US DOLLAR FORECAST – EUR/USD, USD/JPY, GBP/USD

- The U.S. dollar and financial markets will be very sensitive to the upcoming U.S. jobs report

- February’s nonfarm payrolls data could guide the timing of the Fed’s easing cycle

- This article discusses the technical outlook for EUR/USD, USD/JPY and GBP/USD

Most Read: Gold Price Forecast – US Jobs Data to Energize Rally or Squash It, Possible Scenarios

The U.S. Bureau of Labor Statistics will release on Friday February’s U.S. nonfarm payrolls figures. The upcoming NFP survey holds the potential to ignite volatility and force investors to reassess the Federal Reverse’s monetary policy outlook, so traders should prepare for the possibility of wild price swings heading into the weekend across key assets.

Economists anticipate that U.S. employers added 200,000 workers to their ranks last month, building on the momentum of 353,000 jobs created in January. Meanwhile, the unemployment rate is seen holding steady at 3.7%, underscoring the enduring tightness of the labor market. However, recent employment data has consistently outperformed estimates, increasing the risk of yet another upside surprise.

Want to know where the U.S. dollar is headed over the medium term? Explore key insights in our quarterly forecast. Request your free guide now!

Recommended by Diego Colman

Get Your Free USD Forecast

If hiring activity beats projections by a wide margin, investors may be forced to abandon hopes of central bank easing in the second quarter, exposing the widening gap between Wall Street‘s desire for rate cuts and the Fed’s pledge to begin removing restrictive policy only after policymakers have gained greater confidence that inflation is moving sustainably toward the 2.0% target.

In the circumstances described above, interest rate expectations are likely to reprice in a more hawkish direction, with traders pushing out the timing of the first FOMC rate cut to the second half of the year and scaling back the magnitude of future easing. This scenario could propel U.S. Treasury yields higher in the near term, allowing the U.S. dollar to erase some of its losses registered over the past few days.

On the other hand, a lackluster NFP report, especially one with a significant miss in job creation, could galvanize the market’s belief that Fed cuts are coming in June, or possibly even May. This turn of events could weigh heavily on bond yields, accelerating the U.S. dollar’s downturn. A headline NFP around or below 100,000 could trigger this response.

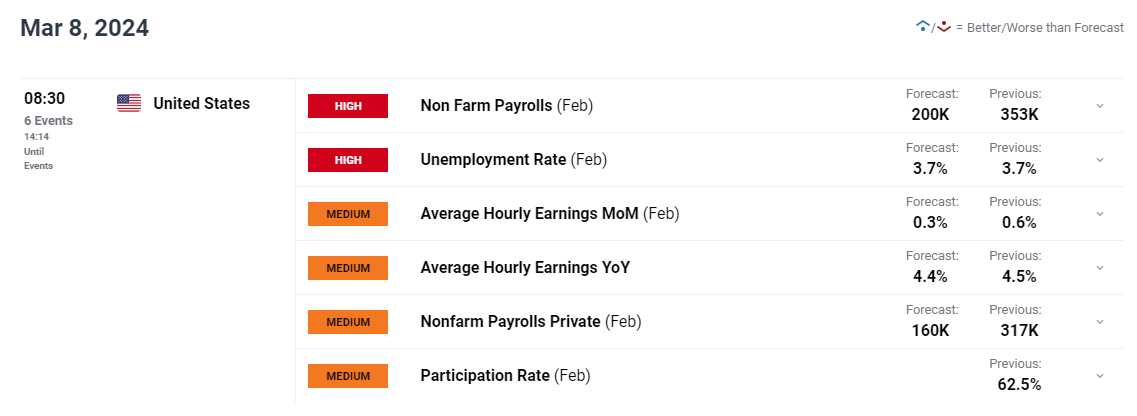

UPCOMING US JOBS REPORT

Wondering about the euro‘s possible trajectory? Dive into our quarterly trading forecast for expert insights. Claim your free copy now!

Recommended by Diego Colman

Get Your Free EUR Forecast

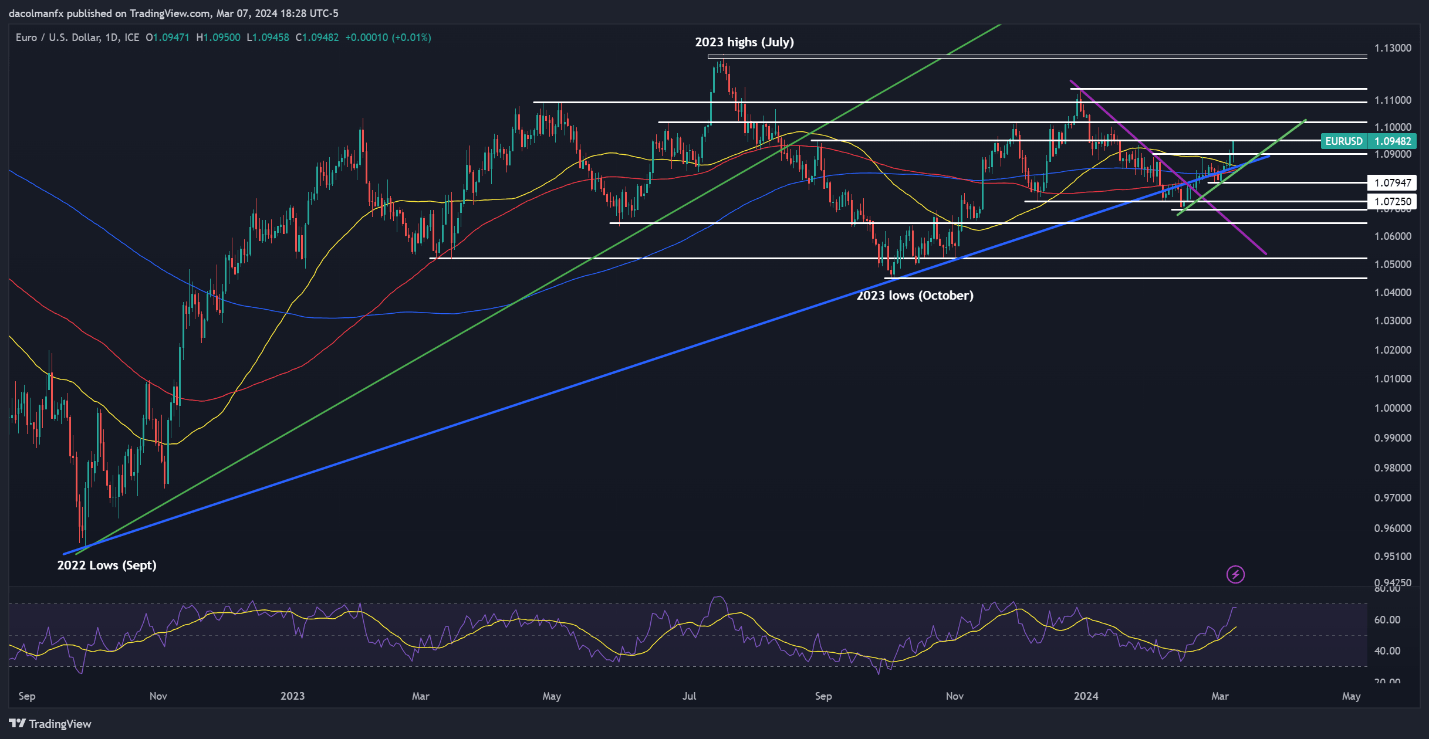

EUR/USD FORECAST – TECHNICAL ANALYSIS

EUR/USD rallied on Thursday, clearing major barriers in the process, and hitting its highest level since mid-January. Following this upswing, the pair has reached the gates of important resistance at 1.0950. Reaction here will be key, with a breakout possibly fueling a move toward 1.1020.

On the flip side, if sellers unexpectedly mount a resurgence and drive the exchange rate lower swiftly, the first technical floor to monitor emerges around the psychological 1.0900 mark. Below this area, confluence support at 1.0850 will become the next key focus, followed by 1.0790.

EUR/USD PRICE ACTION CHART

EUR/USD Chart Created Using TradingView

Eager to discover what the future holds for the Japanese yen? Delve into our quarterly forecast for expert insights. Get your complimentary copy now!

Recommended by Diego Colman

Get Your Free JPY Forecast

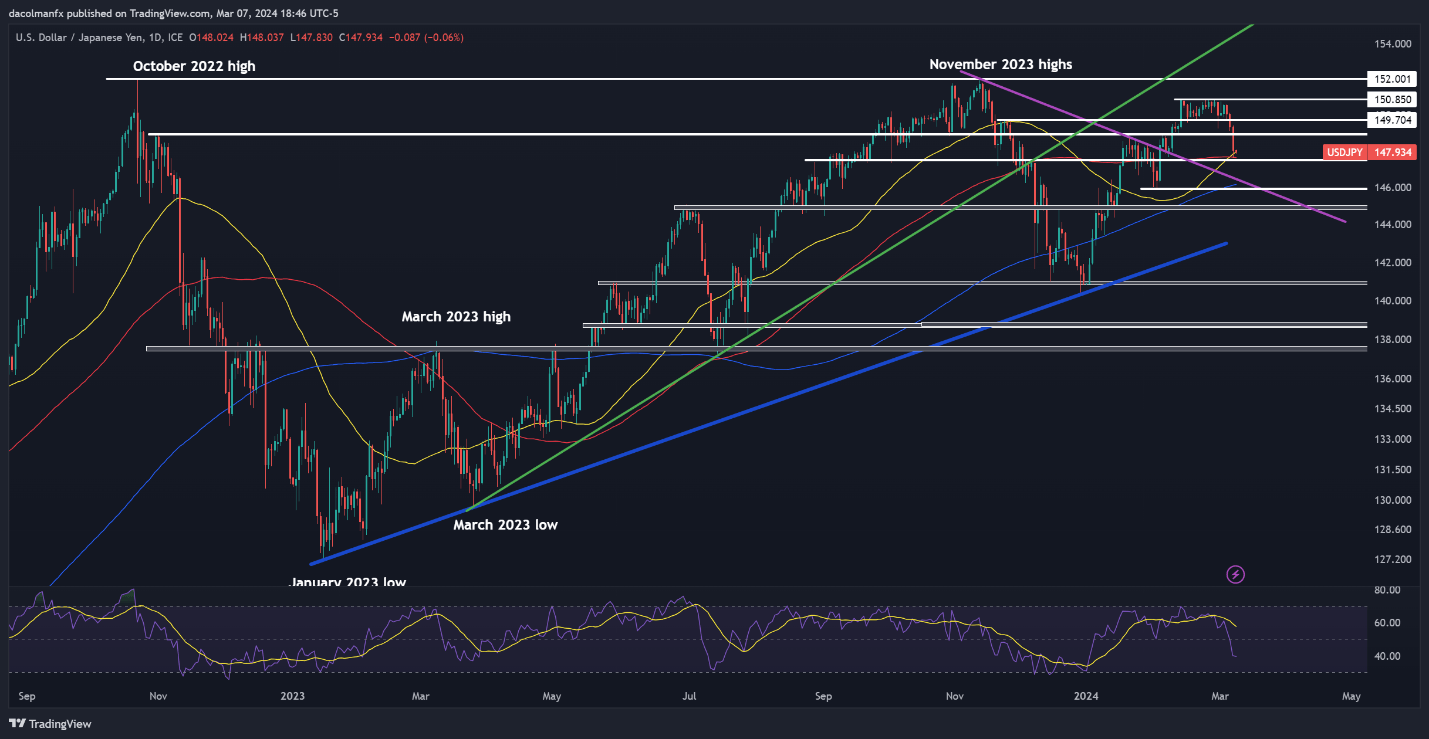

USD/JPY FORECAST – TECHNICAL ANALYSIS

USD/JPY extended losses on Thursday, plummeting towards cluster support ranging from 147.85 to 147.50. Bulls need to fiercely defend this area; failure to maintain this technical band could pave the way for a drop towards 146.60. On further weakness, all eyes will be on the 200-day simple moving average.

Alternatively, if buyers return and trigger an upside reversal, resistance can be identified at 148.90 and 149.70 thereafter. Moving beyond these thresholds, additional gains may motivate bulls to initiate an assault on horizontal resistance at 150.90.

USD/JPY PRICE ACTION CHART

USD/JPY Chart Created Using TradingView

Want to stay ahead of the British pound‘s next major move? Access our quarterly forecast for comprehensive insights. Request your complimentary guide now to stay informed on market trends!

Recommended by Diego Colman

Get Your Free GBP Forecast

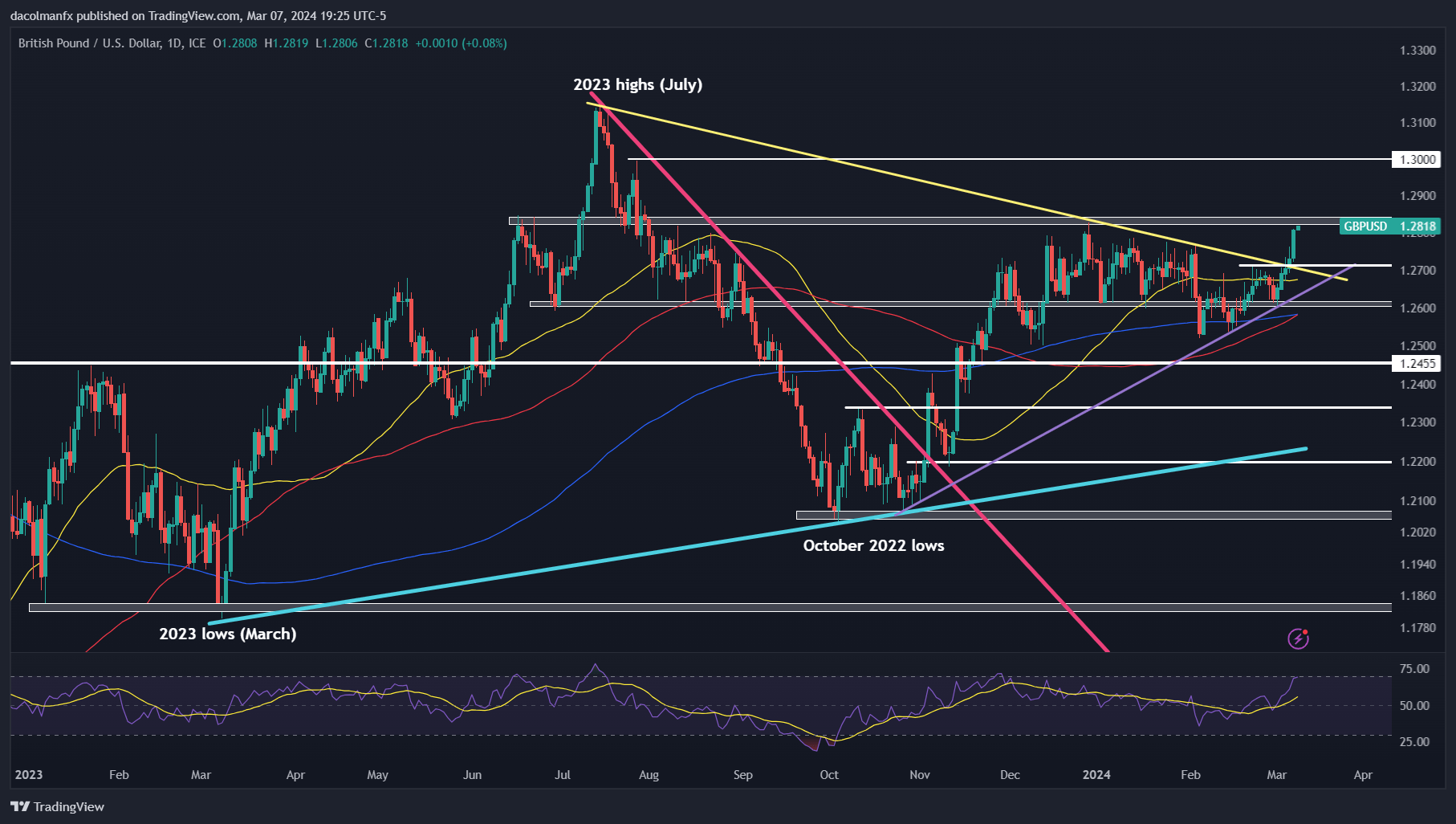

GBP/USD FORECAST – TECHNICAL ANALYSIS

GBP/USD blasted higher on Thursday after taking out trendline resistance around 1.2715 in the previous session. If this breakout is sustained in the coming days, bulls could soon challenge the next major technical ceiling near 1.2830. Further bullish progress beyond this barrier will shine a light on 1.3000.

Alternatively, if sentiment pivots back towards sellers and prices start trending downwards, initial support rests at 1.2715, followed by 1.2675, which corresponds to the 50-day simple moving average. Should these levels cave in, attention will fall squarely on trendline support at 1.2640.