Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Huge bets by Chinese speculators on rising gold prices have helped super-charge the precious metal’s rally to an all-time high this month, in a sign that Asian traders are beginning to eclipse their western counterparts in their influence on the bullion market.

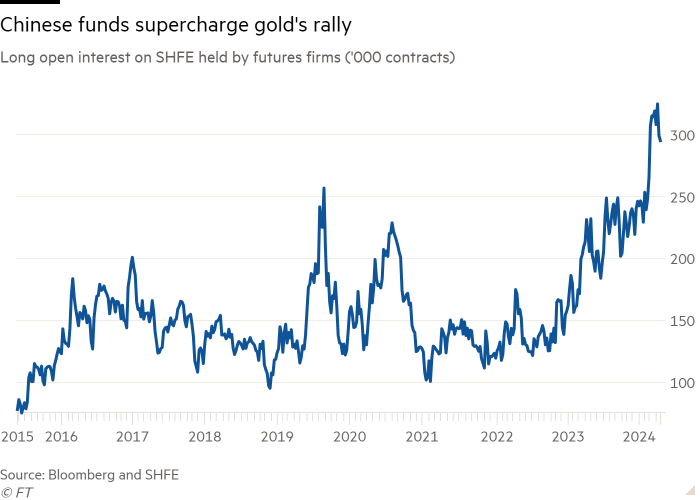

Long gold positions held by futures traders on the Shanghai Futures Exchange (SHFE) climbed to 295,233 contracts, equivalent to 295 tonnes of gold. That marks a rise of almost 50 per cent since late September before geopolitical tensions flared up in the Middle East.

A record bullish position of 324,857 contracts was hit earlier this month, according to Bloomberg data going back to 2015.

One trading firm, Zhongcai Futures, has amassed a bullish position in SHFE gold futures equating to just over 50 tonnes of metal — worth nearly $4bn and equivalent to more than 2 per cent of the Chinese central bank’s reserves of bullion.

Gold volumes on SHFE surged to more than five times last year’s average at 1.3mn lots on the peak day of trading last week, a trading frenzy that analysts say helps explain the ferocity of gold’s record-breaking rally to above $2,400 a troy ounce this month.

“Chinese speculators have really grabbed gold by the throat,” said John Reade, chief market strategist at the World Gold Council, an industry body.

“Emerging markets have been the biggest end consumers for decades but they haven’t been able to exert pricing power because of fast money in the west. Now, we are getting to the stage where speculative money in emerging markets can exert pricing power.”

Gold has rallied more than 40 per cent since November 2022, supported by record bullion purchases by EM central banks seeking to diversify their reserves away from the US dollar and signs of peaking interest rates.

The metal, which is often used as a hedge against inflation and currency depreciation, has been further boosted by its safe haven status since the outbreak of the Israel-Gaza conflict in October, hitting an all-time peak of $2,431 per troy ounce last week.

Even so, the scale of the rally has surprised many analysts, who point out that the rise is at odds with outflows from US and European exchange traded funds.

Instead, some point to activity on SHFE and the Shanghai Gold Exchange — where trading volumes on a key contract have doubled in March and April relative to last year — as a big driver of the rally, as Chinese investors aim to diversify from their crisis-ridden property sector and sagging stock market.

Zhongcai, founded three decades ago by Bian Ximing as a manufacturer of PVC pipes before branching out into futures trading, is foremost among a group of Chinese trading firms whose large bets have been linked to gold’s rapid rise and subsequent pullback from record highs.

“Short-term traders in leveraged futures markets, as we have seen many times over the years, can move the price quickly higher or lower,” said Reade.

Gold prices fell sharply on Monday and were trading at $2,326 a troy ounce on Tuesday.

Other Chinese traders, such as Citic Futures and Guotai Junan Futures, also have large long positions in SHFE gold futures.

Bian, well-known for his “self-reflection” blogs, is a minority investor in Alibaba Pictures, the Chinese media group behind Green Book, Oscar-winner 1917 and some of the recent Mission Impossible movies.

He wrote in 2022 that high inflation and the war in Ukraine meant “it is the right time to lock the fund’s entire position in the highly leveraged Shanghai-traded gold”.

One fund managed by Zhongcai has recorded a return of more than 160 per cent in 2024, according to Wind, a Chinese financial information provider.

Zhongcai and Bian did not respond to requests for comment.