Pound Sterling Analysis

Sterling in Focus Ahead of Lower Anticipated UK Inflation – BoE up Next

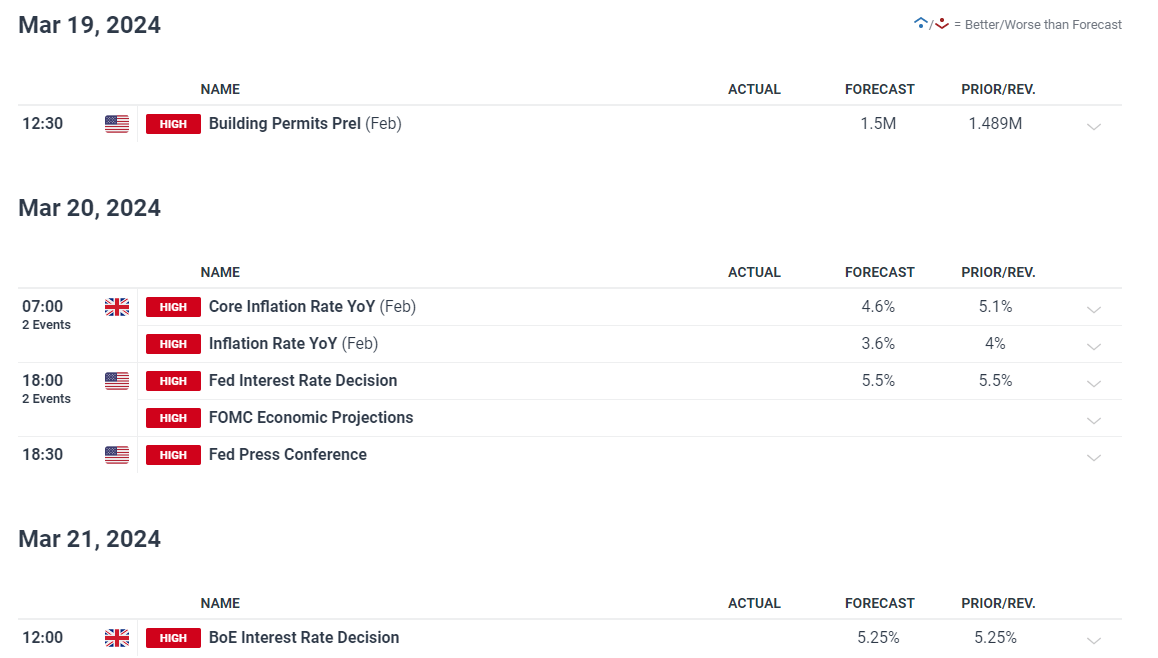

UK inflation, which is due tomorrow and just one day before the Bank of England (BoE) provides an update on monetary policy, is expected to drop notably. This is required for the BoE’s lofty forecast of 2% inflation by mid-year to materialize.

Once more the focus will be concentrated on services inflation which remains elevated and is yet to reveal significant progress. Nevertheless, even if inflation surpasses estimates, the Monetary Policy Committee (MPC) is unlikely to alter their stance materially – supporting market expectations of a cut in August. UK rates at 5.25% hold the pound in good stead and a delayed start to rate cuts has added to its robustness.

The committee’s vote split will be monitored closely in the event the hawks give in and decide to join those on the committee calling for a hold on interest rates. The Fed is also due to provide an update on its monetary policy along with the new summary of economic projections. The Fed’s dot plot will be key for markets in the event anything other than three rate cuts are priced in. The dots are set according to where Fed officials see interest rates at the end of 2024. Both Jerome Powell and Andrew Bailey are expected to largely maintain the same message

Customize and filter live economic data via our DailyFX economic calendar

Learn how to prepare ahead of major news and data releases with an easy to implement strategy:

