Most Read: Australian Dollar Outlook & Sentiment Analysis: AUD/USD, AUD/JPY

The instinct to follow the crowd is powerful in trading – buying in moments of euphoria and selling during a widespread panic. However, savvy traders understand the potential opportunities hidden within contrarian strategies. Indicators like IG client sentiment offer a unique window into the market’s collective mood, potentially pinpointing moments where excessive optimism or pessimism may hint at an approaching trend reversal.

Naturally, contrarian signals aren’t foolproof. They become most powerful when combined with a well-rounded trading plan. By carefully incorporating contrarian signals alongside technical and fundamental analyses, traders develop a richer understanding of the market’s underlying dynamics – aspects that the majority might easily miss. Let’s illustrate this idea by analyzing IG client sentiment and its potential influence on the British pound across three key pairs: GBP/USD, GBP/JPY and EUR/GBP.

Want to know where the British pound may be headed over the coming months? Explore all the insights available in our quarterly forecast. Request your complimentary guide today!

Recommended by Diego Colman

Get Your Free GBP Forecast

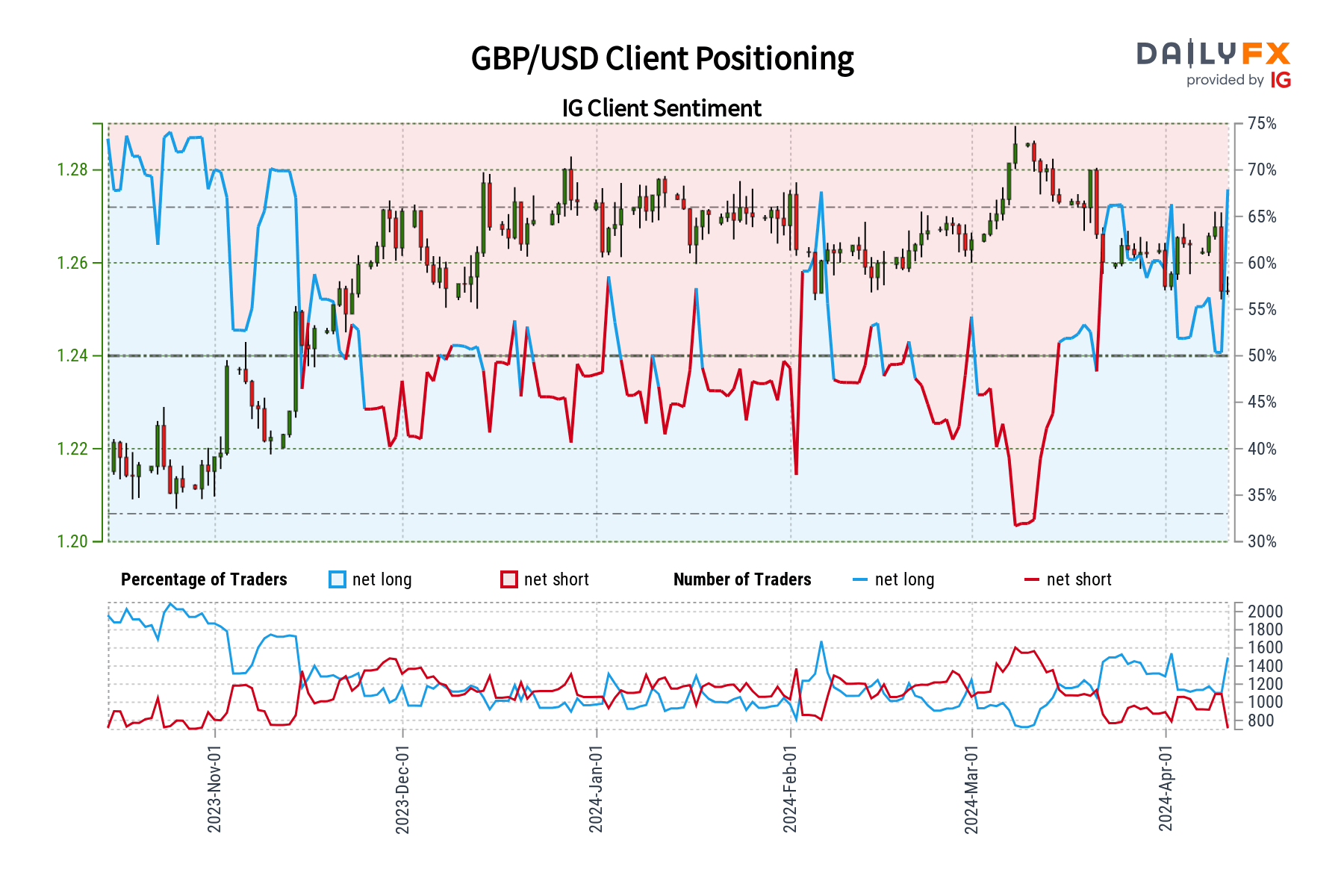

GBP/USD FORECAST – MARKET SENTIMENT

According to IG data, 64.6% of clients are bullish on GBP/USD, with a long-to-short ratio standing at 1.82 to 1. The number of traders in net-long positions has increased by 17.96% since yesterday and by 27.85% compared to last week. Conversely, the tally of those holding bearish bets has decreased by 0.61% since yesterday and by 25.41% since last week.

With our unique interpretation of crowd behavior, the current dominance of bullish positions suggests a possible extension of GBP/USD’s weakness. The substantial increase in net long wagers and changes in market positioning on various timeframes reinforces our bearish contrarian bias on GBP/USD. This means a move below 1.2500 could be around the corner.

Important Reminder: Contrarian signals offer valuable insights, but it’s crucial to integrate them into a broader analysis incorporating technical and fundamental factors. This allows for more informed trading decisions.

Frustrated by trading setbacks? Take charge and elevate your strategy with our guide, “Traits of Successful Traders.” Unlock essential strategies to steer clear of frequent pitfalls and costly missteps.

