The Bitcoin (BTC) spot ETFs approved in the United States in January experienced a net outflow of $94 million on March 21st, marking the fourth consecutive day of net outflows since March 18th. The cumulative outflow over the four-day period amounted to $836 million .

This marks the first instance of outflows exceeding four days in a row since January 25th. The majority of the outflows were attributed to the Grayscale Bitcoin Trust ETF (GBTC), while the remaining nine ETFs saw nearly net inflows.

iShares Bitcoin Trust Leads Inflows, While Grayscale Bitcoin Trust Dominates Outflows

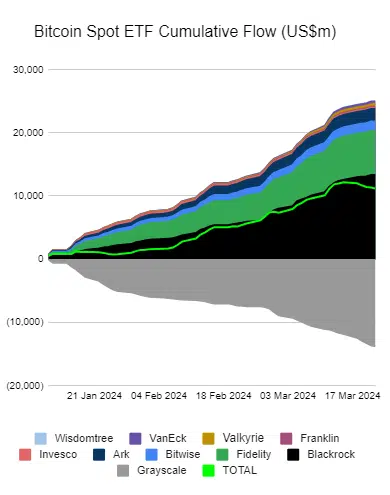

As of March 21st, the iShares Bitcoin Trust (IBIT) has attracted the largest amount of funds among the ten Bitcoin spot ETFs, with cumulative inflows of approximately $13.3 billion. In contrast, the Grayscale Bitcoin Trust ETF (GBTC) has seen outflows exceeding IBIT’s inflows, with a total of approximately $13.8 billion leaving the fund.

Despite the significant outflows from GBTC, the combined net inflow for all ten Bitcoin spot ETFs remains positive, with a total of approximately $11.2 billion (roughly 1.7 trillion yen) as of March 21st.

Eric Balchunas, a Bloomberg analyst, has attributed the substantial outflow from the Grayscale Bitcoin Trust ETF (GBTC) largely to the recent failure of the crypto lending company Genesis. Balchunas shared his perspective on the matter, stating:

Nine Bitcoin spot ETFs other than GBTC have gained about $1.2 billion over the past five days, even as Bitcoin prices have fallen 8%.

There was indeed an outflow from GBTC, but the main culprit was Genesis, and it was a net-neutral event as it was simply exchanging GBTC shares for physical Bitcoin.

Eric Balchunas, the Bloomberg analyst, also expressed his belief that the substantial outflow from the Grayscale Bitcoin Trust ETF (GBTC) will likely subside once the sale of GBTC shares by the failed crypto lending company Genesis is complete.

In February, U.S. bankruptcy court approved Genesis’ plan to sell approximately 35 million shares of GBTC, which were valued at approximately $1.5 billion at the time. Genesis allows investors to exchange their GBTC shares for either fiat currency or Bitcoin.

In addition to the GBTC shares, Genesis also intended to sell more than 11 million shares of the Grayscale Ethereum Trust, which were worth over approximately $230 million as of February.

The sale of these shares by Genesis is expected to have a significant impact on the market, potentially contributing to the recent outflows from GBTC.

However, Balchunas suggests that once this sale is concluded, the outflows from GBTC may stabilize, and the market could potentially see a return to more balanced inflows and outflows across the various Bitcoin spot ETFs.