Adam Selipsky, CEO of Amazon Web Services, speaks during the Bloomberg Technology Summit in San Francisco on June 22, 2023.

David Paul Morris | Bloomberg | Getty Images

Amazon said Tuesday that revenue from its cloud unit grew 17% year over year in the first quarter, a more rapid rate than Wall Street had expected.

Revenue from Amazon Web Services came out to $25.04 billion, according to the company’s earnings statement. Analysts surveyed by StreetAccount had been expecting $24.49 billion. The growth marked a step up from the 13% increase Amazon reported for AWS in the fourth quarter.

While Amazon remains mostly an online retailer, the company has become a major entity in information technology, supplying large companies, startups and governments with computing resources, database software and networking services. AWS accounts for 17% of Amazon’s $143,313 billion in overall revenue.

Cloud is also a reliable source of profit for Amazon, thanks to high software margins. AWS delivered $9.42 billion in operating income, or about 62% of Amazon’s total. Analysts polled by StreetAccount had expected $7.52 billion in AWS operating income. The AWS operating margin widened to 37.6%, the widest at least since 2014.

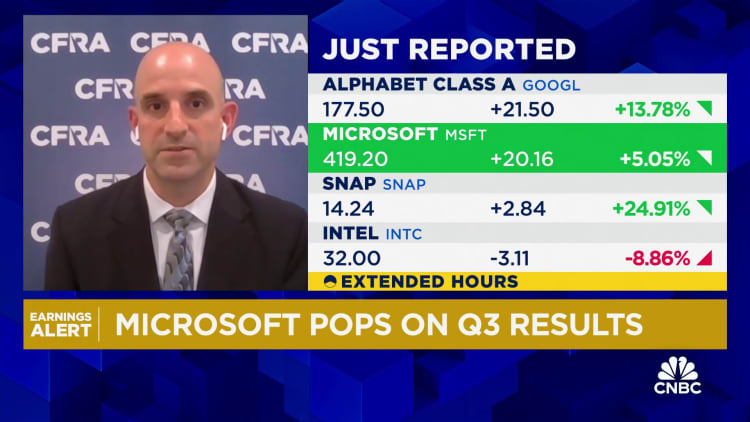

Last week, Google and Microsoft both reported accelerating cloud growth. Amazon remains bigger than both in the market, which is becoming larger more quickly than other areas of information technology, including devices and data center systems, according to industry researcher Gartner.

During the quarter, Amazon said it had completed a $4 billion investment in startup Anthropic, which is relying on AWS chips for training artificial intelligence models. Adam Selipsky, the CEO of AWS, told Axios in an interview that Anthropic offers the “leading models in the market right now” in some areas. Google, which invested in Anthropic earlier, offers its own AI models, as does Microsoft-backed OpenAI.

“We’ve accumulated a multibillion-dollar revenue run rate already,” Andy Jassy, Amazon’s CEO and formerly the head of AWS, said on a conference call with analysts, speaking of generative AI. Analysts presume that Microsoft has billions in annualized cloud revenue tied to AI as well.

Amazon saw further reductions in cloud optimization efforts during the quarter, after many organizations sought to make the most of their cloud spending, Brian Olsavsky, the company’s finance chief, said on the call.

WATCH: Cloud players can monetize AI quicker than other companies, says CFRA’s Zino on Microsoft earnings