DAX 40, Dow Jones 30, Hang Seng Analysis, Prices, and Charts

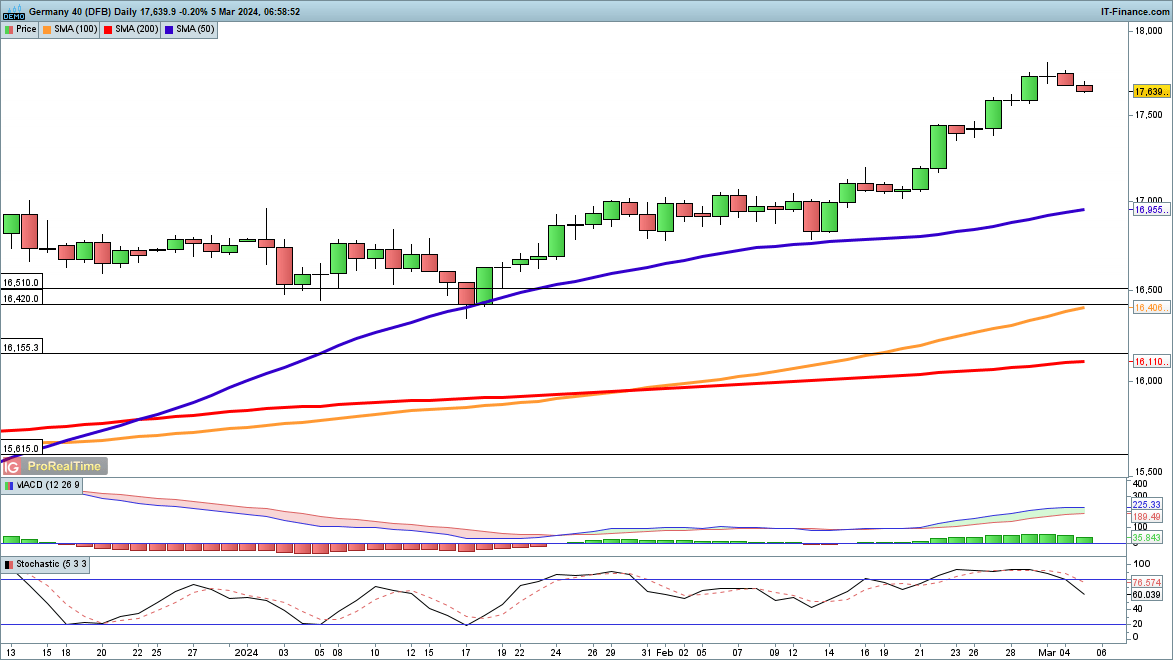

Dax retreats from previous peak

The index recorded a fresh record high last week surging briefly to 17,816 before falling back.It has continued to move lower in the short term, though this barely puts a dent in the gains made throughout February. A steady drift lower, coupled with a bearish MACD crossover, could precipitate a pullback over time to the rising 50-day simple moving average (SMA), as happened over December.

This would leave the uptrend intact, and create a higher low.

