Pound Sterling (GBP) Analysis

- Monetary policy committee set to testify in parliament

- Cable (GBP/USD) appears vulnerable to bearish threat

- Looking for actionable trading ideas? Download our top trading opportunities guide packed with insightful tips for the first quarter:

Recommended by Richard Snow

Get Your Free Top Trading Opportunities Forecast

Monetary Policy Committee Set to Testify in Parliament

This morning members of the Monetary Policy Committee (MPC) are set to provide testimony to parliament’s treasury committee around their views of the economy and inflation that led to their decision to hold interest rates in January.

There was certainly a diverse range of opinions upon the release of the votes, revealing a three-way vote split with two members opting to hike interest rates, six members opting to hold, and the dove within their ranks (Swati Dhingra) favouring a 25 basis point cut.

As a result, the hearing today is likely to shed further insight into the thinking of those on the committee. The UK economy fell into recession in Q4 last year which will likely result in tough questions being asked of the committee as to why they persist with keeping interest rates at a level that constrains economic growth.

In the January meeting, the Bank of England’s forecasts suggested that inflation will drop drastically towards its 2% target by the middle of this year, accompanied by more modest declines in wage growth and inflation within the services sector. The tide is changing and major central banks are nearing the first rate cut of this cycle, however bankers continue to stress that a greater degree of conviction is required before making that huge step.

Customize and filter live economic data via our DailyFX economic calendar

Cable Appears Vulnerable to Bearish Threat

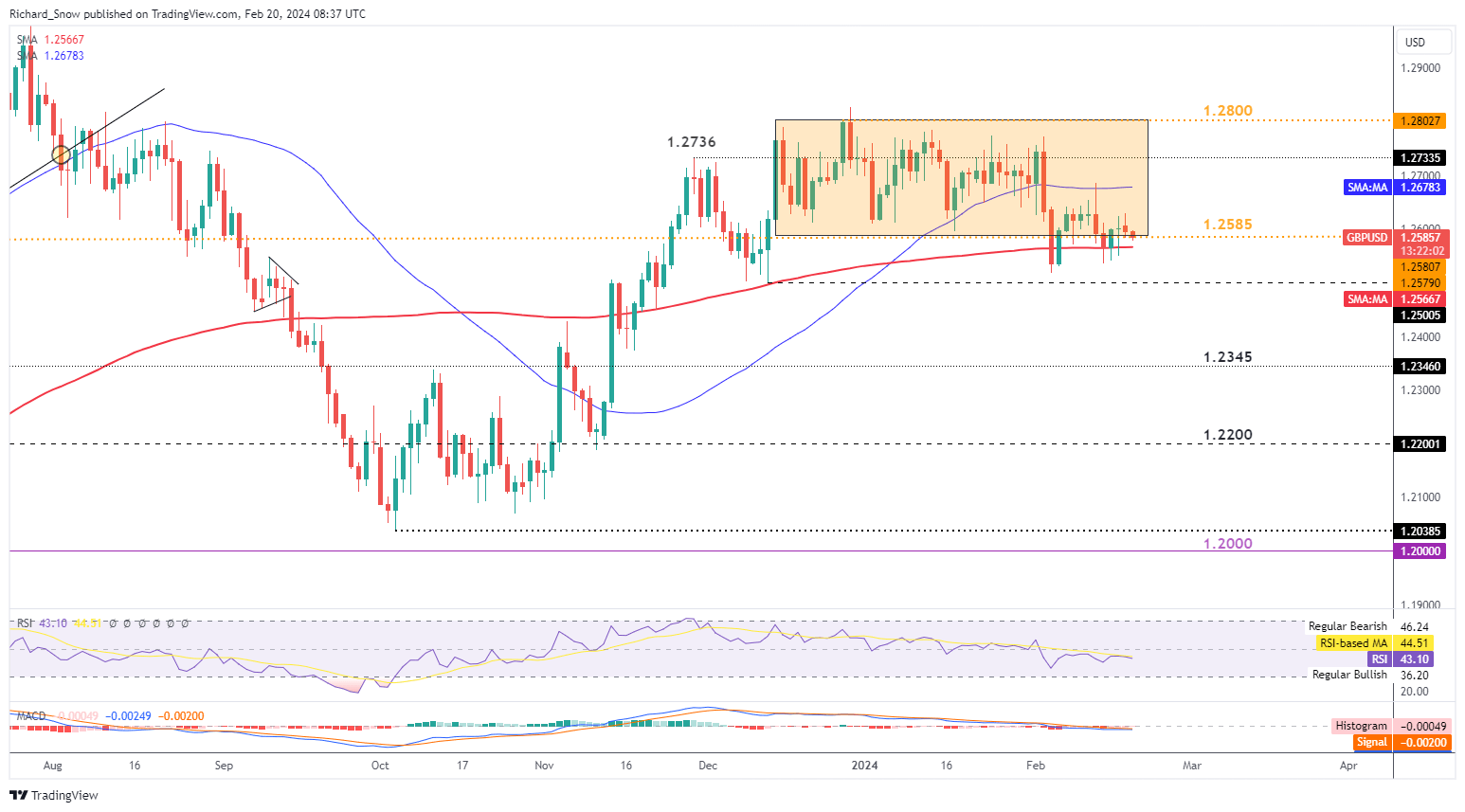

Cable appears vulnerable to further downside momentum ever since attempting to break lower earlier this month. Continued resilience in the US labor market provided the initial catalyst for the downside move which ultimately failed to gain traction below the 200 SMA.

