US Dollar (DXY) Latest Analysis and Charts

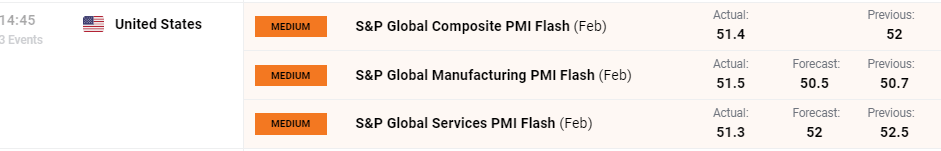

The US service sector slowed down in February, while the manufacturing sector picked up, the latest flash PMIs showed today. According to data provider S&P Global,

‘US companies continued to report an expansion in activity during February, albeit at a slower pace. Output rose marginally as a softer uptick in services business activity weighed on overall growth. Manufacturing, meanwhile, saw a renewed increase in production amid an improvement in supply chains after adverse weather in January.’

Commenting on the data, Chris Williamson, Chief Business Economist at S&P Global Market Intelligence said: “The early PMI data for February indicate that the US economy continued to expand midway through the first quarter, pointing to annualized GDP growth in the region of 2%. Although service sector growth cooled slightly, manufacturing staged a welcome return to growth, with factory output growing at the fastest rate for ten months.”

Download our free guide and how to trade economic data releases

Recommended by Nick Cawley

Trading Forex News: The Strategy

For all economic data releases and events see the DailyFX Economic Calendar

During the US session, four Federal speakers – Jefferson, Harker, Cook, and Kashkari – will give their views on the health of the US economy after last night’s FOMC minutes gave little away.

US Dollar Trims Losses After Fed Minutes Caution Against Premature Rate Cuts

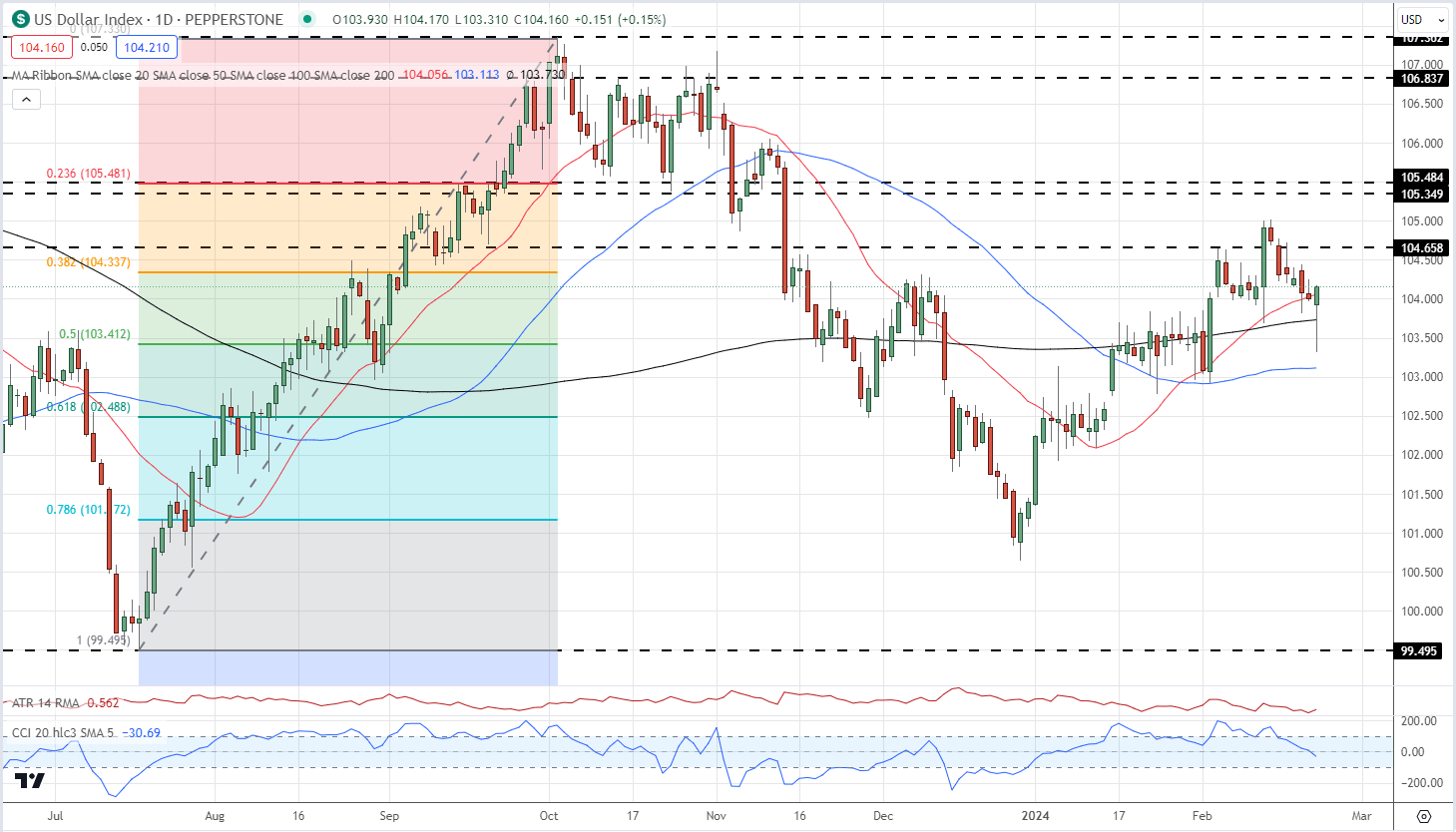

The US dollar opened the European session around the 103.50 level before firming up during the day. The US dollar index (DXY) currently trades around 104.10 and is trying to break a week-long series of lower highs and lower lows off last Wednesday’s 105.02 high. US interest rate probabilities are pricing in between three and four 25 basis point rate cuts this year with the first cut penciled in at the June 12th FOMC meeting.

US Dollar Index Daily Chart

Chart via TradingView

Download our Free Q1 US Dollar Technical and Fundamental Forecasts:

Recommended by Nick Cawley

Get Your Free USD Forecast

What is your view on the US Dollar – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.