EUR/USD, EUR/GBP and EUR/JPY – Prices, Charts, and Analysis

- The ECB looks set to be the first major central bank to cut interest rates.

- PMIs, Ifo, and final GDP and inflation data out next week.

Learn How to Trade EUR/USD with our Complimentary Guide

Recommended by Nick Cawley

How to Trade EUR/USD

Most Read: Euro Price Outlook: Hot US CPI Weighs on the Euro

The economic calendar has a few interesting releases next week, including the latest Euro Area and German PMI reports, the German Ifo, and final Euro Area inflation and German GDP numbers. Add in a handful of ECB speakers spread out over the week and the economic calendar looks interesting without being overly busy.

For all market-moving economic data and events, see the real-time DailyFX Economic Calendar

Recent US and UK data has pushed back rate cut expectations in both countries to the end of H, while Euro Area data suggests that the ECB is likely to pip both central banks and be the first major CB to start cutting rates, albeit by a couple of weeks. If this week’s EU and German data continues to highlight weakness in the single block, these expectations may harden, and that’s likely to weaken the Euro in the weeks ahead.

For all major central bank policy decision dates, see the DailyFX Central Bank Calendar

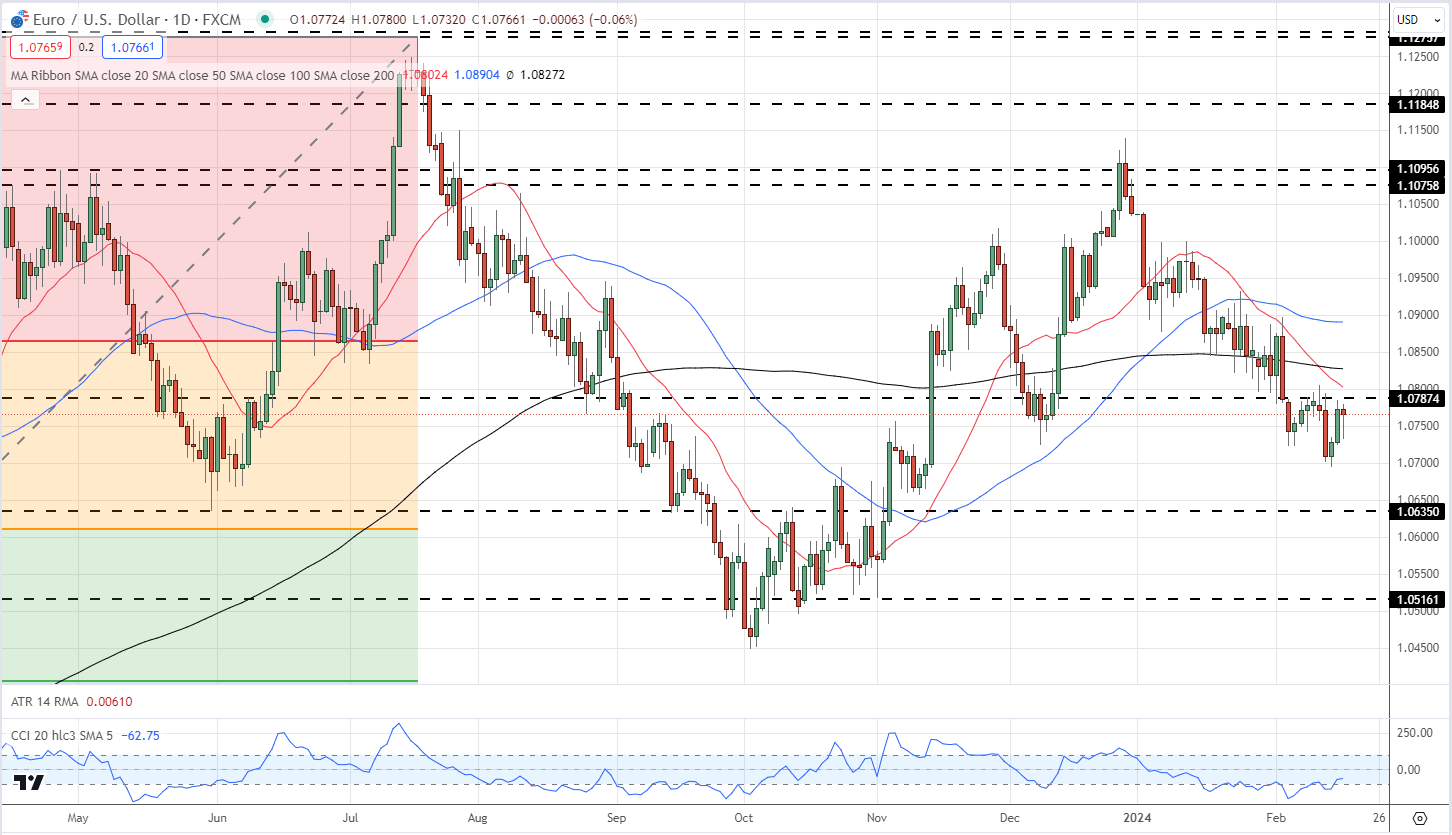

The daily EUR/USD chart looks neutral to slightly bearish with the pair printing a series of lower highs and lower lows whilst also being stuck below all three simple moving averages. A prior level of interest around 1.0787 now looks to be initial resistance, ahead of all three moving averages and the 23.6% Fibonacci retracement level around 1.0865. On the downside, 1.0700 and 1.0635 stand out.

EUR/USD Daily Chart

Charts Using TradingView

IG retail trader data show 50.36% of traders are net-long with the ratio of traders long to short at 1.01 to 1.The number of traders net-long is 0.63% lower than yesterday and 9.51% lower than last week, while the number of traders net-short is 2.80% higher than yesterday and 11.61% higher than last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/USD prices may continue to fall.

To See What This Means for EUR/USD, Download the Full Retail Sentiment Report Below

| Change in | Longs | Shorts | OI |

| Daily | -1% | 1% | 0% |

| Weekly | -14% | 27% | 4% |

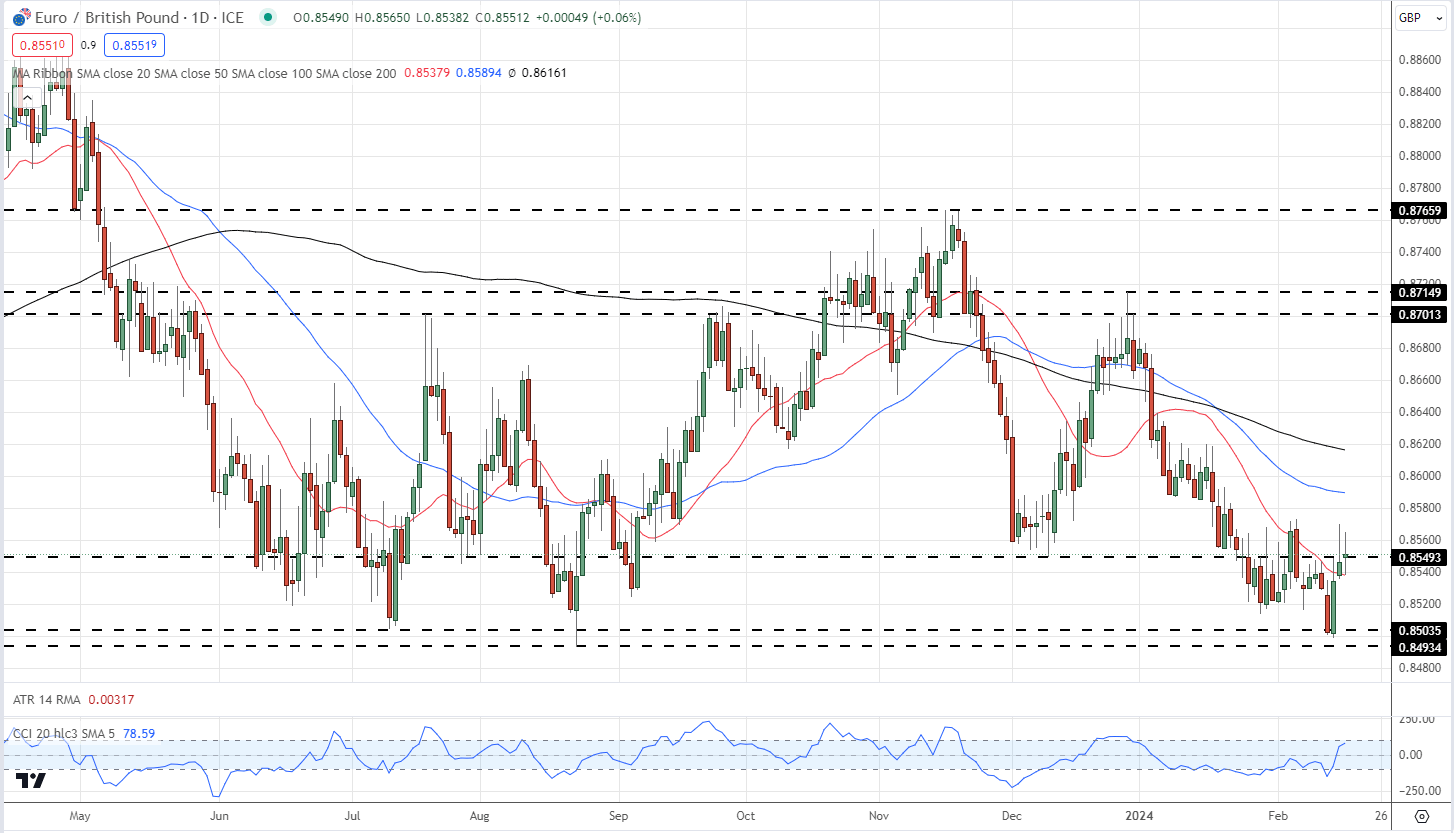

EUR/GBP made a strong turnaround midweek as the pair made a fresh multi-month low and touched the 0.8500 area. The strength of the rebound took EUR/GBP back above the 20-day sma, and a move above 0.8573 would also break the recent series of lower highs. If this happens then the pair may look to move back above 0.8600 with a handful of recent prints around 0.8620 the next area of resistance.

EUR/GBP Daily Chart

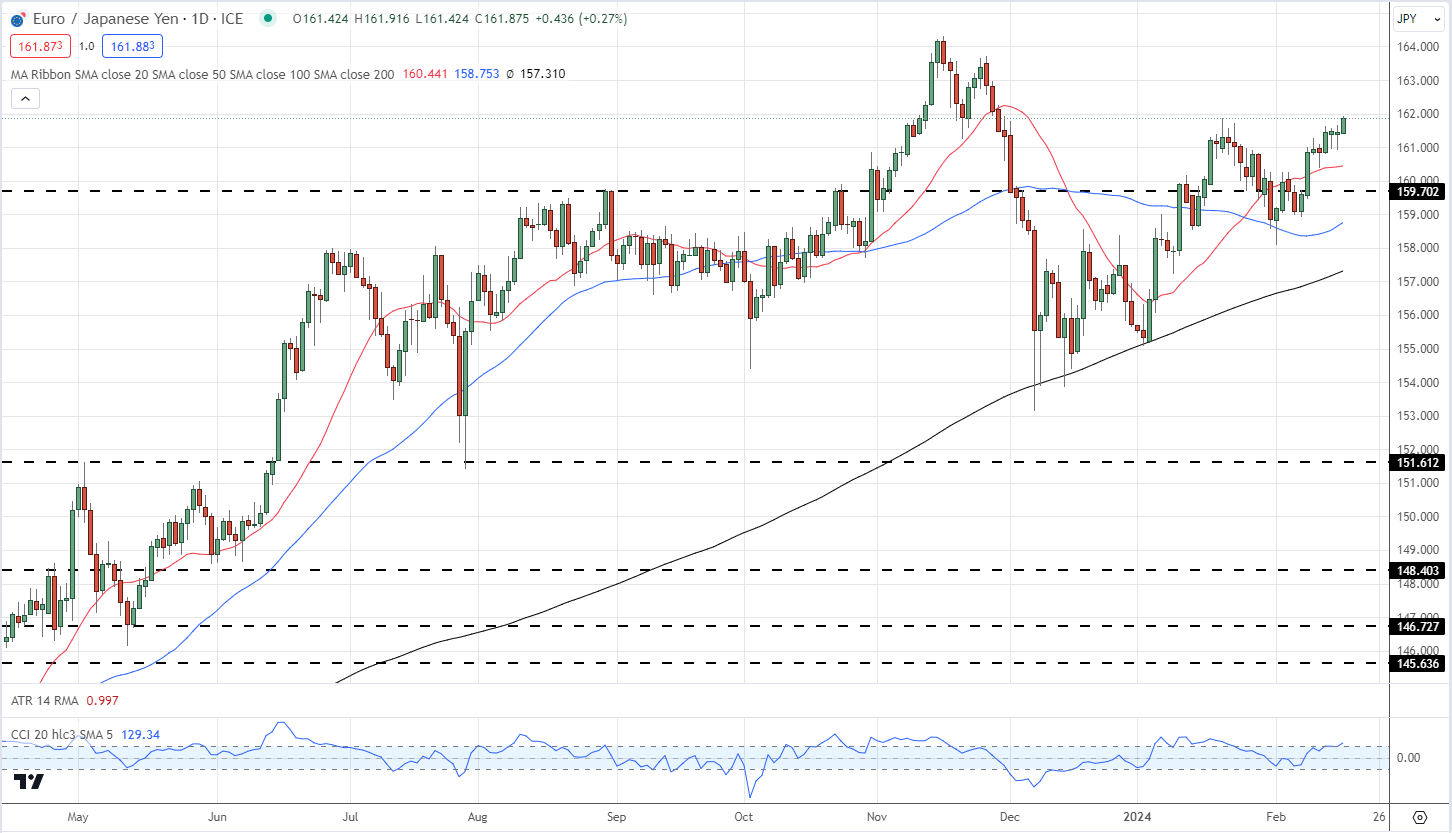

EUR/JPY is now back above all three simple moving averages and is set to make a fresh multi-week high. The move higher in the pair is down to Yen weakness more than Euro strength, and unless the BoJ or MoF start taking action to curb the Yen’s current weakness, the pair may look at the November 16 high at 164.31 as the next target. Care needs to be taken when trading any Yen pair as any sign of intervention, likely to be verbal to start with, will quickly reverse recent Yen weakness from its current stretched levels.

EUR/JPY Daily Chart

Recommended by Nick Cawley

Trading Forex News: The Strategy

What is your view on the EURO – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.