Japanese Yen Prices, Charts, and Analysis

- Japan’s exports hit a record high in January.

- USD/JPY back in the danger zone.

Download our complimentary Q1 Japanese Yen guide below

Recommended by Nick Cawley

Get Your Free JPY Forecast

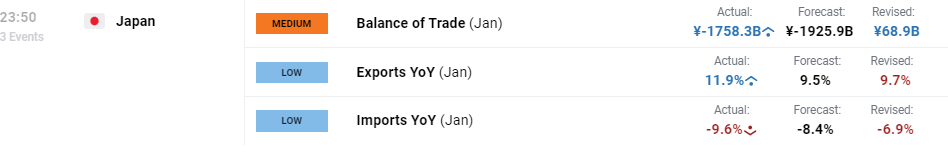

A weak Yen helped Japanese exports boom in January with the latest trade data showing overseas sales soaring to a record high. Exports increased by 11.9% to 7.33 trillion Yen, while imports fell by 9.6%. Today’s data revealed that the country’s deficit is now half the level seen one year ago, down from JPY 3.51 trillion to JPY 1.76 trillion. In January 2023, USD/JPY traded around the 128 level compared to 150 today.

Japan’s export sector has benefitted from a weak Yen over the last year but this is set to change in the coming months. The US Federal Reserve is seen cutting interest rates by around 93 basis points this year – probabilities suggest either three or four25 basis point cuts – while in Japan, interest rates are seen rising by around 27 basis points throughout 2024. A net swing of around one and a quarter points in favour of the Japanese Yen will see USD/JPY move lower this year as the rate differential between the Yen and the USD narrows.

Later today we have the release of the latest FOMC minutes that will give a bit more colour about the future path of US interest rates. The Fed has successfully pushed back backed aggressive market interest rate cut outlooks and now seems to have the market in line with their thinking. On the other side of the pair, Japanese officials will be looking at the current level of the Yen and may be called upon to step in and prevent the Yen from weakening further. While a weak currency helps promote export sales – as seen in today’s data – other countries may soon balk at the competitive advantage Japan is getting from a weak currency.

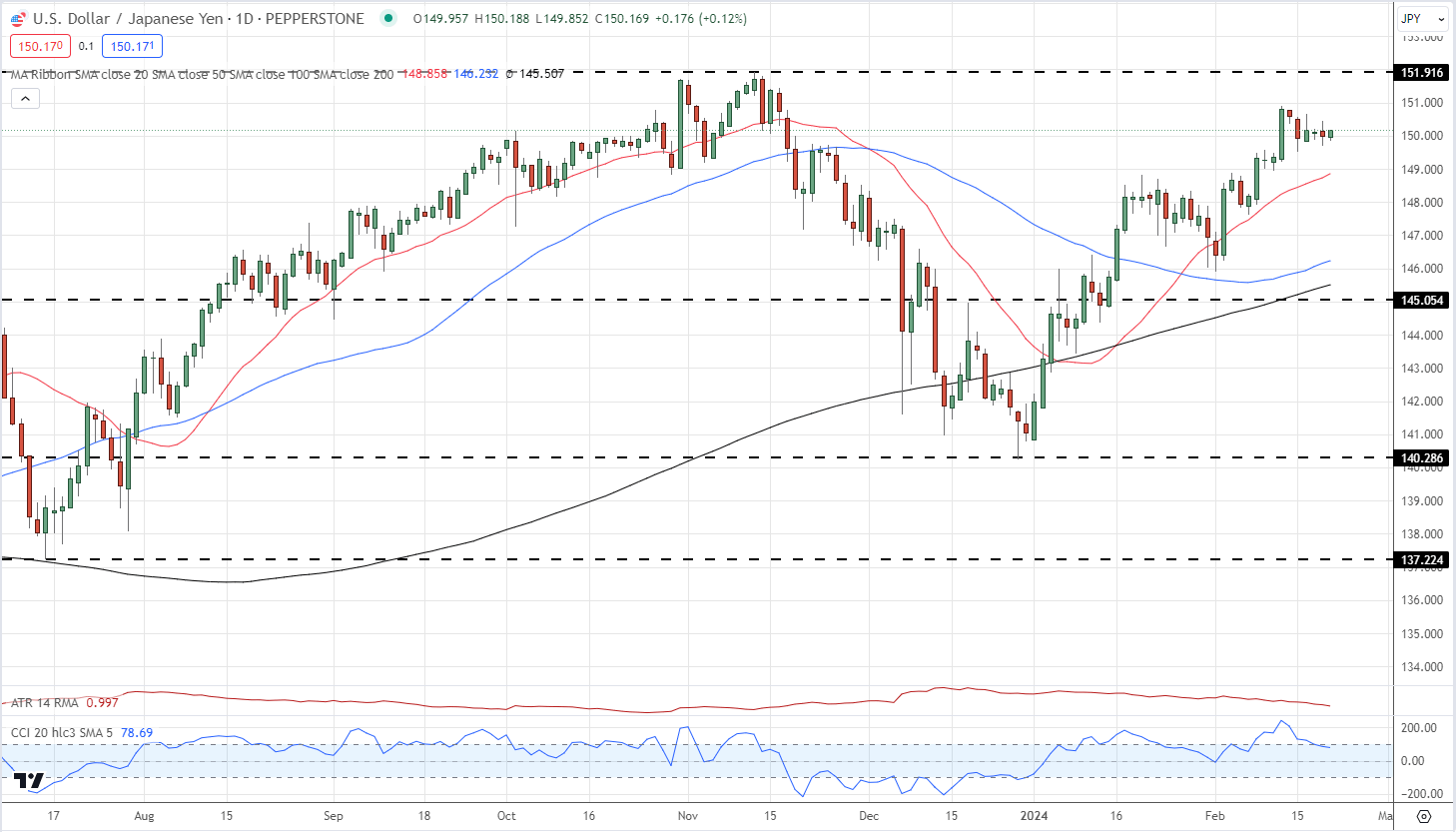

On the daily chart, the late October/early November double high just under 152 stands out as an area of interest. If USD/JPY approaches this multi-decade high then the market will be on high alert for any signs of official intervention, either verbal or actual. If Japanese officials effectively cap USDJPY around this level, and with rate differentials between the currencies narrowing in the months ahead, USD/JPY may have a way to fall this year.

Initial support is seen around 149 before the 145-146 area comes into play.

USD/JPY Daily Price Chart

Retail trader data show 27.24% of traders are net-long with the ratio of traders short to long at 2.67 to 1.The number of traders net-long is 3.98% lower than yesterday and 24.50% higher than last week, while the number of traders net-short is 0.40% higher than yesterday and 4.73% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USD/JPY prices may continue to rise.

Download the Latest IG Sentiment Report to See How Daily/Weekly Changes Affect the USD/JPY Price Outlook

| Change in | Longs | Shorts | OI |

| Daily | -5% | 2% | 0% |

| Weekly | 9% | -1% | 1% |

What is your view on the Japanese Yen – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.