Recommended by Richard Snow

Trading Forex News: The Strategy

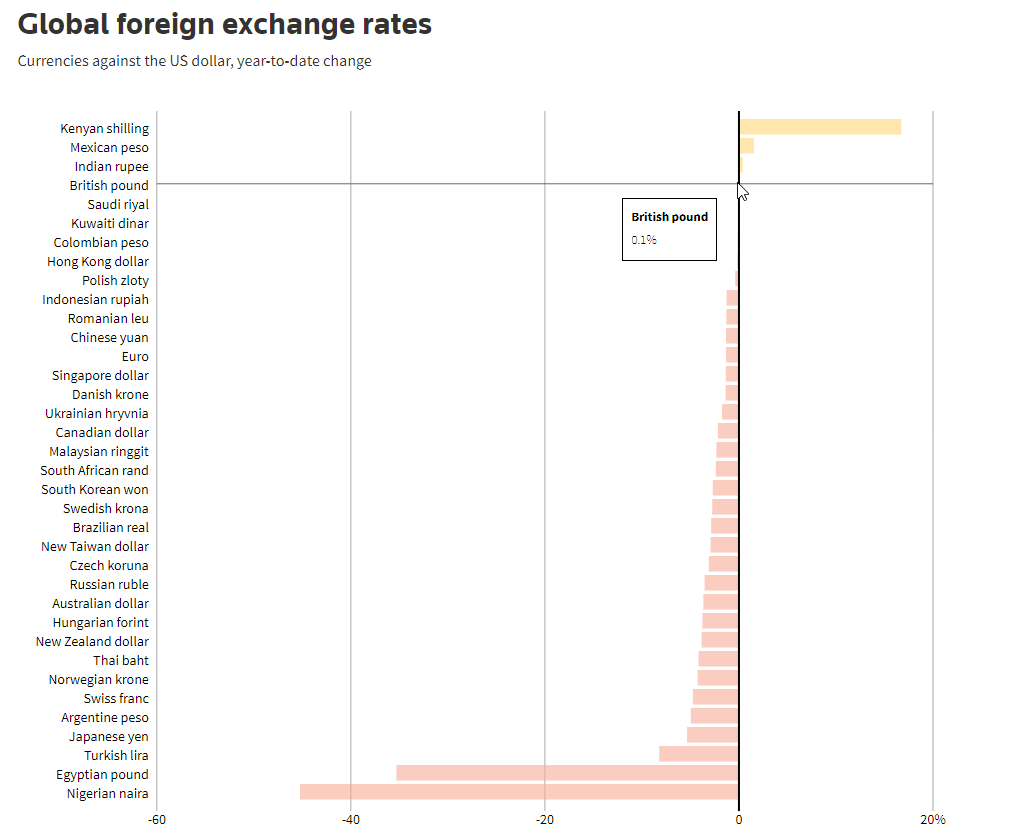

The image below provides the year-to-date performance of various currencies against the dollar:

Source: Reuters, prepared by Richard Snow

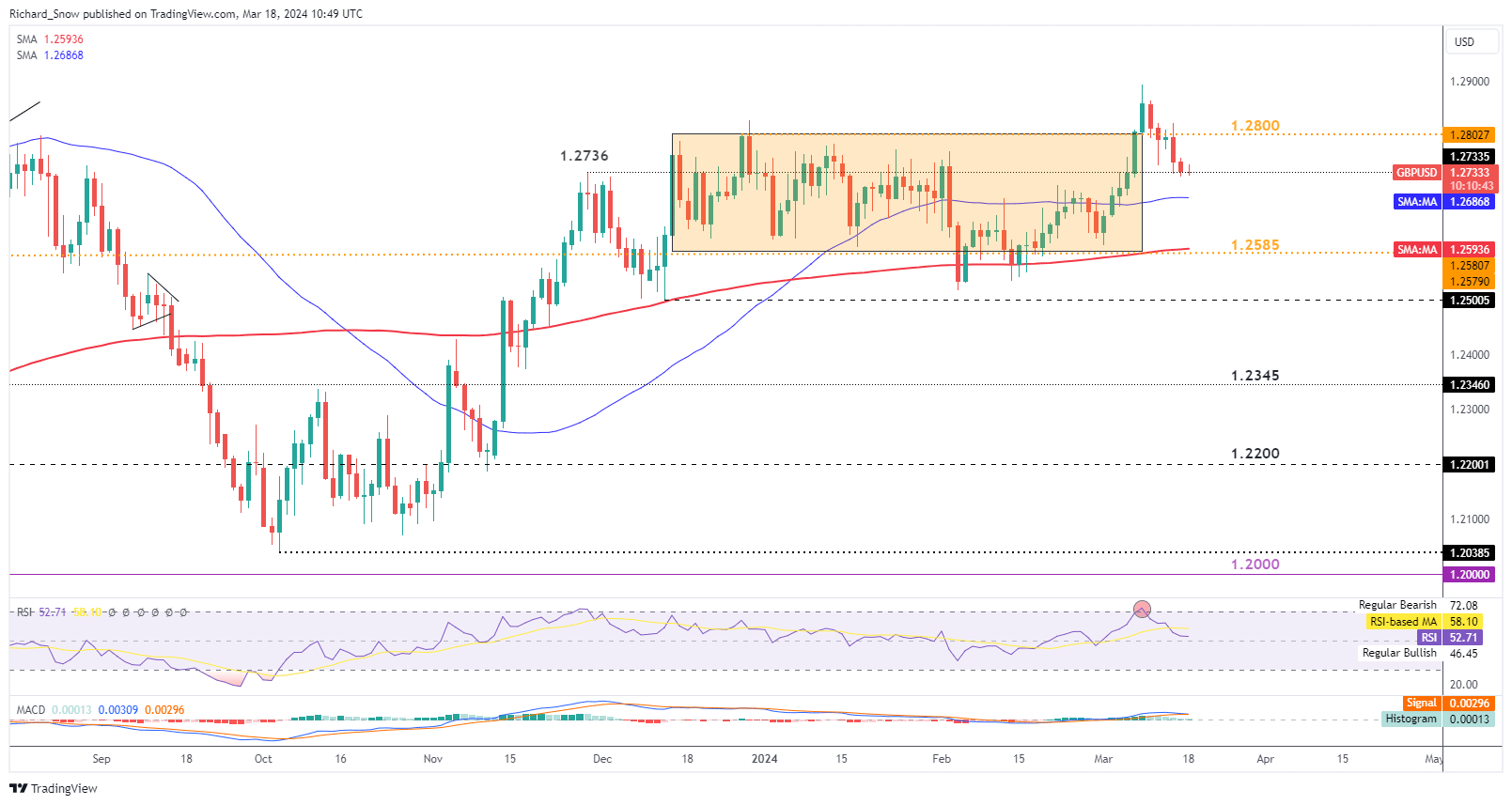

GBP/USD Falls Back into Prior Trading Range as USD Maintains Bid

At the beginning of March, GBP/USD put in an impressive move – breaking above the trading channel that had encapsulated the majority of price action since the start of the year.

However, the recent persistence in US inflation has sent the dollar higher against a number of G7 currencies. The RSI identified the GBP/USD peak and the pair is now testing the prior high of 1.2736 but as support this time. The potential for choppy price action remains, given the number of major central banks meeting this week and given the fact it is very unlikely for any movement apart from the Bank of Japan.

The 50-day simple moving average (SMA) is the next dynamic level of support followed by the bottom of the trading range at 1.2585. Topside resistance appears at 1.2800 followed by the high 1.2893