DAX 40 Daily Chart

Recommended by Chris Beauchamp

Building Confidence in Trading

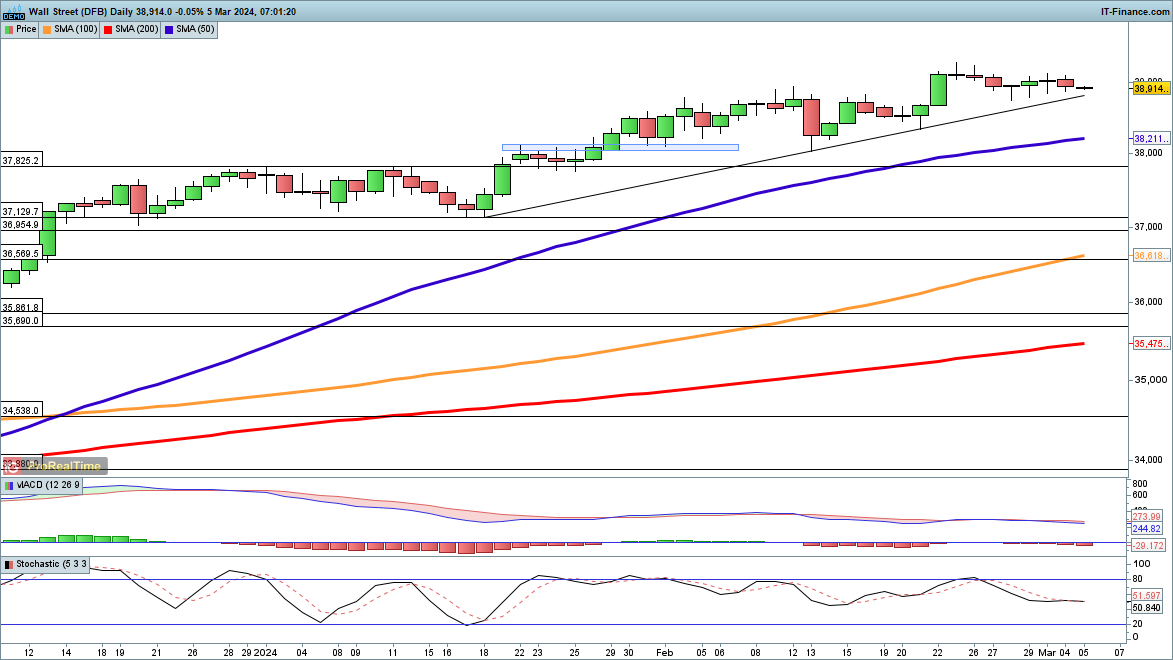

Dow Jones edges down

A slow move lower continues here, as the price drops back from the highs of late February and nears rising trendline support from the late January low. Should support be broken then the 50-day SMA becomes the next destination to watch for support, along with the 13 February low at 38,037.

A recovery back above 39,000 could signal that a bounce off trendline support has initiated a move back to record highs and potentially beyond.

Dow Jones Daily Chart

| Change in | Longs | Shorts | OI |

| Daily | 2% | -3% | -2% |

| Weekly | -17% | -3% | -8% |

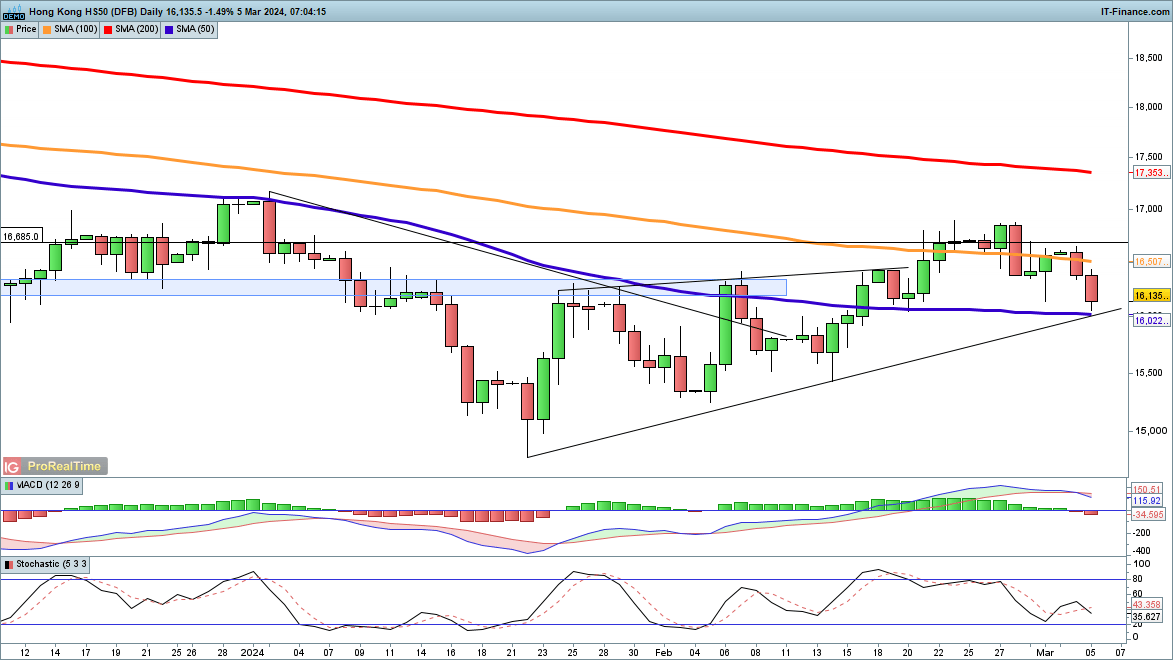

Hang Seng heads lower

After recording a lower high at the end of February, the index has dropped back below the 100-day SMA. It is now heading towards the 50-day SMA, as well as rising trendline support from the January low. A close below both these lines, coupled with the developing bearish MACD crossover, could mark the beginning of a new leg lower.

This might then target the lows of January at 17,745. A bounce-off trendline support might yet see the price move back towards the late February highs.