Crude Oil, WTI, Brent, US Dollar, Gold, FOMC – Talking Points

- Crude oil might be in for some sideways price action as the Middle East conflict unfolds

- Haven assets remain desirable amongst the noise and volatility as gold surges

- The markets appear poised with range trading across many markets

Recommended by Daniel McCarthy

Get Your Free Oil Forecast

Crude oil is contained in the range to start the week, but it has eased slightly through the Asian session. The market remains cautious and concerned about the potential disruption to the global oil supply as a result of the fighting in the Middle East.

Israel began to move ground troops into the Gaza Strip over the weekend and there are hopes that the conflict will not expand across the region. The US and Iran have voiced concerns that the theatre of war might not be contained.

The WTI futures contract has traded below US$ 85 bbl while the Brent contract has dipped under US$ 90 bbl at the time of going to print.

Perceived haven assets have had a mixed start to the week with gold easing slightly after another stellar rally on Friday, dipping toward US$ 2,000 an ounce.

Currency markets have had a quiet start to the week and all eyes will be on the Bank of Japan (BoJ) this week as they contemplate a tilt in monetary policy.

Most pundits are anticipating a shift in yield curve control (YCC) although there has been some speculation that the negative interest rate policy (NIRP) might be addressed.

Meanwhile, the Federal Open Market Committee (FOMC) meeting decision will be known on Wednesday and the interest rate market is not anticipating any change in the Fed funds target rate. The focus will be on the post-conclave press conference.

APAC equities are softer overall after Wall Street finished last week lower while Treasury yields have ticked up slightly after easing on Friday.

The focus for this week is the central bank meetings.

The full economic calendar can be viewed here.

Recommended by Daniel McCarthy

How to Trade Oil

WTI CRUDE OIL TECHNICAL SNAPSHOT

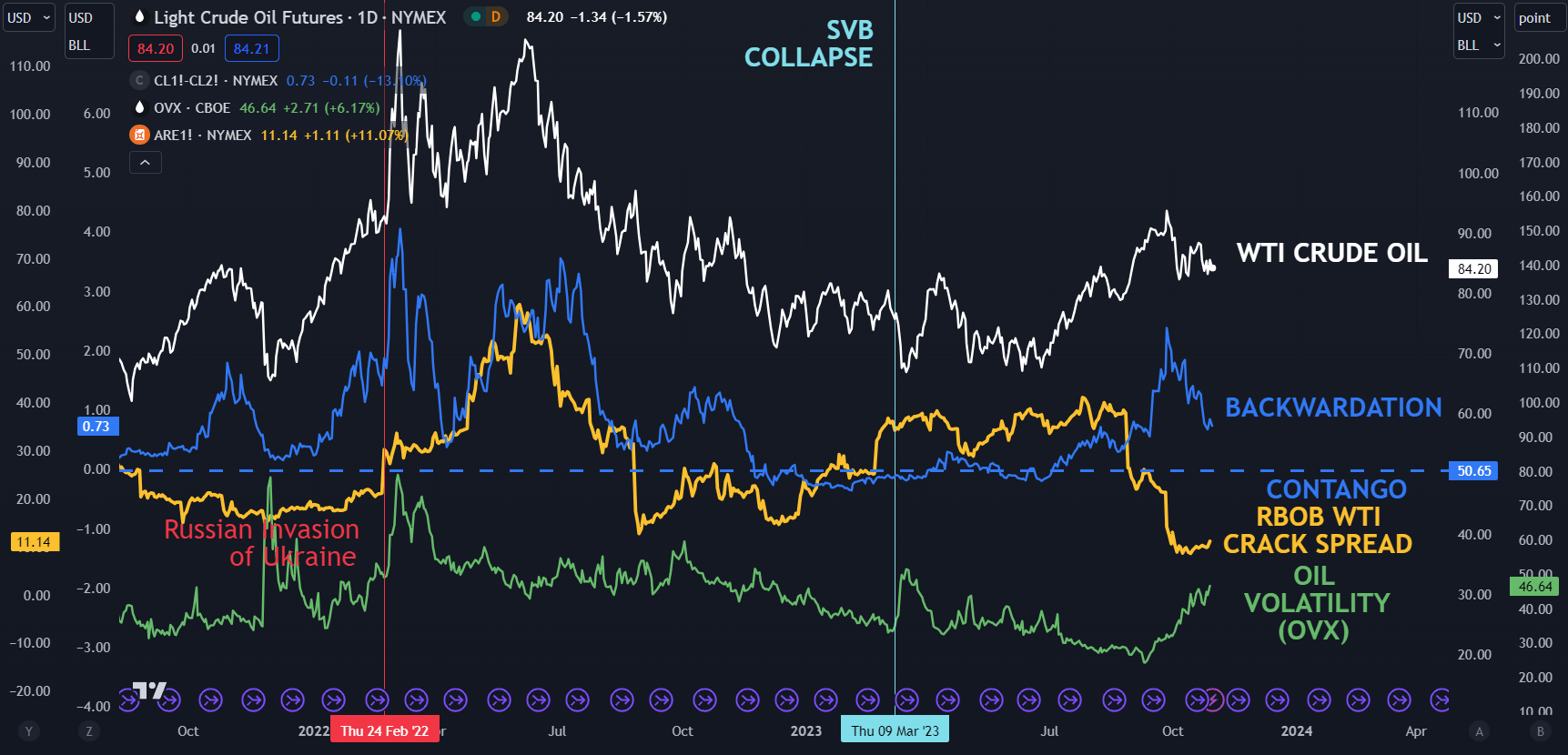

The structural backdrop for crude oil might not be as supportive as initially thought from the prospect of tighter global supply from the war in the Middle East.

Crack spreads are lower as is backwardation at a time when volatility is ticking up.

Backwardation occurs when the futures contract closest to settlement is more expensive than the contract that is settling after the first one. It highlights a willingness by the market to pay more to have immediate delivery, rather than having to wait.

The RBOB crack spread is the gauge of gasoline prices relative to crude oil prices and reflects the profit margin of refiners.

RBOB stands for reformulated blendstock for oxygenate blending. It is a tradable grade of gasoline. If profitability increases for refiners, it may lead to more demand for the crude product.

WTI CHART

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCarthyFX on Twitter