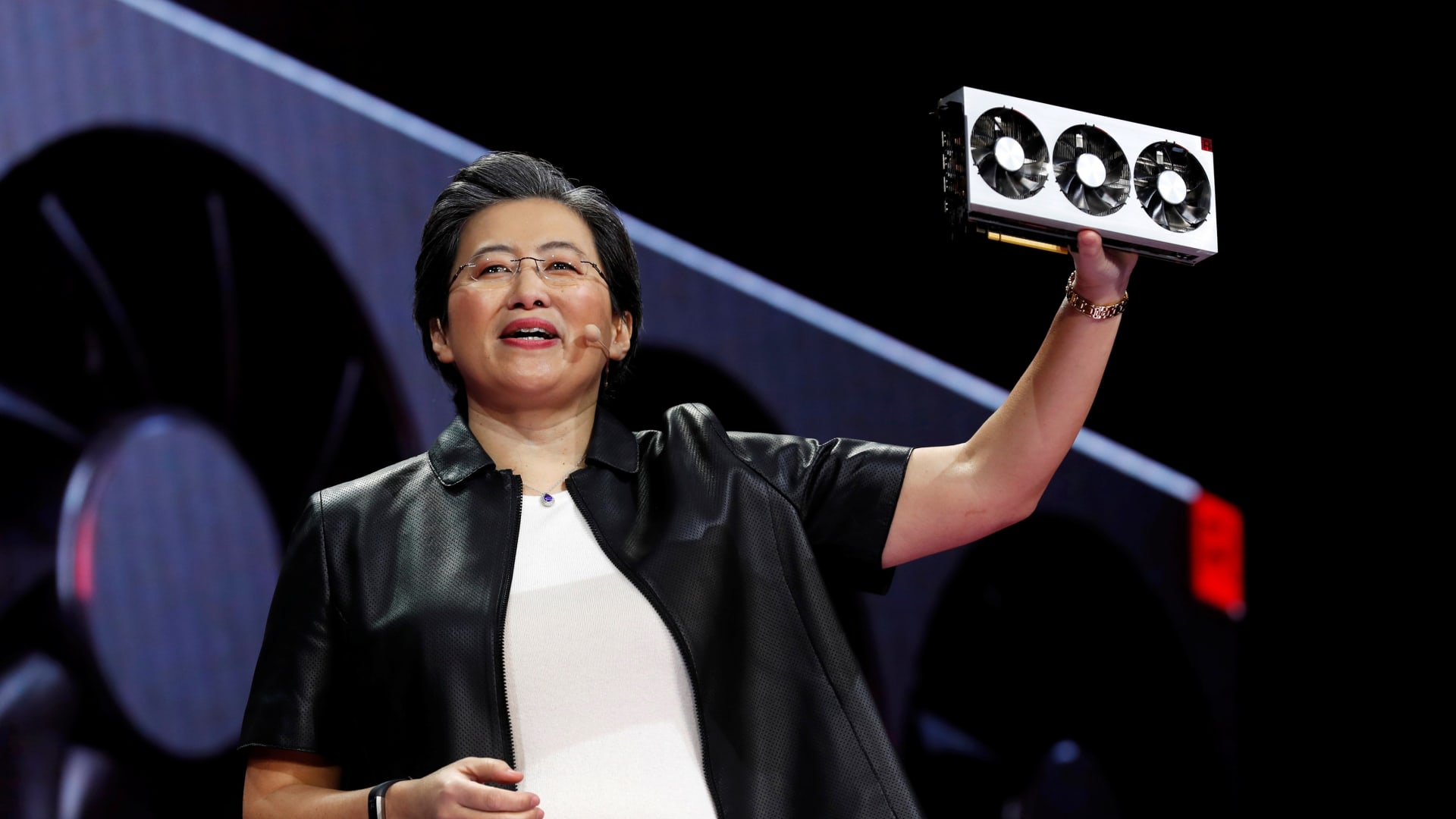

Lisa Su, president and CEO of AMD, talks about the AMD EPYC processor during a keynote address at the 2019 CES in Las Vegas, Nevada, U.S., January 9, 2019.

Steve Marcus | Reuters

AMD reported fourth-quarter earnings Tuesday that were in line with analyst expectations. And while the semiconductor company’s revenue beat estimates, AMD offered a first-quarter forecast that fell short of expectations.

AMD stock slid more than 6% in extended trading, even after the company gave a positive update on how quickly its new AI chips are selling.

Here’s how the company did versus consensus estimates from LSEG, formerly Refinitiv, for the quarter ended in December:

- EPS: 77 cents per share, adjusted, versus 77 cents per share expected

- Revenue: $6.17 billion, versus $6.12 billion expected

For the first quarter, AMD said it expects about $5.4 billion in sales, plus or minus $300 million, while analysts were looking for revenue of $5.73 billion. AMD added that it expected some of its major businesses, including PC chips, to decline sequentially during the quarter. It said its data center revenue would be flat as declines in server central processing units, or CPUs, are offset by sales of graphics processing units, or GPUs, which are needed to train and deploy generative artificial intelligence models.

“For 2024, we expect the demand environment to remain mixed,” AMD CEO Lisa Su said on a call with analysts.

Net income in the fourth quarter was $667 million, or 41 cents per share, versus $21 million, or 1 cent per share, a year ago.

While the GPU market is currently dominated by Nvidia, AMD has said that its new AI chips introduced last year will challenge Nvidia’s H100 GPUs for some applications. Investors are looking for significant growth in the company’s data center segment over the next few years.

AMD gave a bullish update on its AI chips sales. In October, AMD said it expected $2 billion in server GPU sales in 2024. On Tuesday, it said it now expects $3.5 billion in data center GPU sales under its “Instinct” brand this year.

“In cloud, we are working closely with Microsoft, Oracle, Meta and other large cloud customers on Instinct GPU deployments powering both their internal AI workloads and external offerings,” Su said.

AMD’s data center business, which includes server CPUs and AI chips, rose 38% on an annual basis to $2.28 billion in sales. It’s now firmly AMD’s largest segment. The company said that much of the increase in revenue was attributable to “strong growth” in sales of its Instinct graphics processors, which are used for AI. However, AMD’s overall performance in the business was in line with a $2.29 billion FactSet estimate for the Data Center business.

Historically, AMD’s main business has been CPUs for PCs and servers. Compared with AI chips, that part of the semiconductor industry has been flat or shrinking over the past few years, as PC sales have suffered post-pandemic.

AMD’s client segment, mostly chips for PCs and laptops, rose 62% year over year to $1.46 billion in sales, thanks to recent chip launches.

Sales in AMD’s gaming segment, which includes “semi-custom” processors for Microsoft Xbox and Sony PlayStation consoles, fell 17%. AMD blamed slower console sales and said it expected semi-custom revenue to decline by a “significant” double-digit percentage in the current quarter.

AMD’s embedded segment, which includes chips for networking, reported $1.1 billion in sales, down 24% on an annual basis.

Don’t miss these stories from CNBC PRO: