Local CPI Key Takeaways:

1. Consumer inflation in South Africa increased in January 2024, driven by rising prices for food, housing, utilities, transport, and miscellaneous goods and services.

2. The annual consumer price inflation rate was 5.3% in January 2024, up from 5.1% in December 2023.

3. The main contributors to the annual inflation rate were food and non-alcoholic beverages, housing and utilities, miscellaneous goods and services, and transport.

4. Food and non-alcoholic beverages saw a year-on-year increase of 7.2% and contributed 1.3 percentage points to the overall inflation rate.

5. The inflation rate for goods was 6.6% in January 2024, while for services it was 4.0%, both showing an increase compared to December 2023.

Economic data has the potential to drive FX markets, particularly when the actual figure differs greatly from what was anticipated. Learn how to prepare and take advantage of such occurrences via our comprehensive guide below:

Recommended by Shaun Murison, CFTe

Trading Forex News: The Strategy

In January 2024, South Africa faced a notable rise in consumer inflation. The inflationary pressure was largely attributed to the increased costs of essential commodities such as food, housing, utilities, transport, and miscellaneous goods and services. The annual consumer price inflation rate climbed to 5.3%, which was a slight but significant uptick from the 5.1% recorded in December 2023.

The rand’s initial reaction to the CPI news was a slight depreciation, although the domestic currency trades well off yesterdays lows, which correlates to a broader moves in the dollar.

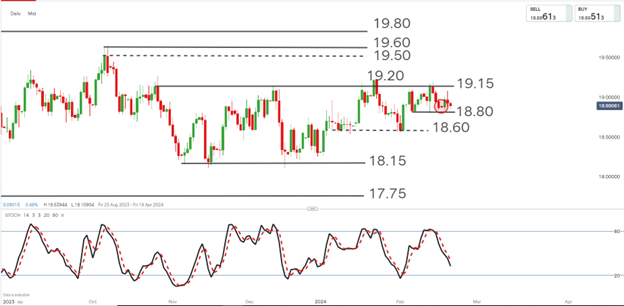

USD/ZAR – technical view

Source: IG charts, Prepared by Shaun Murison

The USD/ZAR continues to trade within a short-term range between levels 18.80 (support) and 19.15 (resistance).

The price has now formed a bullish reversal off the support of this range. Range traders who are long off the reversal might target a move towards the 19.15 level, while using a close below 18.80 as a stop loss consideration.

A tight stop level is considered in lieu of upcoming data in the form of the National Budget Speech and US FOMC meeting minutes.

If you’re puzzled by trading losses, why not take a step in the right direction? Download our guide, “Traits of Successful Traders,” and gain valuable insights to steer clear of common pitfalls:

Recommended by Shaun Murison, CFTe

Traits of Successful Traders