EUR/USD, GBP/USD, and Gold Sentiment Analysis

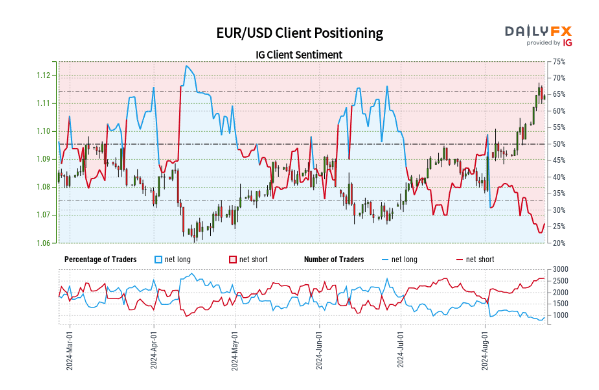

Retail trader data shows 25.76% of EUR/USD traders are net-long with the ratio of traders short to long at 2.88 to 1.The number of traders net-long is 12.88% higher than yesterday and 17.56% lower from last week, while the number of traders net-short is 0.68% higher than yesterday and 19.41% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise. Positioning is less net-short than yesterday but more net-short from last week. The combination of current sentiment and recent changes gives us a further mixed EUR/USD trading bias.

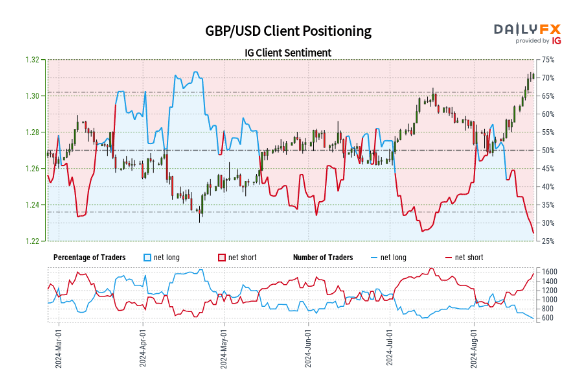

Retail trader data shows 28.27% of GBP/USD traders are net-long with the ratio of traders short to long at 2.54 to 1.The number of traders net-long is 0.48% lower than yesterday and 32.83% lower from last week, while the number of traders net-short is 6.55% higher than yesterday and 41.14% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBP/USD prices may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBP/USD-bullish contrarian trading bias.

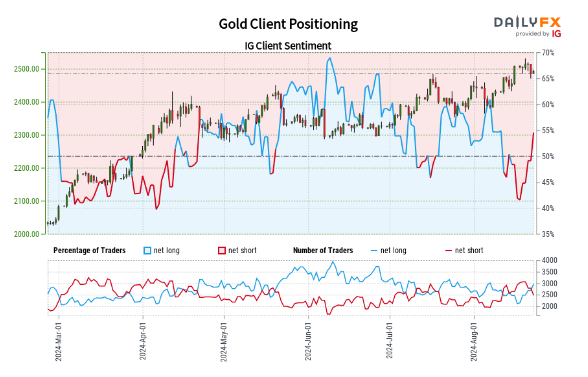

Retail trader data shows 54.85% of Gold traders are net-long with the ratio of traders long to short at 1.21 to 1.The number of traders net-long is 8.56% higher than yesterday and 18.90% higher from last week, while the number of traders net-short is 9.27% lower than yesterday and 5.95% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Gold prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger Gold-bearish contrarian trading bias.