British Pound Weekly Forecast: BoE and GBP/USD Outlook

- The Bank of England will give its first 2024 rate call this week

- It won’t cut rates, but it might look more amenable to the idea

- The question of how soon will dominate the market, and may not be answered

British Pound Forecast: Bullish. Just.

Download our Q1 GBP Technical and Fundamental Forecast:

Recommended by David Cottle

Get Your Free GBP Forecast

This won’t be the week in which the Bank of England cuts interest rates from their sixteen-year highs. But it might well be the week in which it starts to seem a little more open to the idea. After all, some of its counterparts already are. Sterling markets, at least, stand to be surprised if the now familiar hawkish rhetoric isn’t dialed down on Thursday.

The United Kingdom’s central bank will give its first monetary policy decision of 2024 then, just a day after we’ll all have heard from the United States Federal Reserve.

BoE leaders spent much of 2023 sternly dismissing the idea of rate cuts, reasonably citing strong inflation and punchy wage growth. However, economists now think we might see some subtle changes to the form. For example, this might well be the first Monetary Policy Committee meeting since late 2021 at which no one votes to raise interest rates at all. Someone might even feel brave enough to back a cut. Moreover, the prognosis that borrowing costs must ‘stay restrictive for an extended period’ might well be toned down, or abandoned altogether.

So there’s plenty for sterling markets to keep an eye on, and that’s before we get to the Fed.

One major factor to look out for is any clues as to when either central bank might be inclined to move on rates. Sterling markets think local rates could start coming down in May, with US focus on an even earlier move., perhaps in March. Perhaps the major risk event this week on both sides of the GBP/USD pairing is that either central bank leaves markets with the impression that they’ve mispriced these chances. And perhaps the biggest risk within that is that GBP traders have got a little ahead of themselves.

If the BoE leaves this impression, sterling could rise above its current, enduring range at long last. So it’s a bullish call this week, but a very cautious one.

GBP/USD Technical Analysis

Recommended by David Cottle

How to Trade GBP/USD

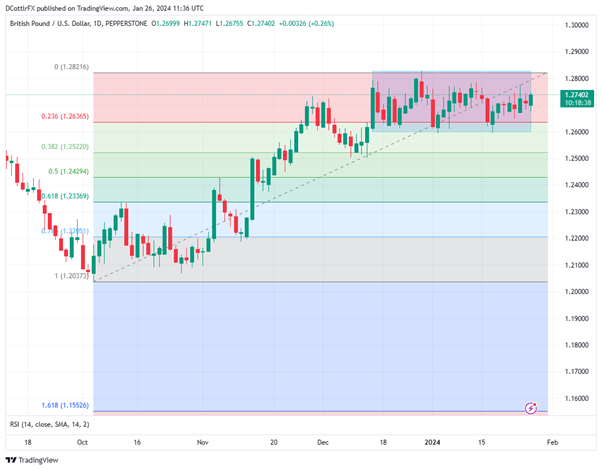

GBP/USD Daily Chart Compiled Using TradingView

The broad trading range bounded by December 28’s four-month peak of 1.28288 and the intraday lows of January 3 and 17, at 1.26007 continues to dominate this market as it has for the past month and more.

Psychological support at 1.2700 looks like the key defense level of this range’s lower limit at present, with sterling bulls staging dogged efforts to keep the market above this point. Even so, they’re regularly falling short of the previous significant peak, January 11’s intraday top of 1.27710. That will need to be retaken and held if the range top is to be challenged, and there seems little sign of that occurring yet.

Support is likely at 1.26365. That’s the first Fibonacci retracement of the run-up from early October to the highs of late December. Should that give way, there may not be much between the market and the second retracement point which comes in at 1.25220.

–By David Cottle for DailyFX