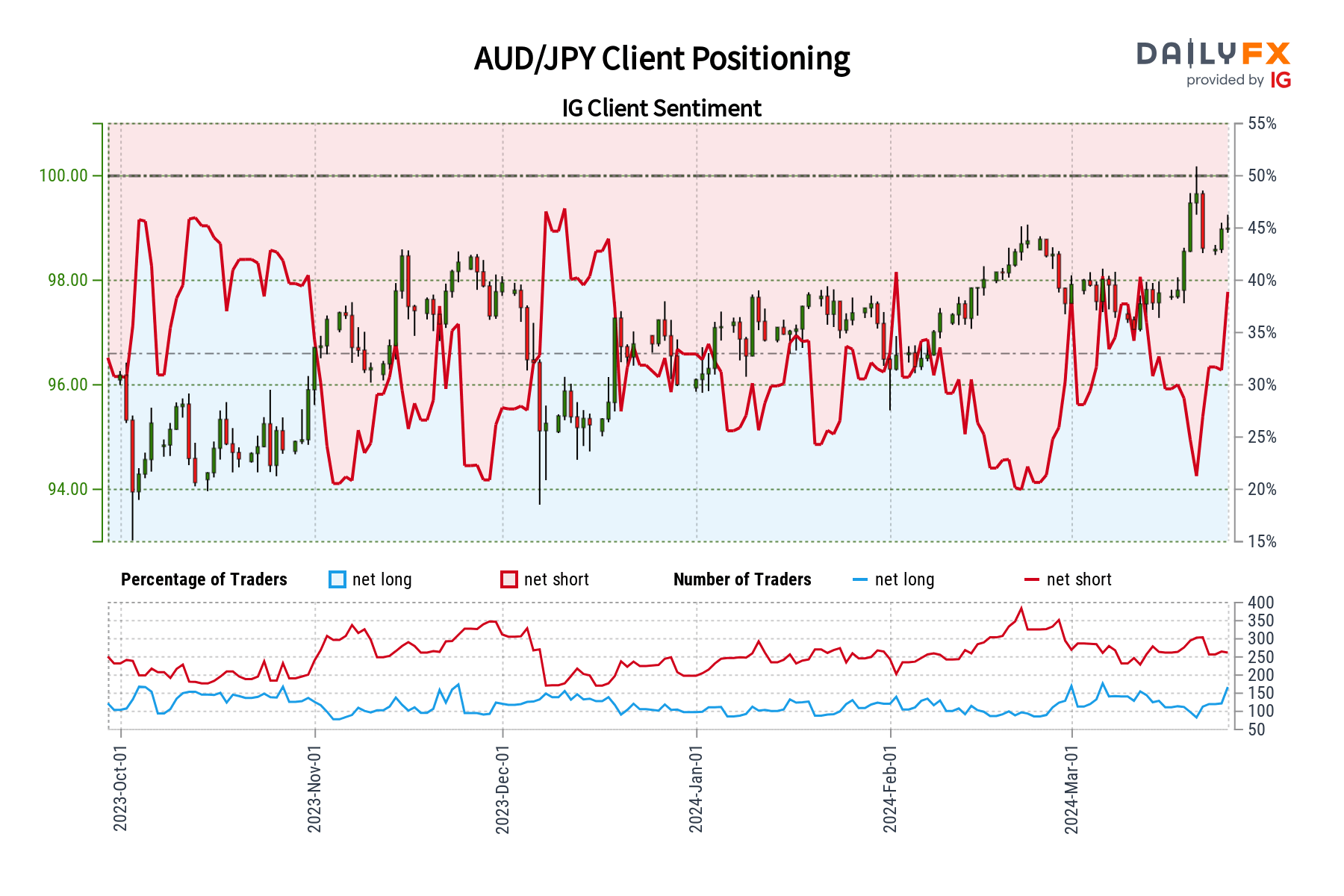

AUD/JPY FORECAST – MARKET SENTIMENT

IG client sentiment data paints a complex picture for the AUD/JPY. While a majority of retail traders (58.88%) remain net-short, this figure represents a decrease compared to both yesterday and last week. The ratio of short to long positions currently stands at 1.43 to 1.

Typically, we view heavy net-short positioning as a contrarian indicator, implying the potential for a price rise. In this case, AUD/JPY may have room to run a little higher. However, the recent weakening of bearish positioning introduces an element of uncertainty and can be tentatively foreshadowing a reversal.

Key Takeaway: It’s crucial to recognize that contrarian signals, while valuable, aren’t infallible. The AUD/JPY situation highlights the importance of combining contrarian insights with technical analysis, fundamental drivers, and overall market context. This multifaceted approach will provide a more robust understanding of the potential price direction.