Nvidia Earnings, S&P 500 Analysis

- Nvidia earnings surpass estimates and issues positive outlook for Q1 2024

- Nvidia set to open at new all-time high after earnings beat

- S&P 500 likely to ride the wave higher on Nvidia optimism potentially testing the all-time high

Recommended by Richard Snow

Get Your Free Equities Forecast

Nvidia Earnings Surpass Estimates and Issues Positive Outlook for Q1 2024

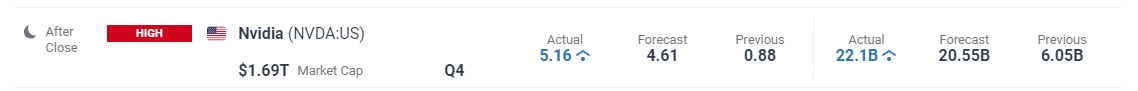

Nvidia announced its earnings for the three month period ending 32 December 2023 after market close yesterday and surprised already lofty estimates. Earnings per share (EPS) – a common metric of growth and shareholder compensation – surprised the market by rising more than 10% above what was expected.

In addition, the forward guidance communicated to the market for Q1 of 2024 put aside concerns around supply chain challenges and potentially waning demand due to the global growth slowdown we have witnessed.

Customize and filter earnings data via our DailyFX economic calendar

Nvidia Set to Open at a New All time High After Earnings Beat

Nvidia is expected to open up more than 11% higher today after the impressive earnings beat after market close yesterday. The chip maker has enjoyed a phenomenal rise since the start of this year as the AI revolution advances and demand for their fine-tuned hardware expands.

In the lead up to the announcement speculators foresaw a number of potential challenges to the Q1 outlook with some of those incorporating recent disappointing growth data witnessed throughout major economies, which may weigh on demand.

However, the upbeat outlook for the first quarter of 2024 dismissed those concerns as the company now anticipates further revenue gains ($24 billion vs $22.17 billion) which has a positive effect on most major equity indices today as Nvidia appears to provide the rising tide that lifts all boats.

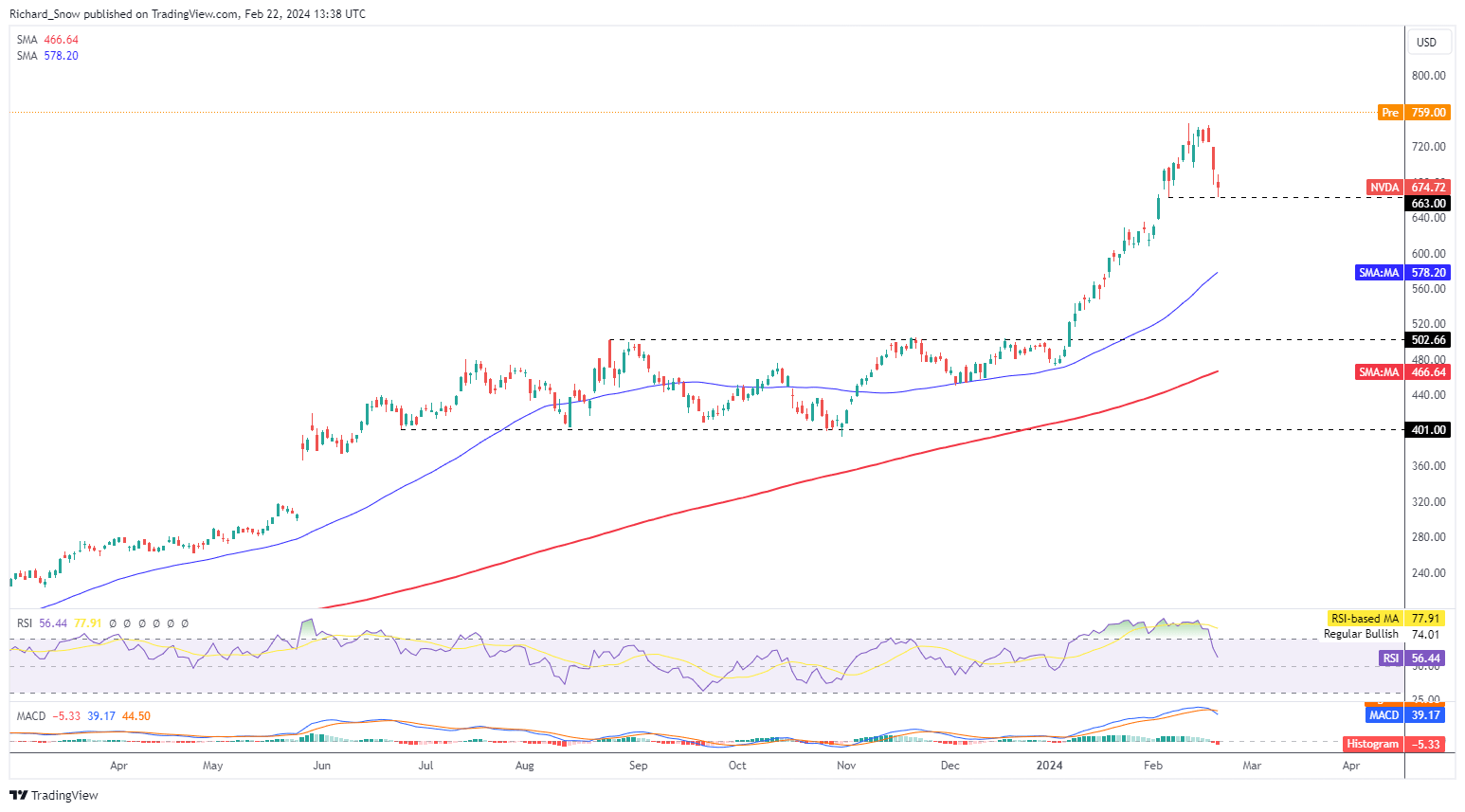

The recent pullback appears to have found support add a prior swing low $663 and according to the premarket is likely to rise all the way to $748 to mark an impressive recovery. Should the stock open at those levels it would represent a new all-time high for the dominant the player in the semiconductor space.

Nvidia Daily Chart – Set to Open at Record Highs According to the Pre-market

Source: TradingView, prepared by Richard Snow

If you’re puzzled by trading losses, why not take a step in the right direction? Download our guide, “Traits of Successful Traders,” and gain valuable insights to steer clear of common pitfalls:

Recommended by Richard Snow

Traits of Successful Traders

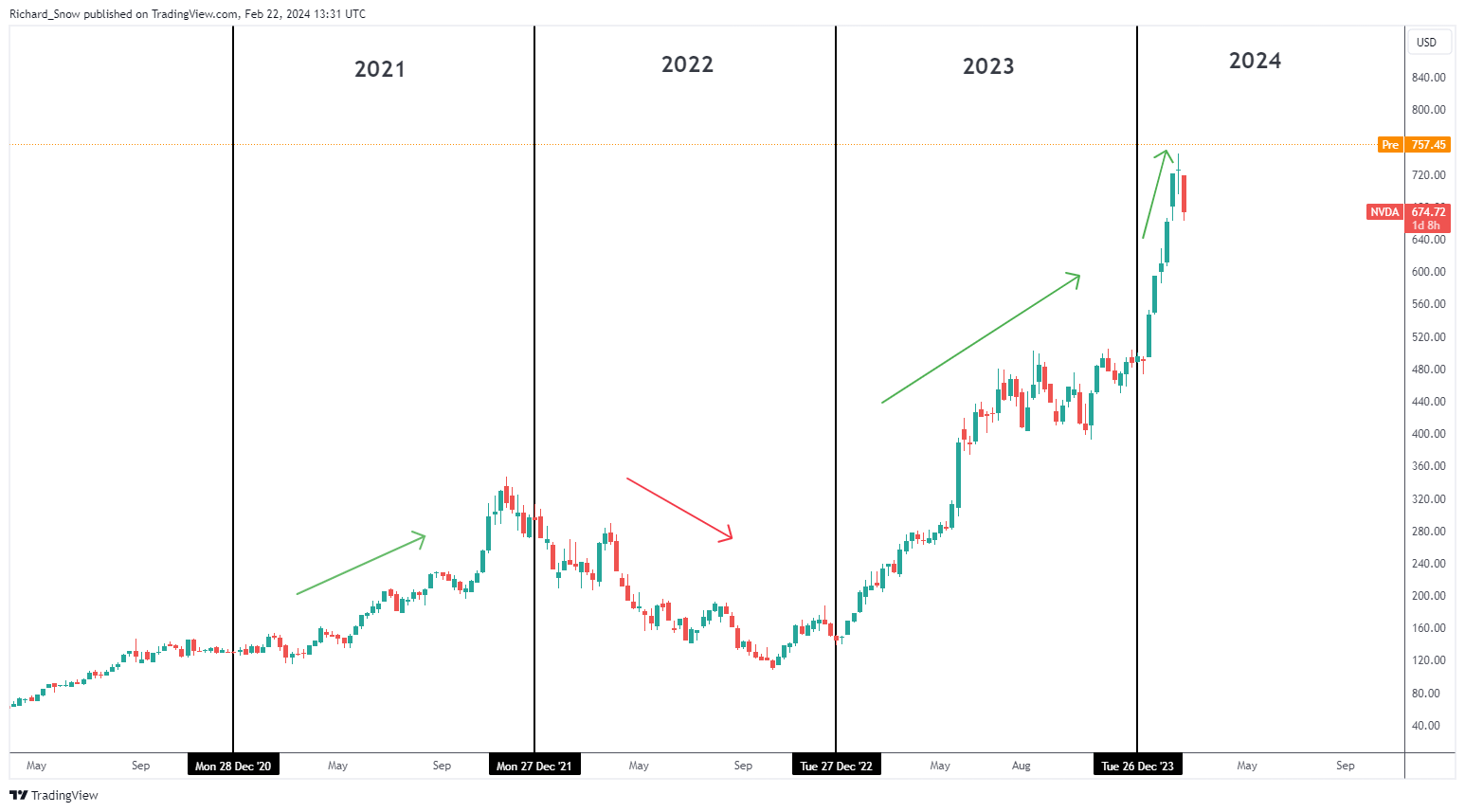

Looking at the weekly chart since 2021 it is possible to put into perspective the recent sharp advances in the stock which can be attributed to the rise of AI applications. In 2021 the stock enjoyed the general rise as interest rates remained near record lows but then in 2022 came under pressure as the Federal Reserve began the rate hiking cycle. In 2023 it was thought that Nvidia may come under pressure as interest rates reached what we now believe is a peak but the stock advanced even further. Finally, since the beginning of this year Nvidia has accelerated notably to the upside as various AI applications gain traction, fueling demand for high-powered, fine-tuned semiconductors for use in data centers and graphics processing units (GPUs).

Nvidia Weekly Chart Breaking Down Year by Year Performance

Source: TradingView, prepared by Richard Snow

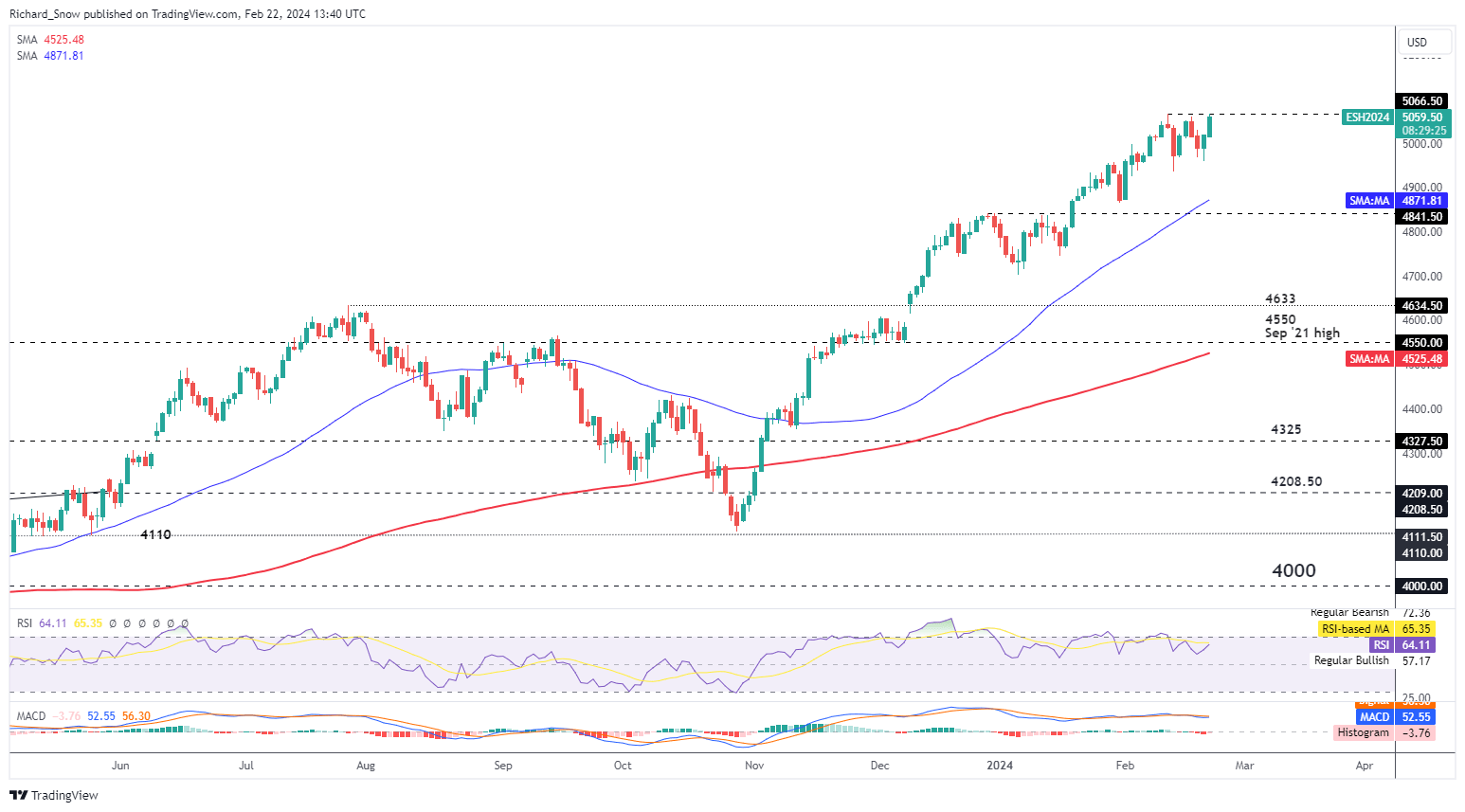

S&P 500 Likely to Ride the Wave Higher on Nvidia Optimism Potentially Testing the All-time High

Ahead of the market open S&P 500 futures point to a higher start to the day, propelled forward by the positive sentiment around Nvidia earnings last night. U.S. stocks have advanced notably since November last year on the hopes of interest rate cuts which typically drive stock markets higher and boost valuations.

A resilient U.S. economy has pulled back expectations of multiple interest rate cuts in 2024 which has seen the dollar recover some lost ground but has yet to effect the bullish trajectory of US stock markets.

S&P 500 E-Mini Futures to Test High

Source: TradingView, prepared by Richard Snow

Learn how to adapt a typical stock trading strategy for the FX market:

Recommended by Richard Snow

How to Trade FX with Your Stock Trading Strategy

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX