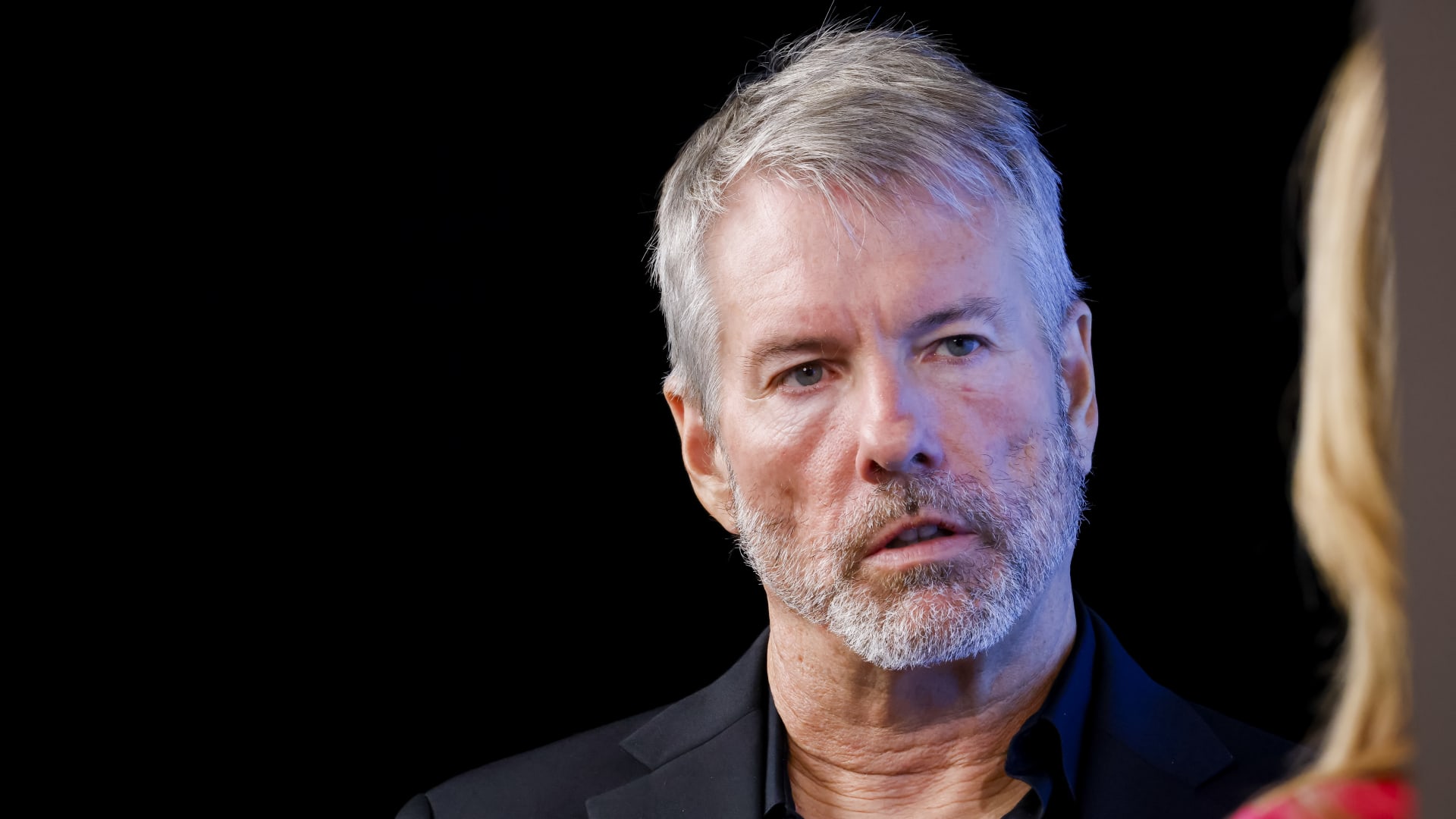

Michael Saylor, chairman and chief executive officer at MicroStrategy, during an interview at the Bitcoin 2023 conference in Miami Beach, Florida, US, on Thursday, May 18, 2023.

Eva Marie Uzcategui | Bloomberg | Getty Images

MicroStrategy founder and bitcoin evangelist Michael Saylor entered into a stock-sale plan with his company last summer that allowed him to unload up to 400,000 shares in the first four months of 2024.

It was a timely agreement for the 59-year-old crypto billionaire.

With the plan more than 90% of the way to completion, Saylor has netted about $370 million from this year’s stock sales, thanks to the stratospheric rise in value of MicroStrategy, which is effectively a bitcoin holding company.

Saylor, who started MicroStrategy in 1989 as a software and tech consulting business and still serves as chairman, has emerged as a bitcoin hero in recent years, telling CNBC last month the cryptocurrency is going to “eat gold.” His company has used its balance sheet and tapped the capital markets to acquire more than 214,000 bitcoins since announcing its strategy to enter the crypto market in mid-2020.

Those assets, equal to about 1% of the total number of bitcoins minted to date, are now worth about $13.6 billion, accounting for the bulk of MicroStrategy’s $21.3 billion market cap. The stock has been a Wall Street darling of late, climbing 91% this year — despite a 37% pullback from its March high — after soaring 346% in 2023, one of the best performers across the U.S. stock market.

Saylor is the largest MicroStrategy shareholder, with Class B holdings worth about $2.3 billion. At the end of 2023, Saylor owned another 400,000 Class A shares due to an option he received in 2014. Those are the shares he’s selling with speed.

Buried near the end of its third-quarter earnings filing on Nov. 1, MicroStrategy announced that the company and Saylor had entered into an agreement, called a 10b5-1 plan, in September, allowing the founder to sell as many as 5,000 shares every trading day from Jan. 2 to April 25 of this year, up to a total of 400,000 shares. The shares were tied to a “vested stock option, which expires if unexercised on April 30, 2024.”

As of this week, Saylor has sold 370,000 shares totaling $372.7 million, according to filings. His Class A holdings are down to 30,000 shares as of the latest sale disclosed on Thursday.

MicroStrategy didn’t respond to requests for comment.

Mark Palmer, an analyst at Benchmark, called the stock sales “entirely programmatic” because of the trading plan executed last year and not at all a reflection of Saylor’s confidence in MicroStrategy or his view of the stock price.

There’s a differing view in the retail investor world, however. Numerous posts on Reddit suggest that Saylor is perhaps selling for other reasons, with some members of the r/MSTR subreddit speculating that he’s using the cash to buy bitcoin directly. Some say they’re selling along with Saylor. The stock is down 29% in April, while bitcoin has dropped 11%.

‘Easy enough to find the truth’

Palmer, who has a “buy” rating on the stock, countered that such a point of view “would be a misread” by investors and traders.

“What we’re seeing here is very straightforward and all of it’s been disclosed already,” Palmer said. “It’s easy for those who either may not understand the details or those who understand the details but might have a short on the stock to twist things around a bit. As is typically the case, it’s easy enough to find the truth.”

Even with the stock sales, the majority of Saylor’s wealth remains wrapped up in his Class B holdings of MicroStrategy, along with the 17,732 bitcoins he purchased in 2020 that are currently worth about $1.1 billion.

Much of the rally in bitcoin and related investments has to do with the emergence of bitcoin exchange-traded funds, which received regulatory approval earlier this year, and the upcoming halving this week. The technical event happens every four years, cutting rewards for bitcoin miners in half and reducing the pace at which new bitcoins enter the market.

In a market where consumers can buy bitcoin directly on various exchanges or choose a host of new ETFs, Saylor has said the ongoing advantage of MicroStrategy is that it’s a leveraged bitcoin play without the management fee. The company can raise money to go deeper in crypto, and last month said it reeled in $782 million “to acquire additional bitcoin.” The cash came from a convertible debt sale at 0.625% interest.

“Is there any company in the world that you wouldn’t like to invest in that could borrow $1 billion at less than 1% interest to invest in your best idea?” Saylor said on CNBC’s “Squawk Box” in March. He added that the company’s leverage leads to volatility, which “attracts capital, and we can then leverage more.”

Benchmark’s Palmer said there are plenty of reasons to remain bullish on MicroStrategy, especially with the halving just around the corner. Following past halving events, the price of bitcoin has jumped.

“If I were in a situation where I had shares in MicroStrategy, this is time where I’d very much want to be holding on to them,” Palmer said.