Recommended by Diego Colman

Traits of Successful Traders

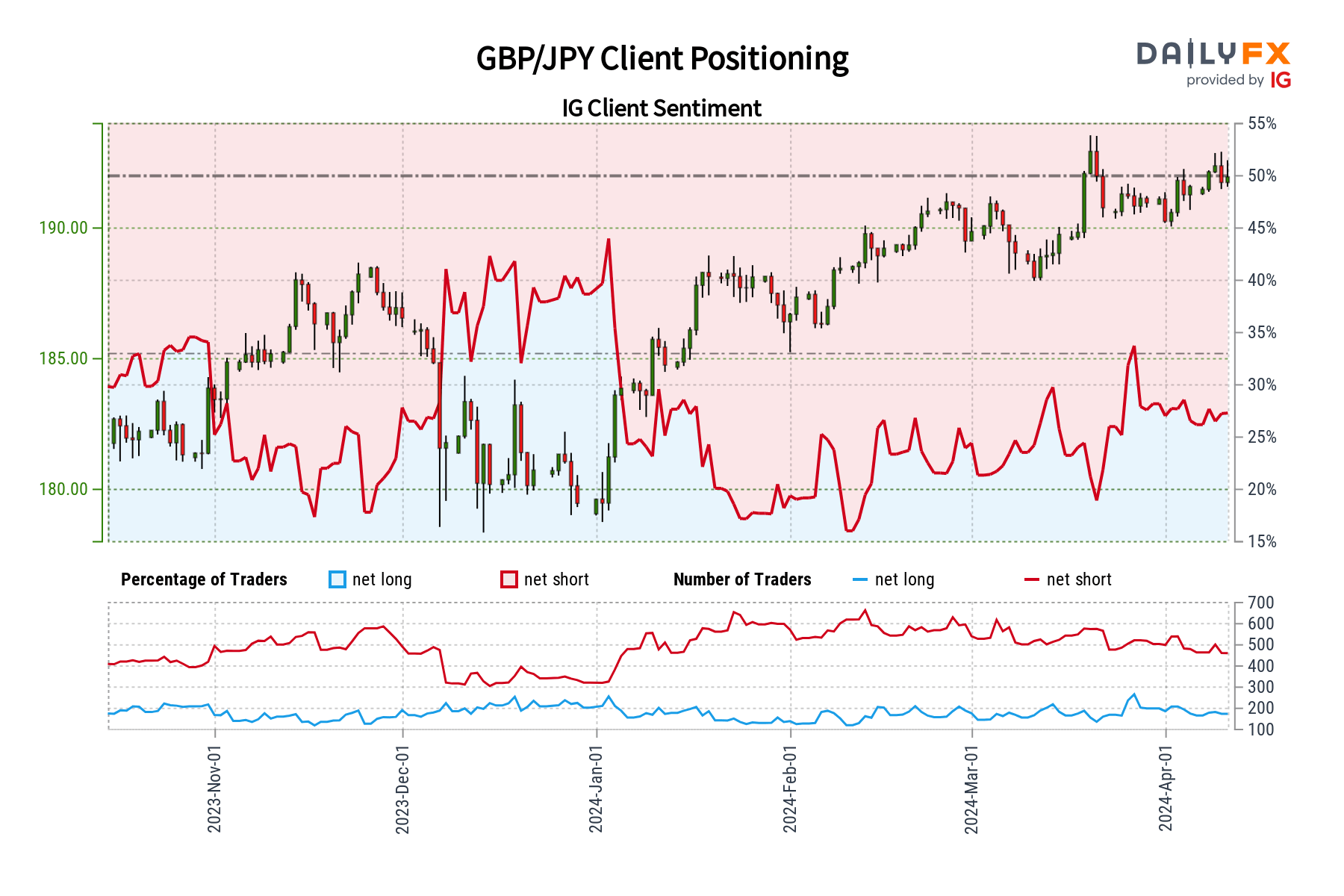

GBP/JPY FORECAST – MARKET SENTIMENT

IG data reveals a predominantly bearish stance on GBP/JPY, with 74.48% of clients holding net-short positions. This translates to a short-to-long ratio of 2.92 to 1. While this bearishness has slightly decreased compared to yesterday (3.09%) and last week (0.99%), it remains significant.

Our approach often favors a contrarian viewpoint. This prevalent pessimism towards GBP/JPY hints at potential upside for the pair. The continued net-short positioning further strengthens this bullish contrarian outlook.

Key point: Remember, contrarian signals offer a unique perspective but should always be considered alongside technical and fundamental analysis for a comprehensive trading strategy.

Interested in understanding how retail positioning may shape EUR/GBP’s near-term outlook? Our sentiment guide holds all the answers. Don’t wait, download your free guide today!

| Change in | Longs | Shorts | OI |

| Daily | 2% | -10% | -3% |

| Weekly | 7% | -27% | -7% |

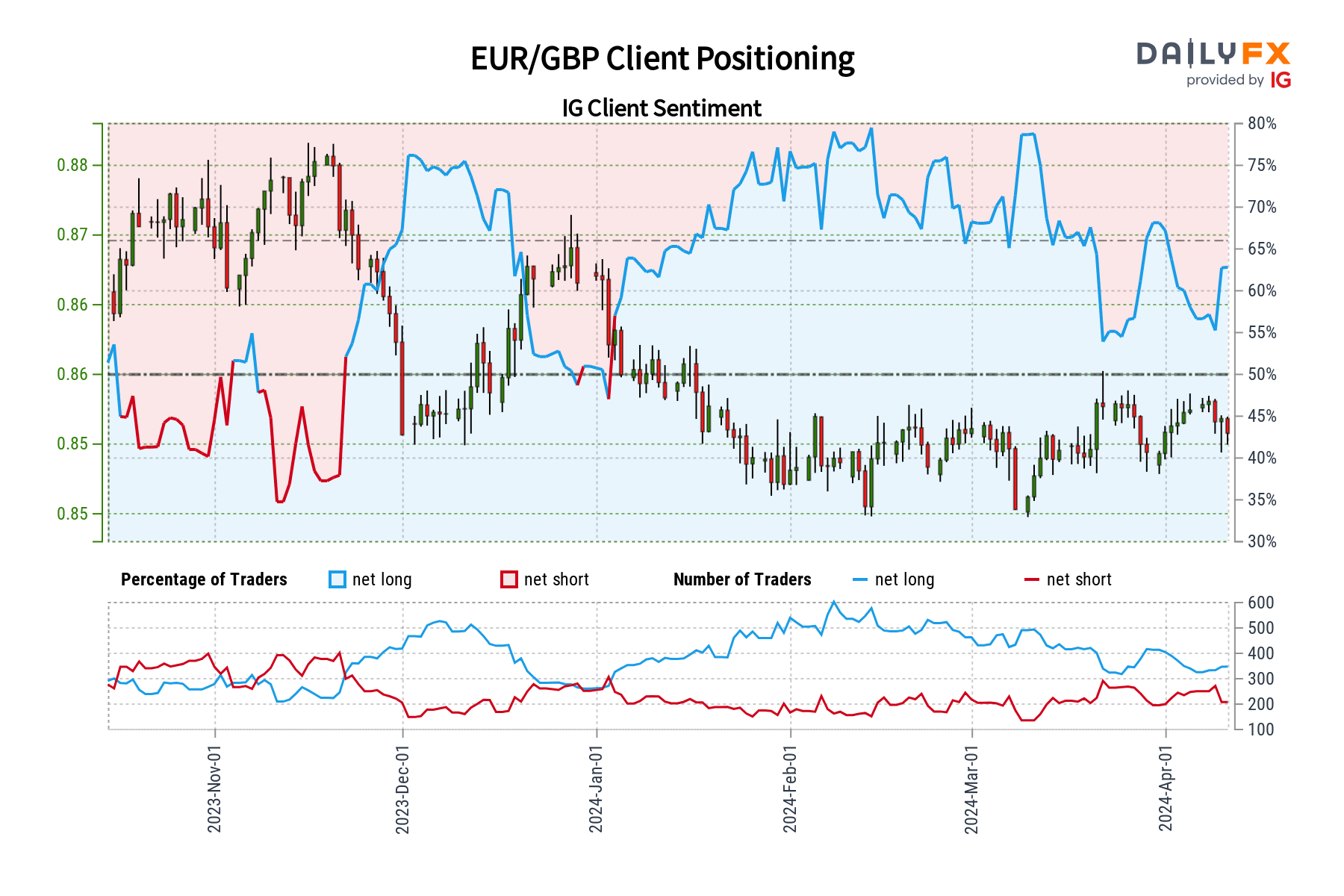

EUR/GBP FORECAST – MARKET SENTIMENT

IG data indicates that the retail crowd maintains a bullish bias towards EUR/GBP, with 67.89% of clients currently holding net-long positions. This translates to a long-to-short ratio of 2.11 to 1. Net-long bets have risen by 7.2% since yesterday and by 11.21% since last week, whereas traders with net-short wagers have decreased by a l4.08% versus yesterday and by 28.52% relative to prevailing levels seven days ago.

We commonly take a contrarian approach to herd positioning in trading. The existing bullish sentiment among retail traders signals that EUR/GBP may see continued losses in the short term. The steady uptick in net-long positions further bolsters this bearish contrarian perspective.

Important Reminder: While contrarian signals provide valuable insights, they are best used to complement a well-rounded trading strategy that includes technical and fundamental analysis.