US Dollar, Gold, and Bitcoin Analysis, Prices, and Charts

- Fed and ECB are confident, but not confident enough yet to start cutting rates.

- Gold continues to rally, Bitcoin primed for another ATH

- US NFPs the next driver of price action.

Recommended by Nick Cawley

Get Your Free USD Forecast

In his testimony to the Senate Banking Committee yesterday, Fed Chair Jerome Powell indicated that interest rates could soon be on the way down.

‘If the economy does as expected, we think carefully removing the restrictive stance of policy will begin over the course of the year’, Powell said Thursday.

He added ‘I think we are in the right place…We are waiting to become more confident that inflation is moving sustainably down to 2%. When we do get that confidence, and we’re not far from it, it will be appropriate to begin to dial back the level of restriction so that we don’t drive the economy into recession.’

Earlier in the session yesterday, the European Central Bank kept all monetary policy settings unchanged as expected, but staff projections revised inflation and growth forecasts lower. Speaking at the press conference after the decision, ECB President Christine Lagarde also gave a small nudge that rate cuts are on the horizon.

‘We are making good progress towards our inflation target and we are more confident as a result…But we are not sufficiently confident. We need clearly more evidence and more data. We will know a little more in April, but we will know a lot more in June.’

Financial markets are now fully pricing in a 25bp ECB rate cut at the June 6th meeting, while the probability of a similar-sized Fed rate at the June 12th FOMC meeting is in the mid-high 70% area.

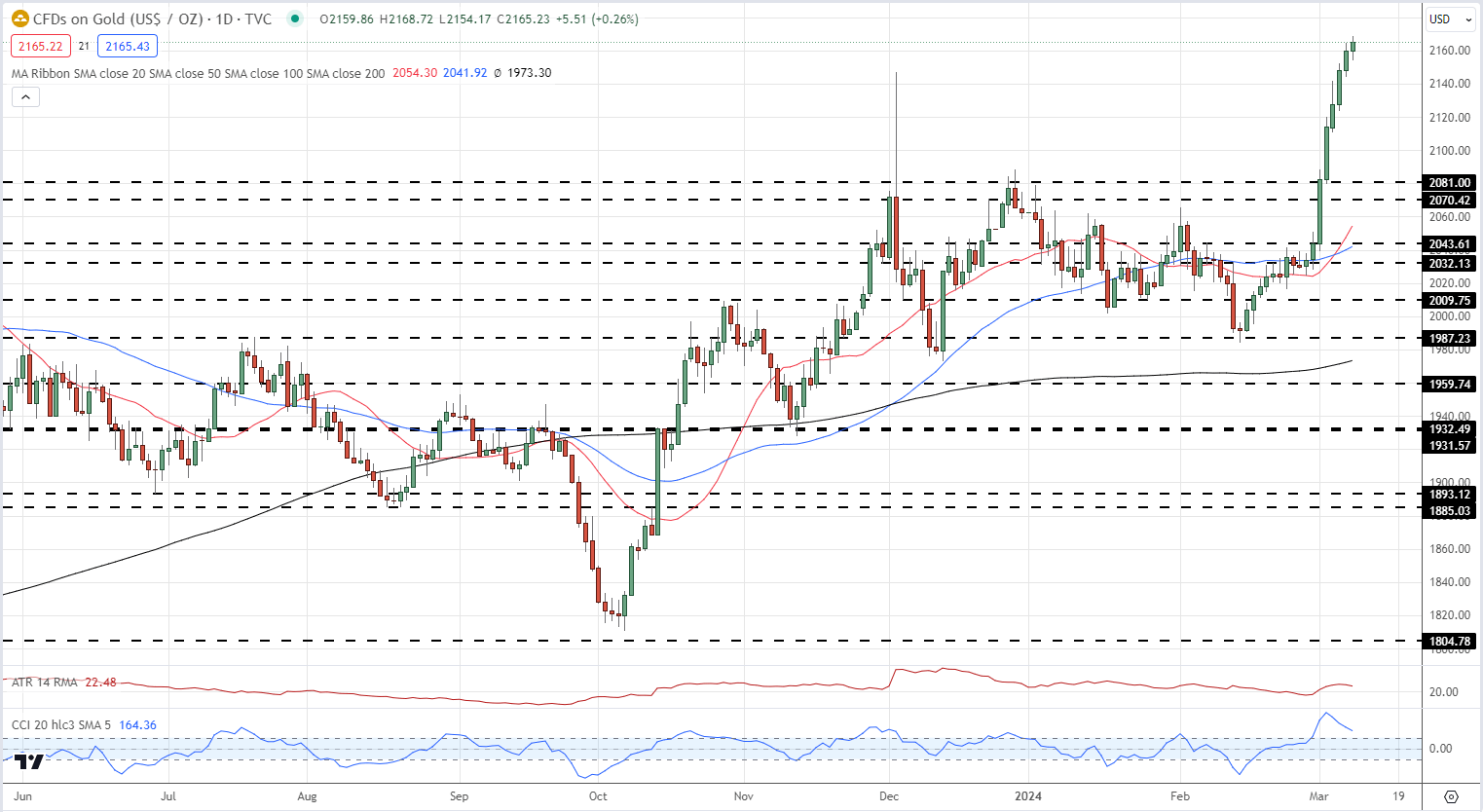

This firming of upcoming rate cuts by the Fed has continued to push the US dollar lower. After posting a multi-week high of 105.02 on February 14th, the US dollar index has fallen steadily to a near-two-month low of 102.85. Over the same time frame, gold has rallied from a low of $1,984/oz. to a current fresh high of $2,164/oz.

Gold Daily Price Chart

IG Retail trader data shows 41.77% of traders are net-long with the ratio of traders short to long at 1.39 to 1.The number of traders net-long is 1.00% lower than yesterday and 10.75% lower than last week, while the number of traders net-short is 4.36% higher than yesterday and 45.06% higher than last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests Gold prices may continue to rise.

| Change in | Longs | Shorts | OI |

| Daily | -10% | -4% | -7% |

| Weekly | -4% | 23% | 10% |

The latest US Jobs Report (NFPs) will be released at 13:30 UK today and will drive price action going into the weekend. An above-forecast headline number may slow the decline of the greenback, but not for long, while a below consensus print will likely see the US dollar decline further, boosting the price of gold further into record territory. Revisions to prior releases will also be worth noting.

For all economic data releases and events see the DailyFX Economic Calendar

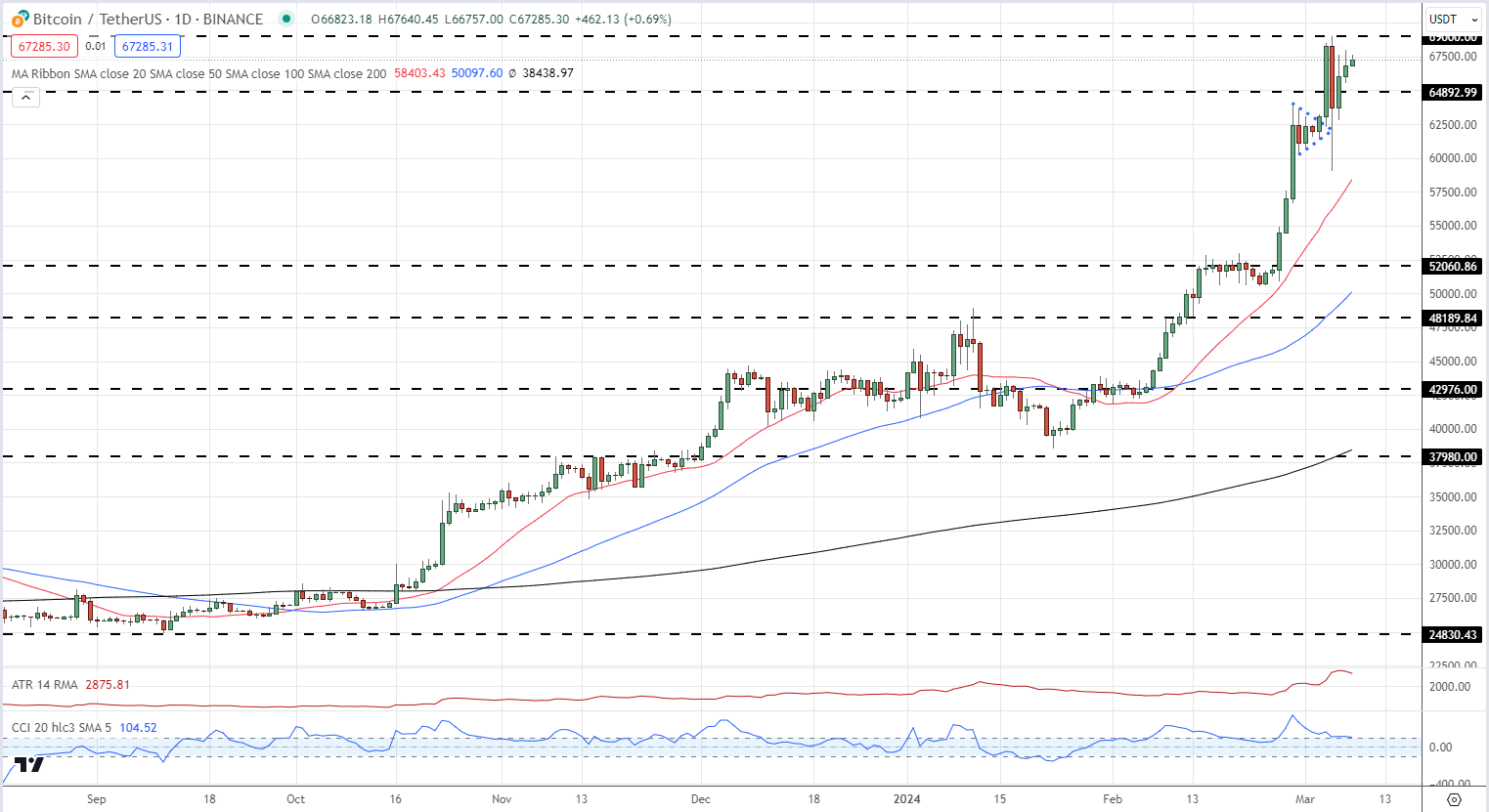

Bitcoin traders will also have one eye on today’s NFP report, with the largest crypto-currency by market cap looking to re-test its all-time high. While the current demand and supply mismatch, driven by spot Bitcoin ETF demand, and the upcoming halving event are the dominant forces behind Bitcoin’s recent rally, lower interest will help underpin the latest move. A positive technical setup for Bitcoin will also likely see fresh record highs in the days ahead.

Bitcoin Daily Price Chart

All Charts via TradingView

What are your views on the US Dollar, Gold, and Bitcoin – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.