Since then price action has oscillated around channel support and the key 200 day simple moving average. Bullish drivers for the pound are scarce, particularly at a time when they economy has finally faltered and markets have begun to price in the need for more support from the Bank of England which ultimately takes the form of rate cuts.

GBP/USD Daily Chart

Source: TradingView, prepared by Richard Snow

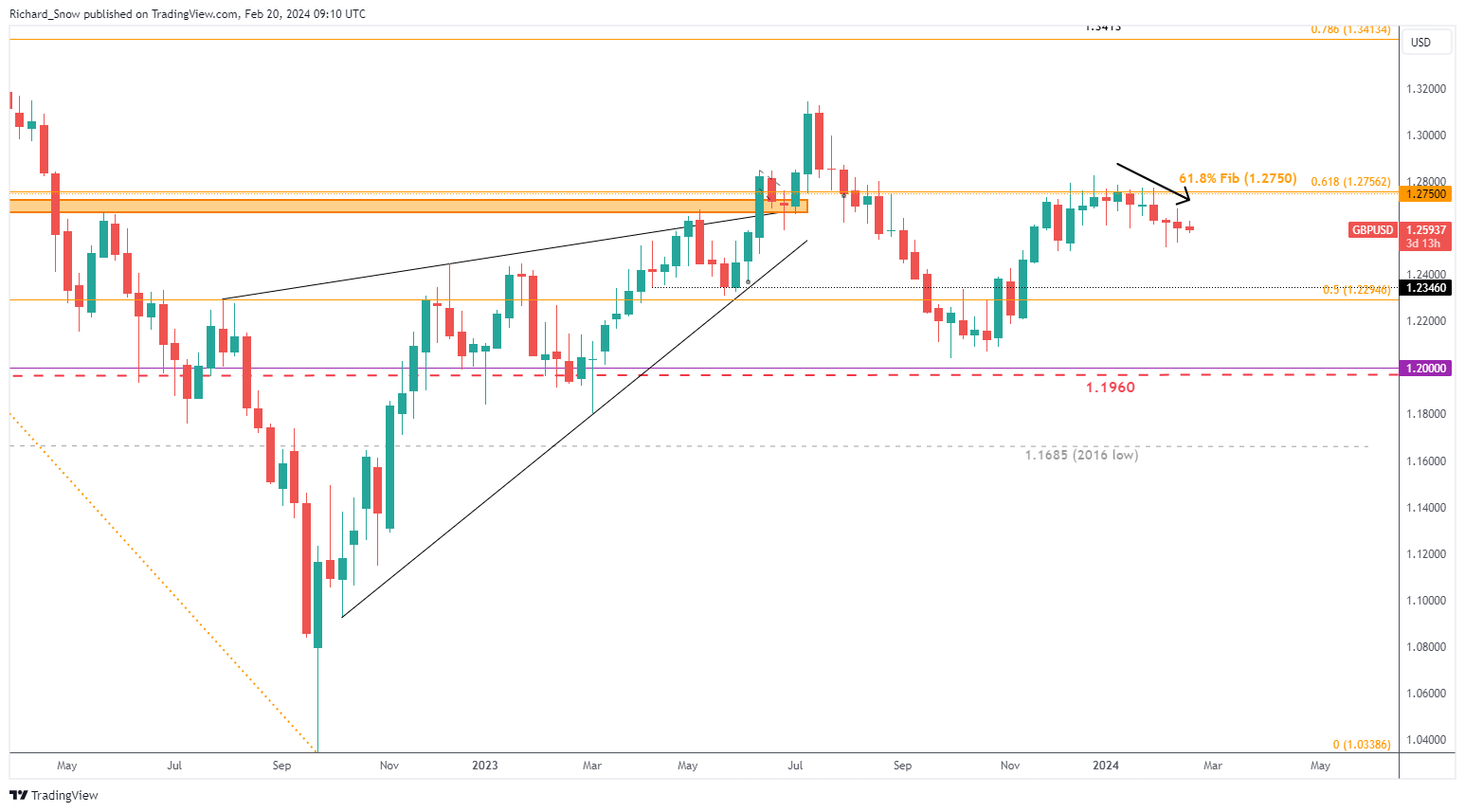

The weekly chart helps to get a feel for the waning bullish momentum and zone of resistance at the 61.8% Fibonacci retracement of the major 2021-2022 decline. A series of long upper wicks on the weekly candlesticks help to reveal bullish reluctance, suggesting the path of least resistance may appear to the downside. This week we see a number of FOMC members making appearances alongside the release of the FOMC minutes from the January meeting, which is likely to bring intra-day volatility to US-related pairs.

Weekly GBP/USD Chart

Source: TradingView, prepared by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX