FTSE 100, DAX 40, Nasdaq 100 Analysis and Charts

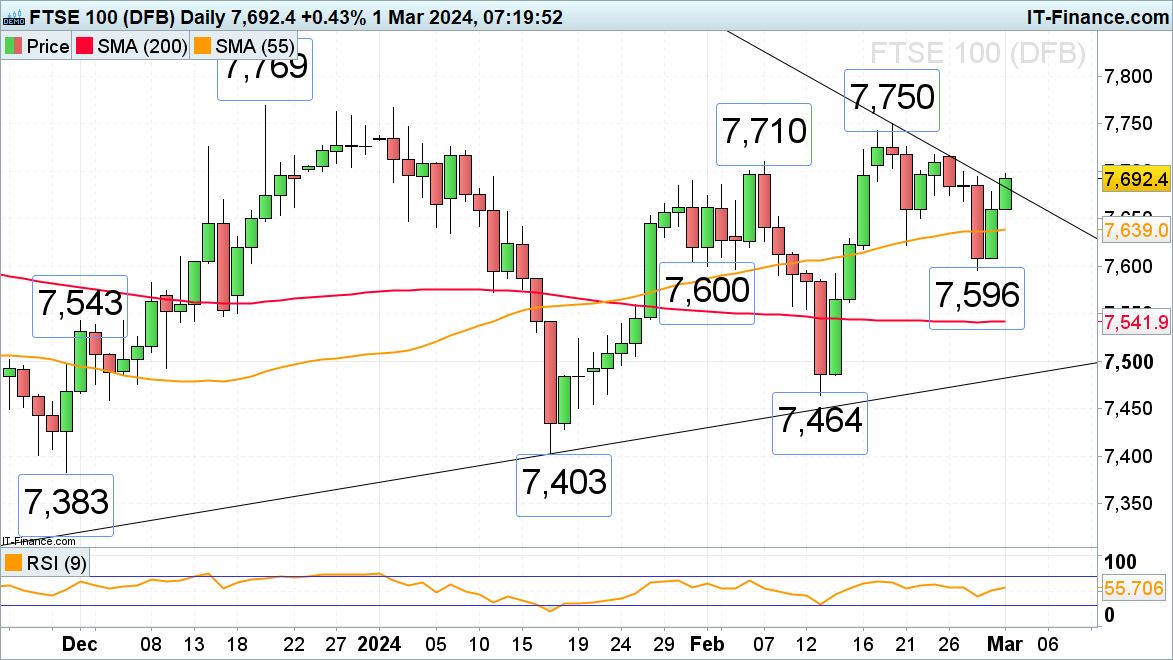

FTSE 100 targets 7,710 to 7,769 region

The FTSE 100’s recovery from Wednesday’s 7,596 low looks to be impulsive with the early February high at 7,710 in sight. Further up sits the 7,750 to 7,769 resistance area which consists of the December-to-February peaks. The 23 February high at 7,717 needs to be exceeded for the 7,750 to 7,769 region to be reached, though.

Minor support sits at Friday’s intraday low at 7,660 ahead of the 55-day simple moving average (SMA) at 7,639.

FTSE 100 Daily Chart

IG Retail Sentiment shows daily and weekly changes in client positioning

| Change in | Longs | Shorts | OI |

| Daily | -21% | 11% | -7% |

| Weekly | -3% | -10% | -7% |

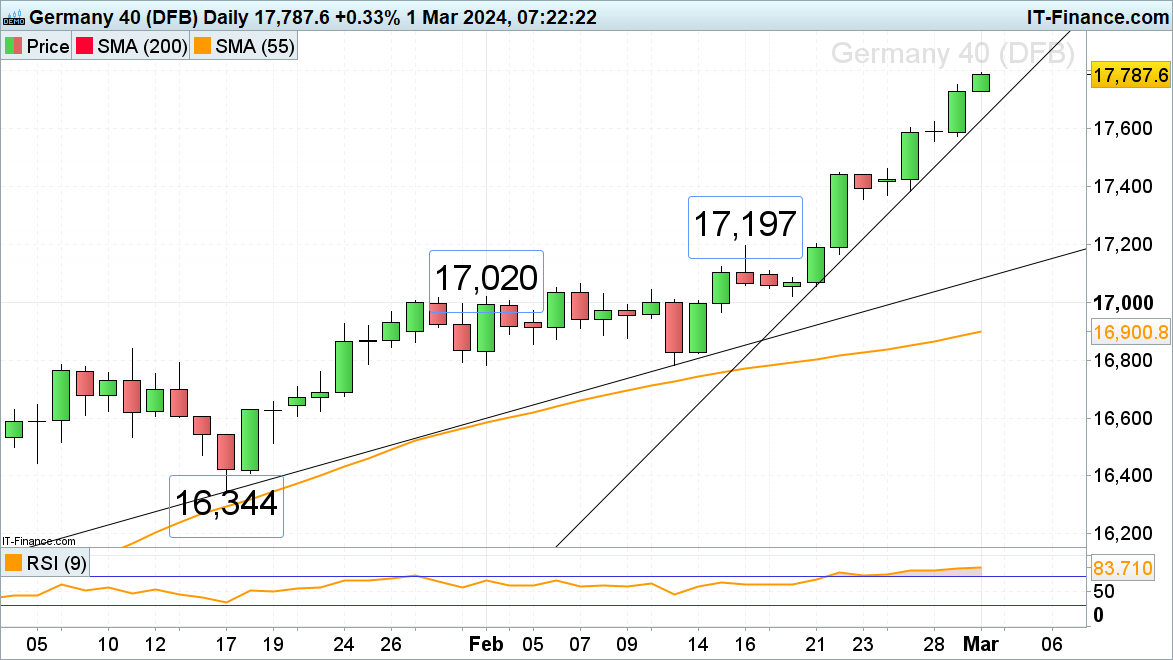

DAX 40 on track for sixth record high in a row

The DAX 40 index seems to be unstoppable as it rallies to yet another record high around the 17,800 mark as the latest earnings season showed that European stocks remain undervalued compared to their American counterparts with regards to Price-to-Earnings (PE) ratios. This has attracted further investment in Europe’s largest economy and its stock market. Minor support is seen along the accelerated uptrend line at 17,628.

Above the current record high lies the 18,000 region.

DAX 40 Daily Chart

Recommended by Axel Rudolph

Traits of Successful Traders

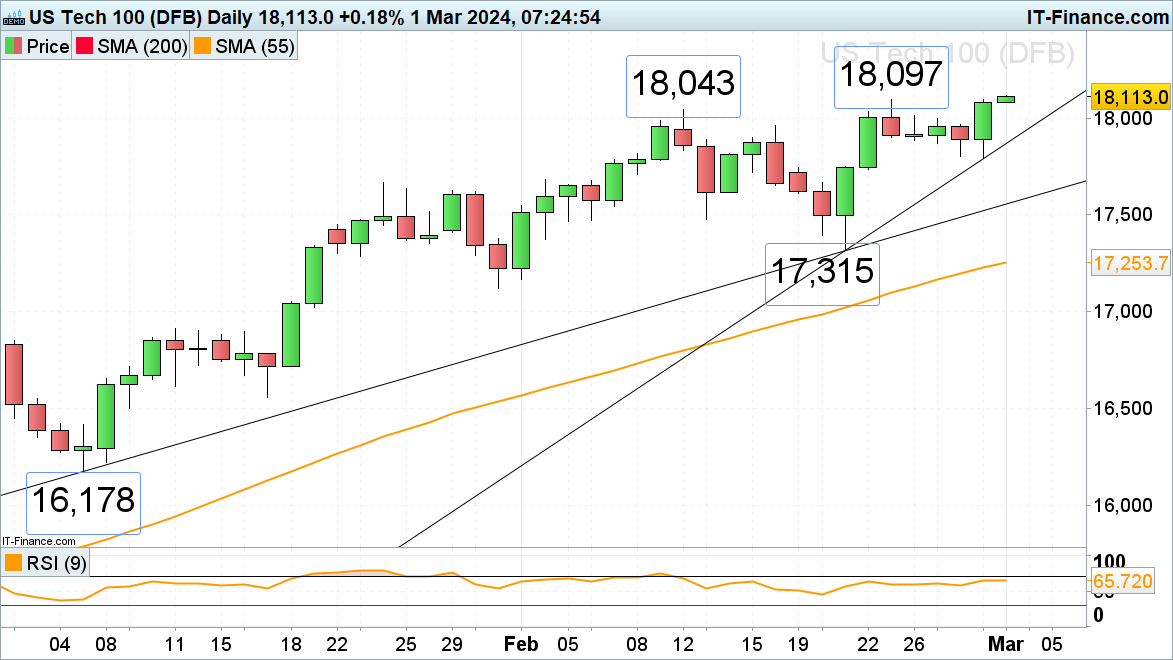

Nasdaq 100 trades at record highs

On the first day of March the Nasdaq 100 is about to overcome its February record high made close to the 18,100 mark to make yet another all-time high. The 18,200 zone represents the next minor upside target. Support can be found between the 12 and 23 February highs at 18,097 to 18,043.

While this week’s low at 17,791 underpins, the medium-term uptrend will remain intact.