GBP/USD Analysis and Charts

Most Read: Fed on Hold, 2024 Policy Outlook Unchanged

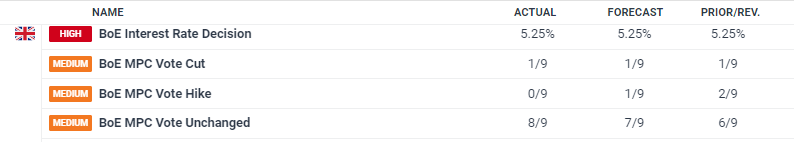

The BoE left the Bank Rate untouched today but MPC voting left a dovish feeling post-decision. At the last meeting, six out of nine members voted to keep rates unchanged, two voted for a rate hike, and one member voted for a rate cut. Today’s vote, eight unchanged and one cut, suggests that rate cuts are nearing.

For all market-moving events and data see the real-time DailyFX Economic Calendar

The probability of a 25 basis point UK rate cut at the June meeting rose to over 65% after the announcement, the highest level seen in recent weeks. While the May meeting may be slightly too early for the BoE to start cutting rates, the June meeting is live.

UK Inflation Falls to a Two-Year Low

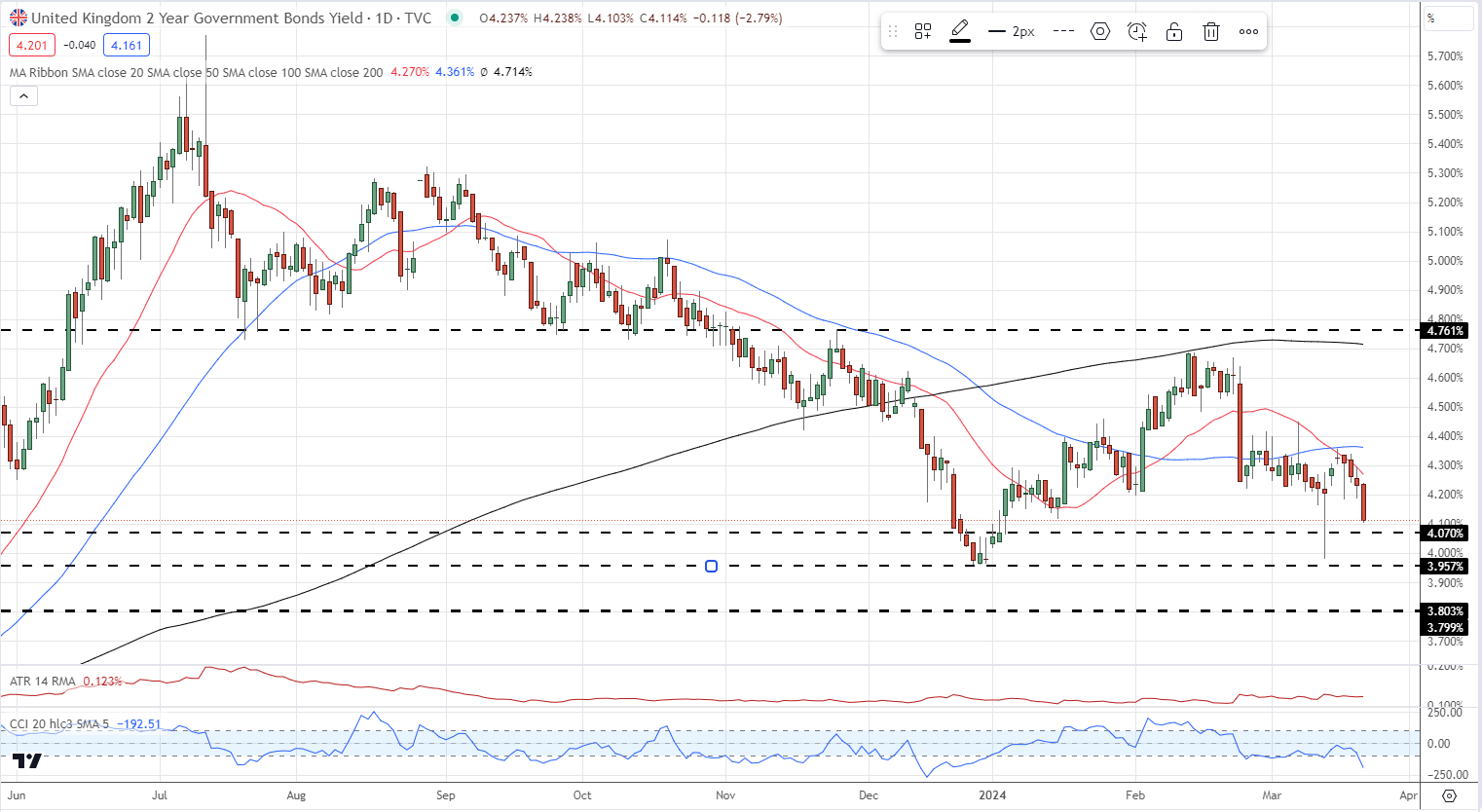

The interest-rate sensitive UK 2-Yr gilt shed a further 7-8 basis points on the announcement, pushing the yield further lower. The late-December triple yield low of around 3.96% may soon come under pressure.

UK 2-Yr Gilt Yield

Learn How to Trade GBP/USD with our Complimentary Guide:

Recommended by Nick Cawley

How to Trade GBP/USD

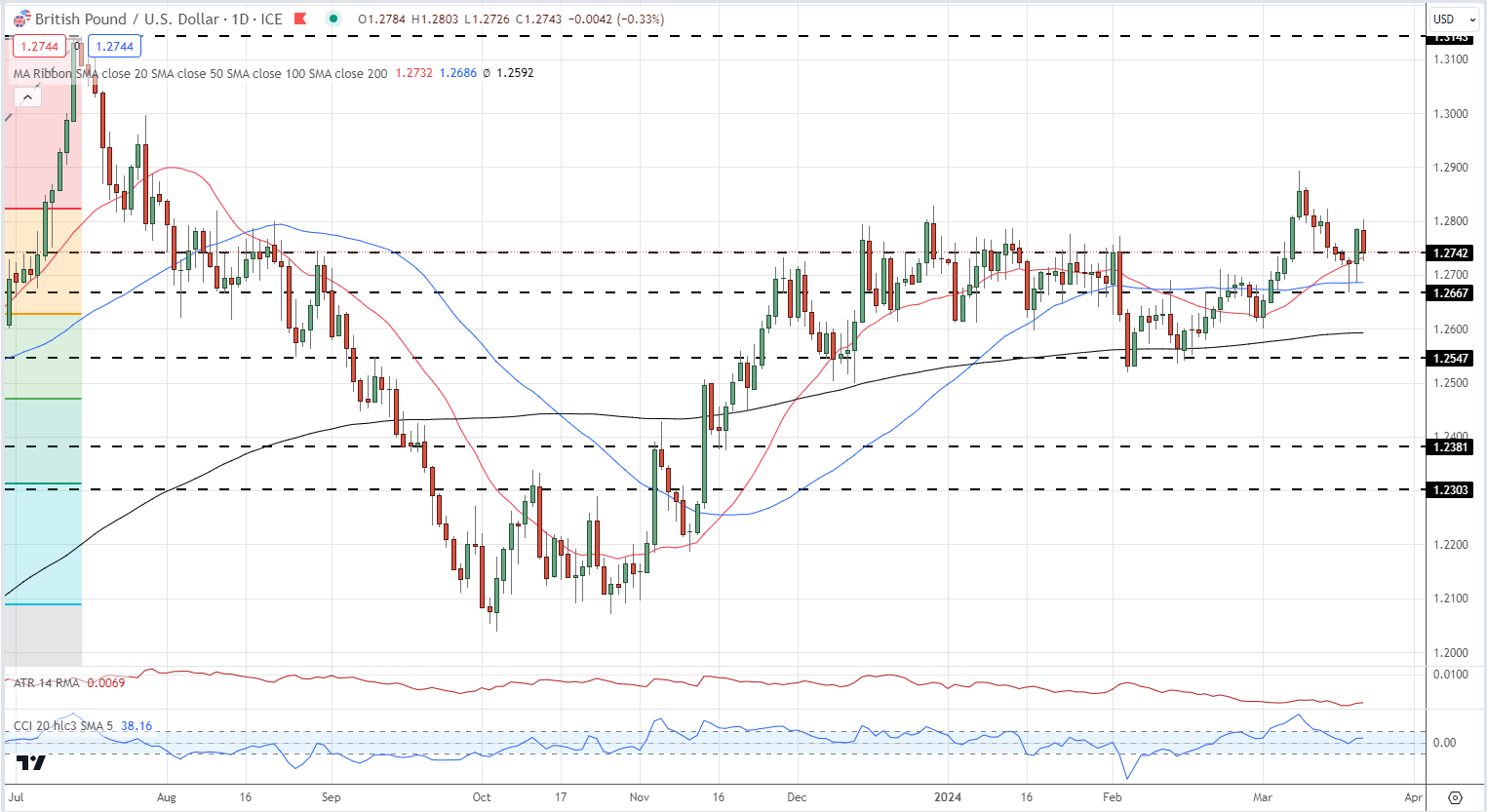

GBP/USD is around 25 pips lower after the decision and trying to reclaim the 1.2750 area. The US dollar is weak today after last night’s FOMC meeting reaffirmed the Fed’s outlook for three 25 basis point rate cuts in the US this year.

GBP/USD Daily Price Chart

IG Retail Trader data shows 47.11% of traders are net-long with the ratio of traders short to long at 1.12 to 1.The number of traders’ net long is 14.32% lower than yesterday and 2.63% lower than last week, while the number of traders’ net short is 9.93% higher than yesterday and 13.48% lower than last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBP/USD prices may continue to rise

See How IG Client Sentiment Can Help Your Trading Decisions

| Change in | Longs | Shorts | OI |

| Daily | 8% | -9% | 1% |

| Weekly | 25% | -28% | 0% |

What is your view on the British Pound – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.