GBP/USD Daily Chart

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

How to Trade GBP/USD

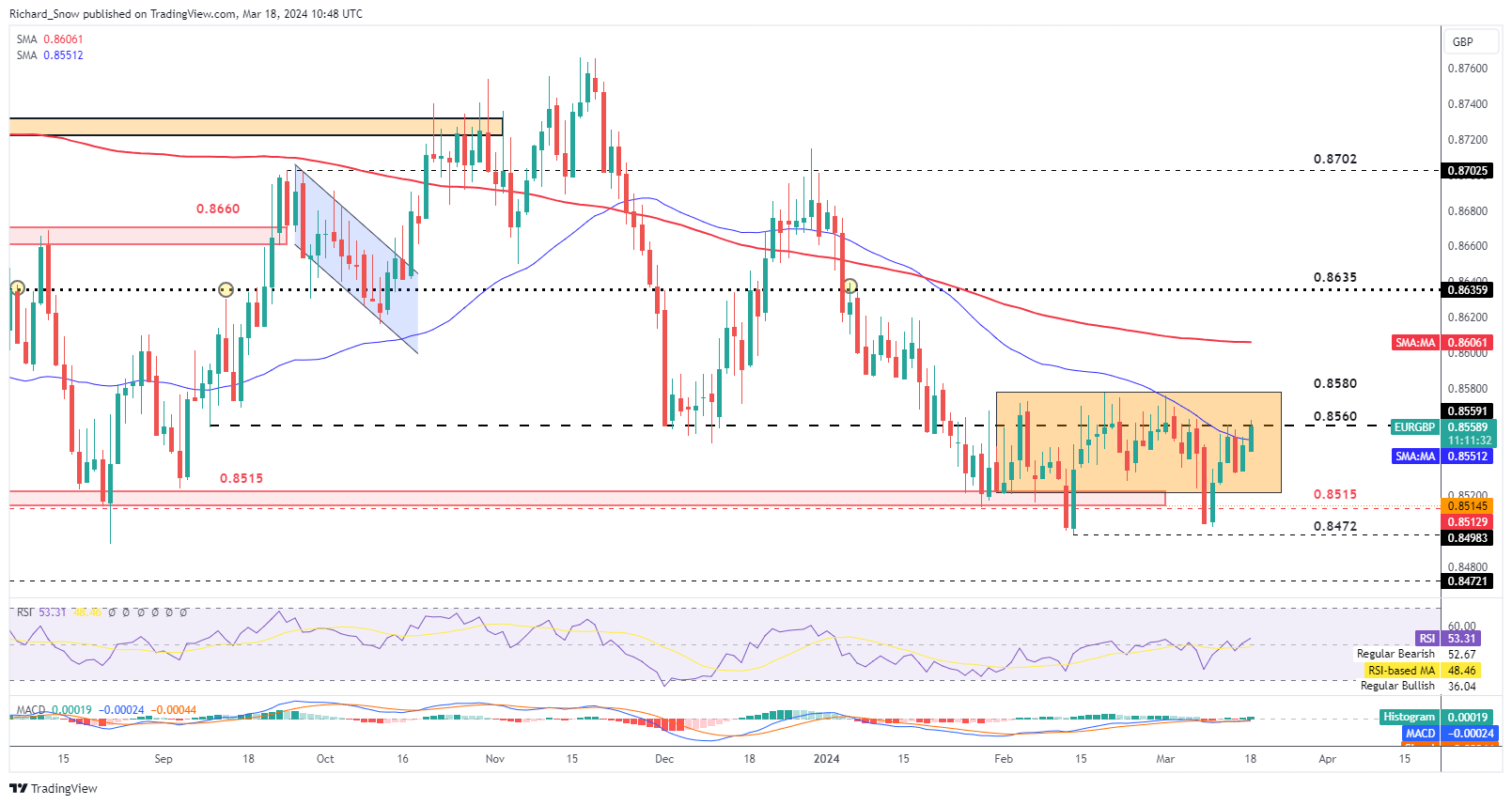

EUR/GBP Consolidates Further – Approaches Channel Resistance

EUR/GBP has built on the recent bullish pivot, now testing the 0.8560 level which has proved difficult to crack. Price action has moved above 0.8560 before but has struggled to close above it – evidenced by the appearance of multiple long upper wicks.

Additionally, the 50 SMA (blue line) acts as dynamic resistance – potentially slowing the move to the upside. The euro remains devoid of a longer-term bullish move especially when factoring in Europe’s poor fundamentals (lower interest rate differential and stagnant economy). A close below 0.8560 may open the door for bears to send prices back towards channel support but a week full of major central bank announcements may result on choppy, non-directional moves.

EUR/GBP Daily Chart

Source: TradingView, prepared by Richard Snow

Stay up to date with the latest breaking news and themes driving the market by signing up to our weekly newsletter:

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

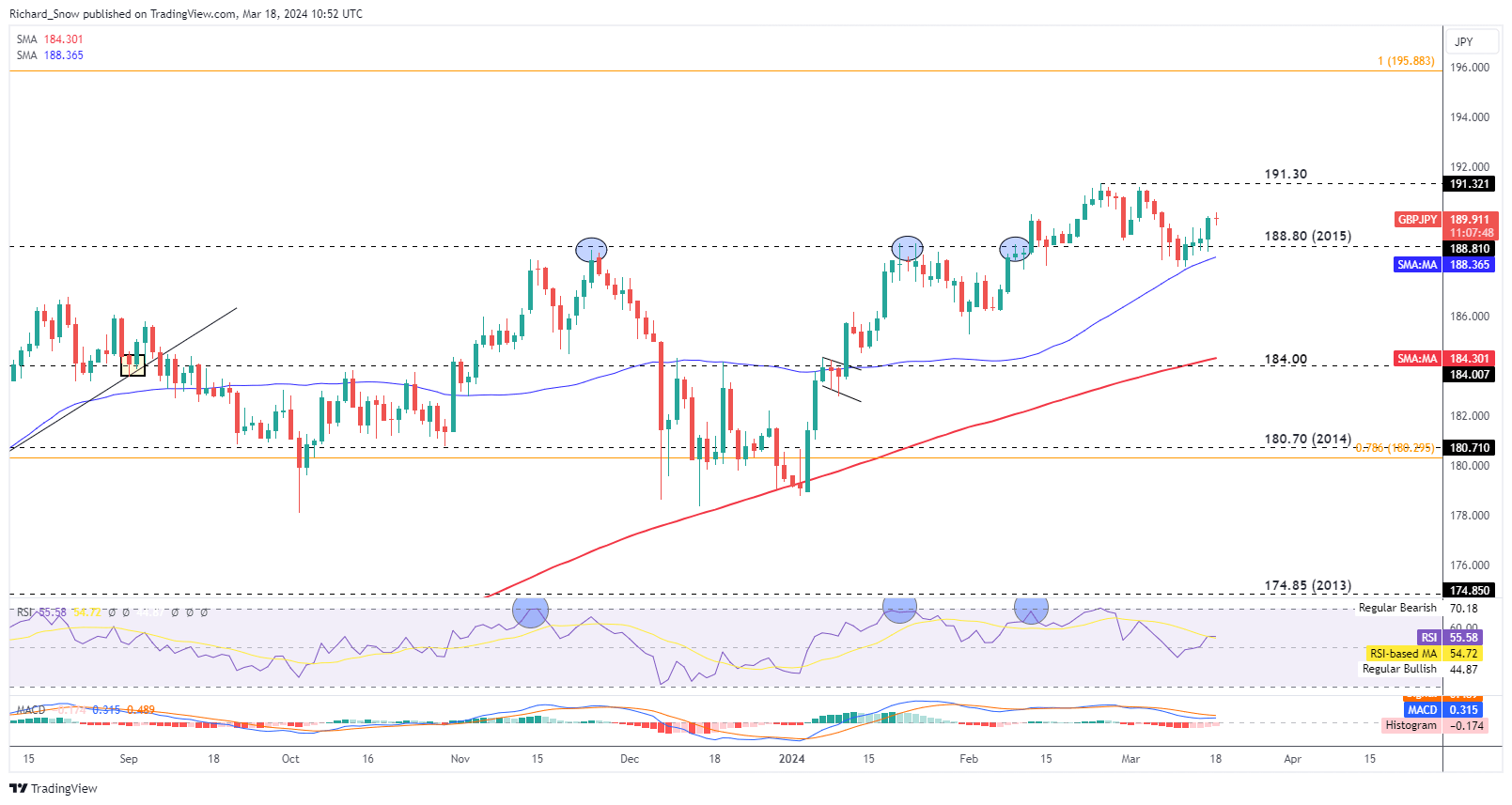

GBP/JPY Eyes a Return to the Recent High if the BoJ Bides its Time

GBP/JPY has found dynamic support along the 50-day simple moving average (blue line), riding the wave higher. The Bank of Japan is due to announce its decision to hike or not to hike in the early hours of tomorrow morning after wage growth accelerated to a 30-year high at the end of last week.

Markets have assigned a little less than 50% chance the Bank votes to hike tomorrow, with the base case for many observers favouring April instead. A hike would be the first in 17 years as the ultra-loose central bank looks to leave its negative interest rate policy behind.

191.30 is the high and appears as resistance while 188.80 and the 50 SMA come in as notable levels of support. Once again, given the sheer number of central banks meeting this week, a clear directional move may be difficult to come by. However, if the BoJ stands pat, the market appears motivated sell yen until such time as a rate hike is a more realistic outcome.

GBP/JPY Daily Chart

Source: TradingView, prepared by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX