EUR/USD Prices, Charts and Analysis – Outlook Bearish

- Major central banks will dominate next week’s market activity.

- EUR/GBP continues to test multi-month support.

Recommended by Nick Cawley

Traits of Successful Traders

Five of the largest central banks will reveal their latest monetary policy decisions, and thoughts for the months ahead, over the next week. The Reserve Bank of Australia (March 19th) starts proceedings, followed by the Bank of Japan (March 19th), the US Federal Reserve (March 20th), the Swiss National Bank (March 21st) and the Bank of England (March 21st). While all central bank meetings are important, the only ‘live’ meeting is the BoJ where markets currently show a 40% probability of a 10 basis point rate hike. The rest of the meetings however may give markets further clues about policy settings going forward. Euro-pair traders across these currencies will need to follow these meetings closely.

For all Central Bank Meeting Dates, see the DailyFX Central Bank Calendar

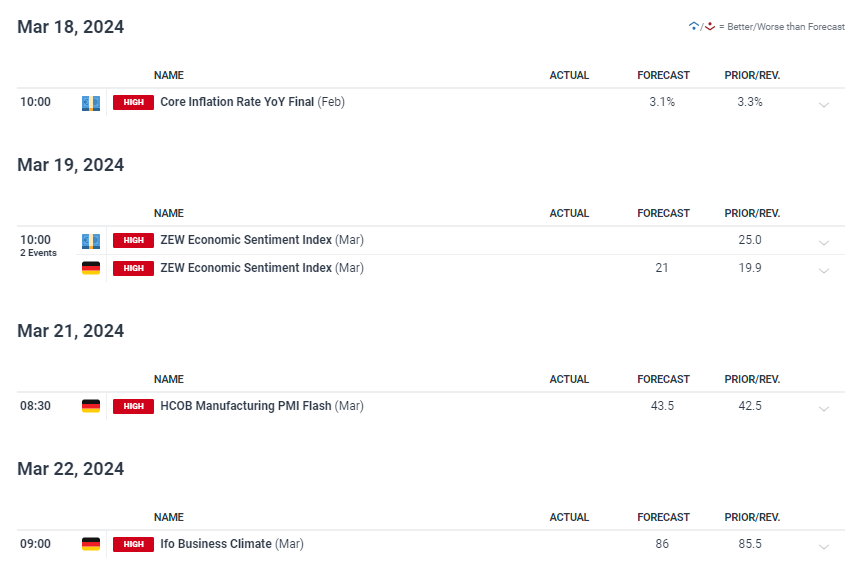

The economic calendar has a few noteworthy releases next week, with reports by ZEW, the HCOB PMIs, and the German IFO all capable of moving markets.

For all market-moving economic data and events, see the real-time DailyFX Economic Calendar

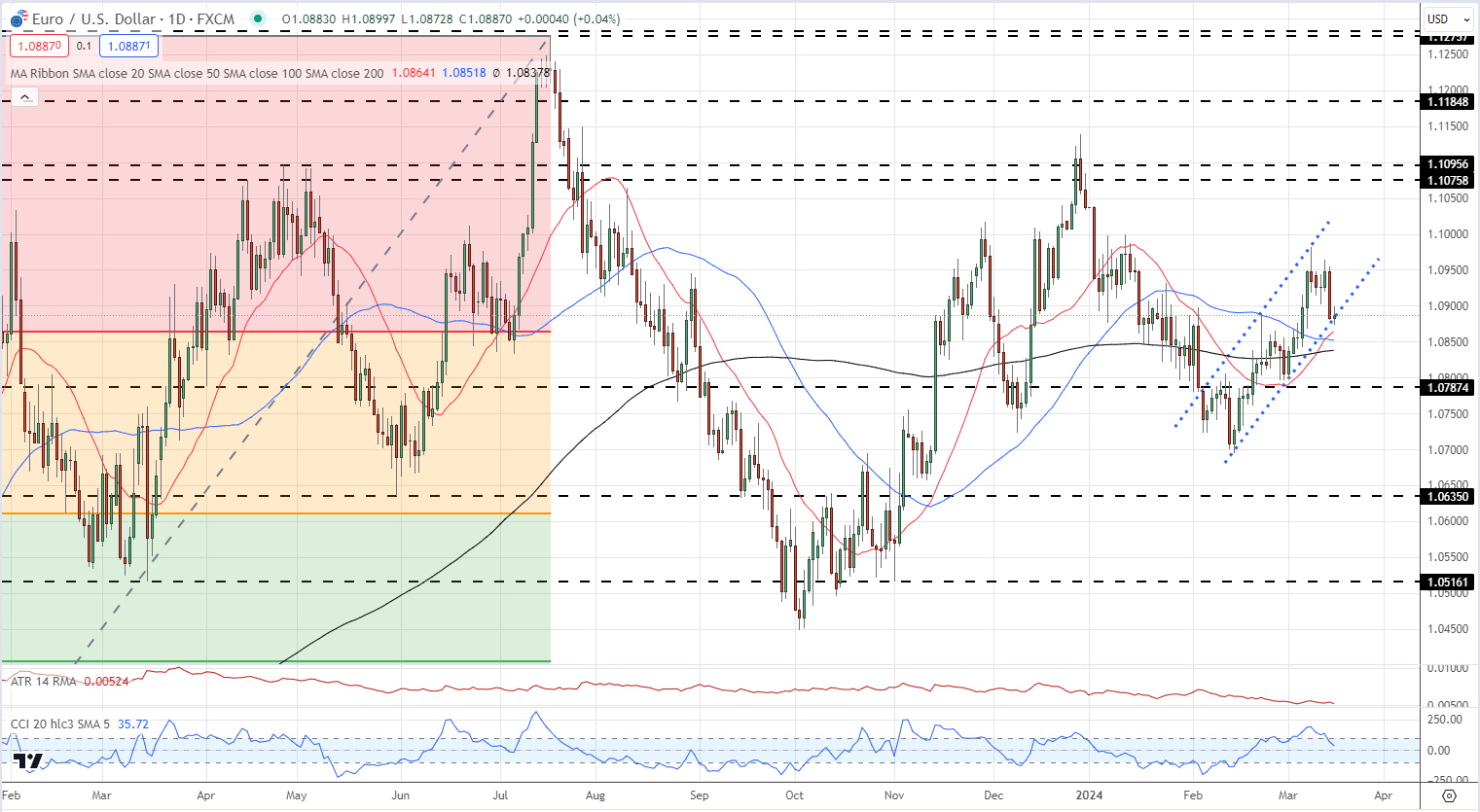

The most widely-traded FX-pair, EUR/USD, currently sits at a one-week low around 1.0885, forced lower by a recent bout of US dollar strength. The ECB is currently seen as the first major central bank to lower interest rates with the June meeting widely seen as the starting point. With markets currently pushing back the Fed’s first rate cut from June to July, EUR/USD looks set to move lower in the days and weeks ahead. The recent multi-week high at 1.0981 is unlikely to be tested unless the Fed turns dovish next week, while all three simple moving averages, and the 23.6% Fibonacci retracement all cluster between 1.0840 and 1.0864 to provide the first zone of support. A break lower would bring 1.0787 into focus. While an ascending channel remains in play, ascending support is being tested.

EUR/USD Daily Price Chart

Retail trader data shows 54.68% of traders are net-long with the ratio of traders long to short at 1.21 to 1.The number of traders net-long is 29.64% higher than yesterday and 47.56% higher than last week, while the number of traders net-short is 21.59% lower than yesterday and 23.87% lower than last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/USD prices may continue to fall.

See how retail trade data affects a wide range of tradeable assets.

| Change in | Longs | Shorts | OI |

| Daily | 3% | 1% | 2% |

| Weekly | 48% | -17% | 9% |

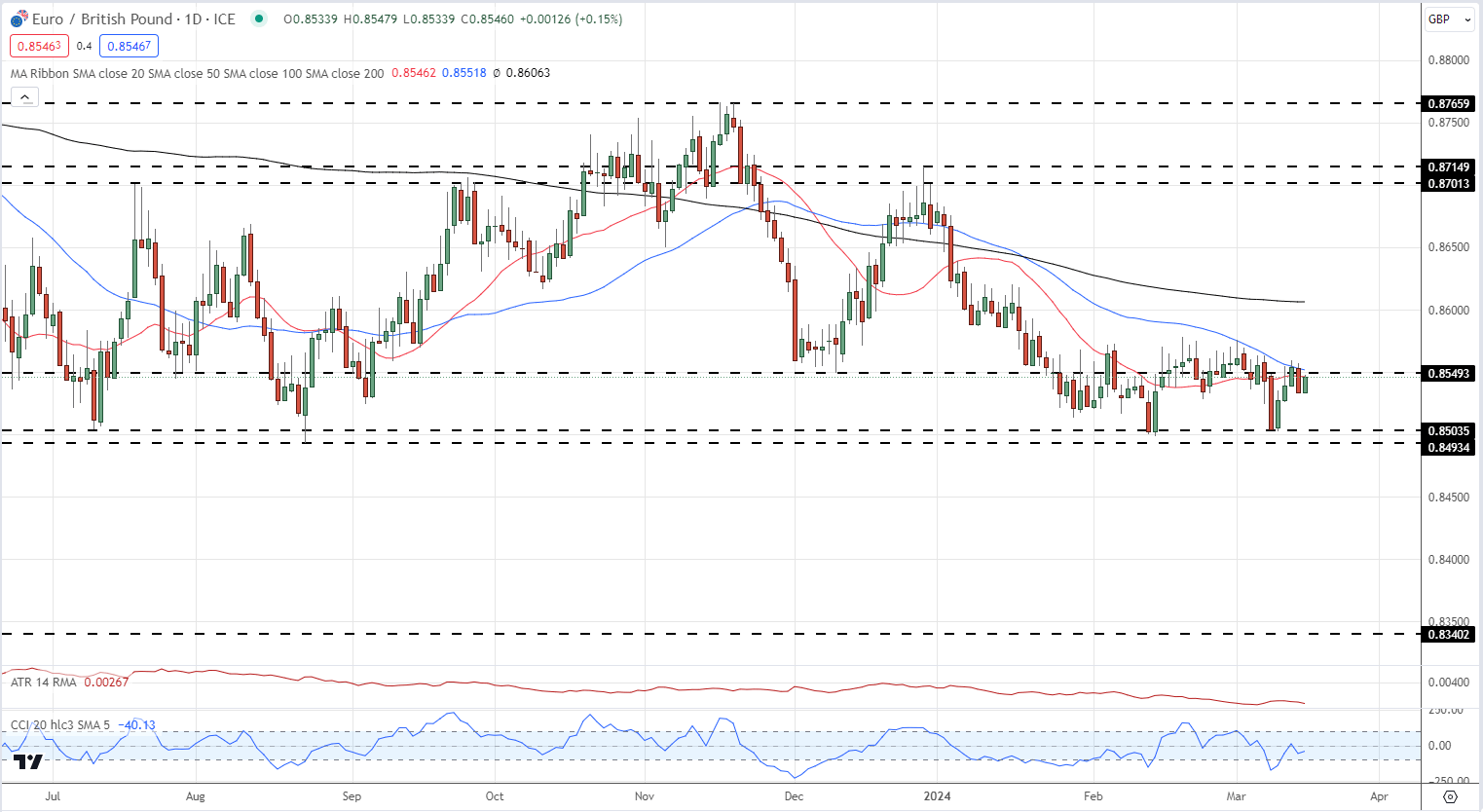

EUR/GBP is another pair that looks weak as it trades near the bottom of a multi-month range. The pair are now below all three simple moving averages and eye the 0.8500 area. A close and open below the August 23 low at 0.8493 will open the way for the pair to test a prior swing low at 0.8340, made on August 2nd, 2022. The pair may struggle to rally above 0.8550 in the short-term.

EUR/GBP Daily Price Chart

All charts using TradingView

What is your view on the EURO – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.